The Dow Jones Industrial Common rallied out of the crimson as shares ended the week with features. Tesla (TSLA) was pressured decrease on adverse headlines. A trio of Warren Buffett shares are close to purchase factors, together with RH (RH) and Aon (AON). Apple (AAPL) was a prime blue chip.

X

In the meantime, a trio of noteworthy progress names made bullish strikes. MercadoLibre (MELI), Copa Airways’ dad or mum Copa Holdings (CPA) and Fluor (FLR) all provided entries.

Quantity on the Nasdaq and the New York Inventory Trade was decrease vs. the day past, in accordance with early knowledge.

The yield on the benchmark 10-year Treasury word rose 5 foundation factors to three.5%. West Texas Intermediate crude rose 2% to simply beneath $80 per barrel.

Nasdaq Positive aspects, IBD 50 Excels

The Nasdaq managed to battle out of adverse territory to rise 0.7%. Pinduoduo (PDD) was a prime performer right here because it rose 3.8%.

The S&P 500 additionally clambered greater because it gained 0.2%. Illumina (ILM) was a standout because it gained 3.8%, however its chart is unremarkable.

The S&P 500 sectors had been principally optimistic. Shopper discretionary and financials fared greatest, whereas actual property and utilities lagged. Small-cap shares shined, with the Russell 2000 closing up 0.6%.

Development shares impressed most, with the Innovator IBD 50 ETF (FFTY) rallying 1.2%.

Dow Jones At present: Caterpillar Up, Apple Inventory Shines

The Dow Jones Industrial Common continued to impress after it managed to reverse greater after early stress. It ended the day up 0.3%.

Exterior of the banking names, it was Leaderboard inventory Caterpillar that impressed most on the index. CAT inventory, which is prolonged previous a 239.95 purchase level, rose almost 1%.

Apple inventory reversed greater, closing 1% greater. It stays rooted beneath its 50-day shifting common, nevertheless.

UnitedHealth (UNH) was the inventory that lagged most on the Dow Jones right now. UNH inventory fell 1.2% in a bearish reversal.

Market Breaks Previous Resistance; Tesla’s Painful Transition

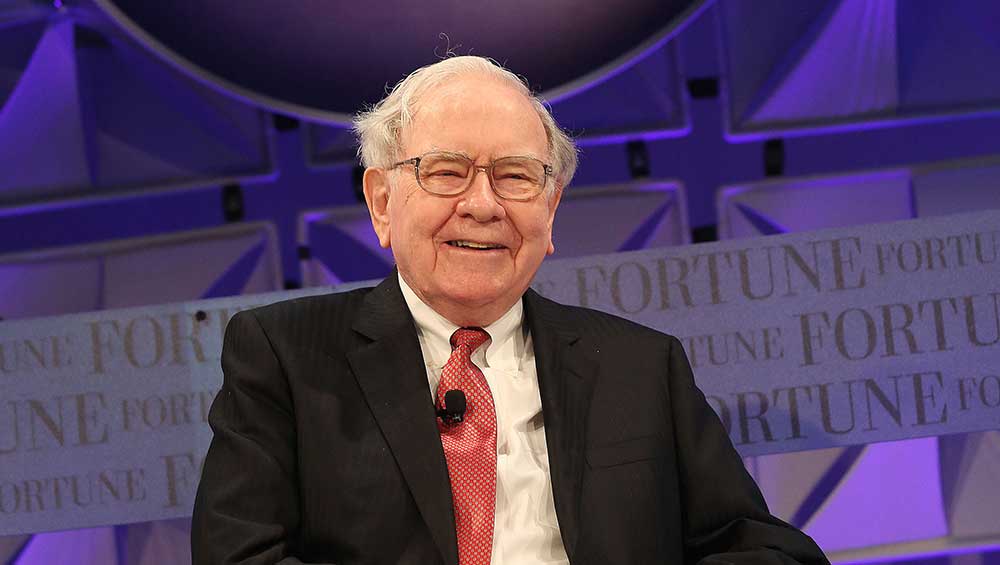

Warren Buffett Shares Eye Purchase Factors

Many traders preserve monitor on the portfolio of well-known traders, and none is extra well-liked than Berkshire Hathaway (BRKB) CEO Warren Buffett. A trio of shares in his agency’s portfolio are both constructing bases or testing a purchase level.

Aon inventory is in a purchase zone after clearing a cup-with-handle entry of 314.74, in accordance with MarketSmith evaluation. The relative power line for the insurance coverage inventory is at new highs.

All-around robust efficiency has netted the inventory an IBD Composite Ranking of 90.

Flooring & Decor (FND) is one to observe because it kinds a cup base with a 102.25 purchase level. The inventory holds a strong EPS Ranking of 93. It’s within the prime 20% of shares when it comes to worth efficiency over the previous 12 months.

RH, previously Restoration {Hardware}, is closing in on an entry at 338.71. It’s a massive favourite with establishments, with 71% of its inventory held by funds. Ahead earnings estimates are usually not ideally suited although, with EPS seen slipping 2% within the fiscal 12 months ending this month.

Various shares inside RH’s Retail-Residence Furnishing trade group have been displaying power not too long ago, together with Arhaus (ARHS) and Ethan Allen Interiors (ETD), with the latter near a purchase level. This makes RH a inventory price maintaining a tally of.

Tesla Inventory Hit By These Negatives

Tesla inventory was pressured decrease after a spate of adverse developments Friday. It battled off lows however closed down 0.9%.

First, the EV big reduce U.S. Mannequin 3 costs 6%-14%, relying on the trim. It additionally reduce Mannequin Y costs.

The agency, which is led by CEO Elon Musk, is aiming to make extra fashions eligible for U.S. tax credit.

As well as, Guggenheim analyst Ronald Jewsikow downgraded Tesla to promote from impartial with an 89 worth goal. Wells Fargo analyst Colin Langan slashed Tesla’s worth goal to 130 from 230. Nonetheless, Langan maintained an equal weight score.

Tesla inventory stays rooted beneath its main shifting averages. Regardless of the day’s adverse motion, the EV inventory has been rallying mightily of late. It’s up round 19% on its Jan. 6 low of 101.81.

Banks Shares Dig In After Earnings

Massive banks had been displaying grit after posting blended fourth-quarter outcomes early Friday.

Shopper banking behemoth Wells Fargo (WFC) reversed greater regardless of a blended This fall report. It ended the day up 3.3% after falling close to December lows.

JPMorgan Chase (JPM) additionally rallied to show in a 2.5% acquire. The inventory dipped beneath the 138.76 purchase level of its flat base, however is actionable as soon as once more. The corporate impressed traders by besting This fall expectations.

Financial institution of America (BAC) and Citigroup (C), which each topped Wall Road views, additionally rose. BAC gained 2.2% whereas Citi rose 1.7%.

Exterior Dow Jones: 3 Shares Take a look at Entries

MercadoLibre has moved away from an alternate purchase level at 1,039.49. It stays actionable from this entry.

The Latin America e-commerce play can be closing in on an extended consolidation sample entry of 1,095.44. Sturdy all-around efficiency is mirrored in its IBD Composite Ranking of 95.

Copa Holdings is on the prime of its purchase zone previous an 89.27 deal with purchase level. It surged in heavy quantity after JPMorgan upgraded the IBD 50 airline inventory to chubby from impartial. It additionally hiked its worth goal from 105 to 132.

The relative power line hit contemporary highs, a bullish signal. Copa is within the prime 11% of shares when it comes to worth efficiency over the previous 12 months.

Fluor has cleared a trendline entry inside a flat base. The bullish motion noticed the inventory added to the distinguished IBD Leaderboard checklist of prime shares.

It’s also closing in on a correct purchase level of 36.16. Its new sample is second stage, which nonetheless counts as a positive early stage.

Wall Road sees income hovering on the agency, which manages massive infrastructure initiatives. Full-year earnings are seen vaulting 84% in 2023 to $1.66 per share.

Please observe Michael Larkin on Twitter at @IBD_MLarkin for extra evaluation of progress shares.

YOU MAY ALSO LIKE:

These Are The 5 Finest Shares To Purchase And Watch Now

Chip Inventory Will get A Raise On These Merchandise

Be part of IBD Reside Every Morning For Inventory Suggestions Earlier than The Open

This Is The Final Warren Buffett Inventory, However Ought to You Purchase It?

This Is The Final Donald Trump Inventory: Is DWAC A Purchase?