It hasn’t gone unnoticed that the market’s robust efficiency this 12 months has been led by the mega-caps, with the tech giants largely chargeable for the surge within the S&P 500 and NASDAQ. This has led many commentators to subject warnings in regards to the lack of market breadth driving the beneficial properties, with many believing it signifies that the market is much more fragile than it seems.

Nevertheless, that isn’t the case in any respect, in response to billionaire Ken Fisher, who thinks that “unhealthy breadth” is a bullish indicator.

“This widespread doom and gloom – whether or not it’s the Fed, the Ukraine invasion, or the newest banking disaster – is definitely bullish for shares,” says the Fisher Investments founder whose web value is valued at ~$6.7 billion. “That is what we name worry of a false issue. False worry is all the time hurting costs in a given second, setting the stage for spring-loaded beneficial properties. Dangerous breadth is the newest such false worry – and it screams that this mega-cap-led surge has legs — perhaps not this week or this month, however totally by 2023.”

So, the rally, in response to Fisher, is about to push forward. With this in thoughts, we thought we’d get the lowdown on three shares residing in his portfolio that he clearly expects to capitalize on the upward pattern.

In response to the TipRanks database, Wall Road analysts are on board too, giving all of those picks a ‘Sturdy Purchase’ consensus score. Let’s see why Fisher and the Road’s consultants suppose these are good funding decisions proper now.

Danaher Company (DHR)

The primary inventory Fisher is betting on is Danaher, a multinational company working within the world life sciences and diagnostics business. The corporate’s intensive choices vary from scientific devices and water remedy techniques to dental instruments, and industrial applied sciences. Danaher operates as a conglomerate, with over 20 distinct firms working below its wing. It is a large enterprise boasting a market-cap of virtually $172 billion with the corporate’s R&D, manufacturing, gross sales, distribution and administrative premises situated in over 60 international locations.

For a really feel for this world agency’s dimension, we are able to have a look at the newest quarterly numbers. In 1Q23, Danaher raked in revenues of $7.2 billion. Nevertheless, that represented a 6.4% year-over-year decline on account of decrease Covid-19-related gross sales. Likewise on the different finish of the dimensions, adj. EPS dropped from $2.76 a 12 months in the past to $2.36. Moreover, the working money movement reached $1.9 billion, whereas the non-GAAP free money movement amounted to $1.7 billion by the top of the quarter.

Whereas the top-and bottom-line figures nonetheless trumped Road expectations, buyers appeared much less satisfied with the outcomes or the agency’s outlook of high-single-digit % development of base enterprise core income, subsequently sending shares decrease. All informed, the shares have but to take pleasure in any of 2023’s market spoils, down by 12% year-to-date.

Nonetheless, Ken Fisher’s confidence in Danaher’s trajectory stays steadfast, as evidenced by his fund’s vital possession of 4,035,913 shares, that are at present valued at over $940 million.

The corporate additionally will get the help of SVB Securities analyst Puneet Souda who factors out to buyers the chance at play right here.

“We see DHR as probably the most significant mega-cap lengthy for 2023-24 among the many life science instruments universe with its information now totally reset on probably the most engaging, spec’d-in and recurring revs market of bioprocess instruments,” Souda defined. “Regardless of the near-term development contraction that’s already baked in, we imagine DHR’s scale, diversification, its DBS (Danaher enterprise system) course of, main profitability profile (60%+ GM; 30%+ OM) and $25B dry powder for M&A, mixed with the best-in-class or near-best-in-class companies (Aldevron, Cepheid, Cytiva…), set the stage for outperformance for years to return.”

These feedback underpin Souda’s Outperform (i.e., Purchase) score, whereas his $300 worth goal makes room for 12-month returns of ~29%. (To observe Souda’s observe report, click on right here)

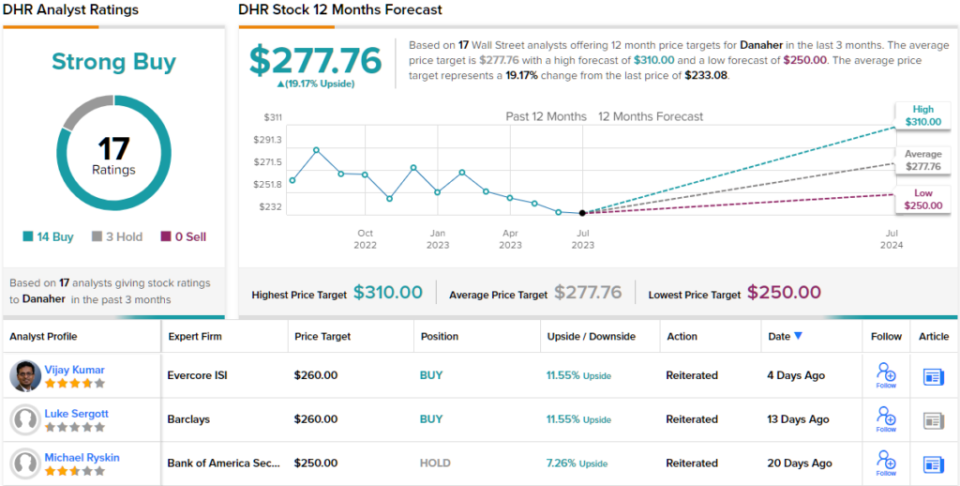

Most agree with that thesis. DHR claims a ‘Sturdy Purchase’ consensus score, based mostly on 14 Buys vs. 3 Holds. At $277.76, the common goal implies shares will recognize by 19% within the 12 months forward. (See DHR inventory forecast)

Schlumberger Restricted (SLB)

Let’s now swap gears and take a flip into the power sector for our subsequent Fisher-backed inventory. Schlumberger, the biggest offshore drilling firm on the planet, is a dominant participant within the oilfield companies business. With a presence in over 120 international locations, the corporate delivers a variety of oilfield gear and companies to the worldwide oil and gasoline business. Its intensive service portfolio encompasses essential operations comparable to oil nicely testing, website analysis, knowledge evaluation, drilling, and lifting actions.

Boasting a market cap of $76 billion, it is a massive operation, one which generated over $28 billion in revenues final 12 months. Going by the gross sales delivered in Q1, the Houston, Texas-based firm seems on observe to exceed that this 12 months.

Within the quarter, the corporate generated income of $7.7 billion, amounting to a 30% enhance on the identical interval final 12 months and beating the consensus estimate by $240 million. Adj. EPS of $0.63 additionally outpaced analyst expectations by $0.02.

Whereas these had been good outcomes, the corporate delivered softer-than-anticipated money movement and indicated that North American onshore market exercise – particularly U.S. shale gasoline, which boosted development final 12 months – might plateau throughout 2023.

In the meantime, Fisher stays closely invested in Schlumberger, as his fund at present owns 19,604,360 SLB shares, valued at over $1.04 billion.

Mirroring that assured stance, RBC analyst Keith Mackay likes the look of what’s on provide, a lot in order that SLB is on RBC’s International Vitality Finest Concepts Checklist.

“We imagine SLB is well-positioned to learn from a unbroken up-cycle within the worldwide and offshore house which ought to drive additional income development and margin enlargement,” the 5-star analyst mentioned. “Longer-term, the corporate has additionally recognized 5 key areas for Vitality Transition-related development.”

Quantifying this stance, Mackay charges SLB shares an Outperform (i.e., Purchase), together with a $67 worth goal. If the determine is met, buyers might doubtlessly earn returns of 25.5% a 12 months from now. (To observe Mackay’s observe report, click on right here)

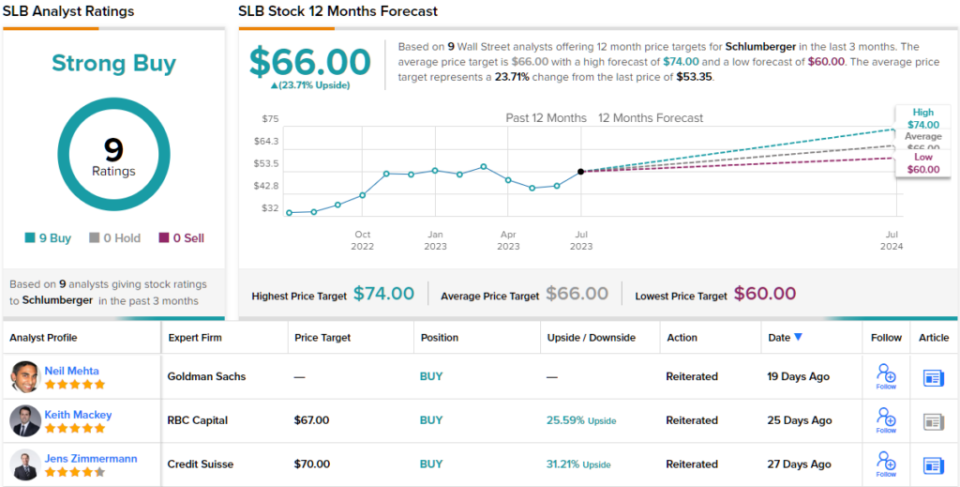

Wanting on the consensus breakdown, different analysts have additionally been impressed. Primarily based on 9 Buys and no Holds or Sells, the phrase on the Road is that SLB is a Sturdy Purchase. At $66, the common goal suggests shares will climb ~24% greater over the one-year timeframe. As an added bonus, Schlumberger additionally pays a quarterly dividend. The present payout stands at $0.25 per share and yields 1.87%. (See SLB inventory forecast)

ConocoPhillips (COP)

We’ll keep within the power sector for our final Fisher-endorsed identify and take a look at one other business large. On the subject of manufacturing and proved reserves, ConocoPhillips stands as one of many world’s largest impartial E&P (exploration and manufacturing) companies. In different phrases, it’s a firm actively concerned in looking for and extracting oil and gasoline assets. With a historical past courting again to the late nineteenth century, ConocoPhillips operates in varied areas worldwide, together with the Americas, Europe, Asia, and Australia. The corporate maintains a various portfolio of property that encompasses each typical and unconventional assets.

With a market cap of $125 billion, the corporate sits at quantity 49 on the Fortune 500 checklist, climbing 28 spots greater this 12 months after income elevated by virtually 70%, and its income rose 131% in 2022, boosted by an uptick in crude oil costs on account of Russia’s invasion of Ukraine.

In probably the most lately reported quarter, income didn’t fairly attain the degrees attained in the identical interval final 12 months however nonetheless exceeded Road expectations. Q1 earnings reached $2.9 billion, or $2.38 per share vs. $5.8 billion ($4.39 per share) in 1Q22, though the analysts had been solely searching for EPS of $2.07. Moreover, Q1 manufacturing climbed by 45,000 boe/day to a quarterly report of 1.792 million boe/day, whereas the agency additionally elevated its full-year manufacturing outlook on the midpoint by 10 MBOED.

ConocoPhillips affords each a set dividend and a variable dividend that modifications relying on the corporate’s efficiency. The newest payout included a daily dividend of $0.51 per share (providing a 1.98% yield) and a variable dividend of $0.60 per share (2.32% yield).

Ken Fisher is evidently eager on this oil and gasoline exploration firm. He holds an enormous COP place, proudly owning 7,022,759 shares. These are at present value virtually $725 million.

It’s no surprise that Truist analyst Neal Dingmann comprehends Fisher’s funding rationale, because the enchantment of Conoco is simple to clarify. The 5-star analyst writes, “The fruits of prior labor is paying dividends (actually) as Conoco’s legacy acreage together with the extremely profitable 2021 Concho and Shell Permian additions are ensuing within the highest manufacturing in firm historical past. COP additionally continues to place itself neatly with strategic non-Decrease 48 property comparable to Willow, Port Writer LNG, APLNG, and varied typical property amongst others. We forecast the corporate to simply generate the best FCF yield among the many majors utilizing the proceeds to reward buyers, get rid of debt, and doubtlessly take down additional strategic exterior property.”

Accordingly, Dingman charges COP shares a Purchase, whereas his $165 worth goal represents potential upside of 60% from present ranges. (To observe Dingman’s observe report, click on right here)

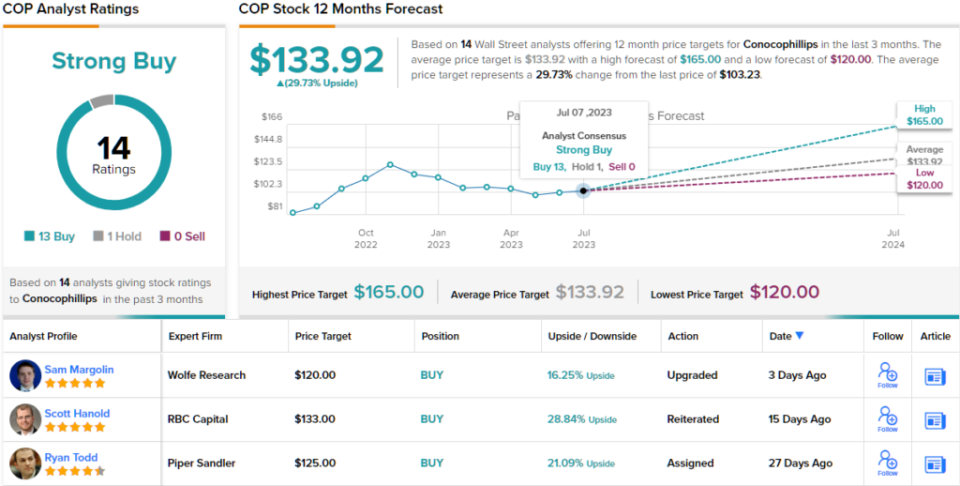

On the Road, barring one fencesitter, all 13 different analyst opinions are constructive, making the consensus view right here a Sturdy Purchase. The forecast requires 12-month returns of ~30%, contemplating the common goal stands at $133.92. (See COP inventory forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally essential to do your individual evaluation earlier than making any funding.