Market volatility is selecting up once more, with main sell-offs in lots of prime shares. Tesla (NASDAQ: TSLA) and Cognex (NASDAQ: CGNX) have plummeted in latest weeks, whereas Plug Energy (NASDAQ: PLUG) continues its multiyear downtrend.

This is what’s driving the sell-off in these development shares and whether or not they’re value shopping for on the dip.

From development to worth, to development once more

Daniel Foelber (Tesla): Tesla has been on a curler coaster in recent times. Lengthy often known as a development inventory, Tesla has traditionally been valued based mostly on its potential income and money flows quite than what it’s producing right this moment. However that every one modified in late 2022 when Tesla’s price-to-earnings (P/E) ratio plummeted beneath 35, and its ahead P/E tumbled beneath 30.

Tesla’s inventory worth would go on to double in 2023 — pushing the valuation again as much as development inventory ranges. It appeared like Tesla was again to sustaining its excessive working margin and constant gross sales development. Nonetheless, Tesla merely hasn’t been placing up the outcomes that traders had come to anticipate, which is weighing on the inventory.

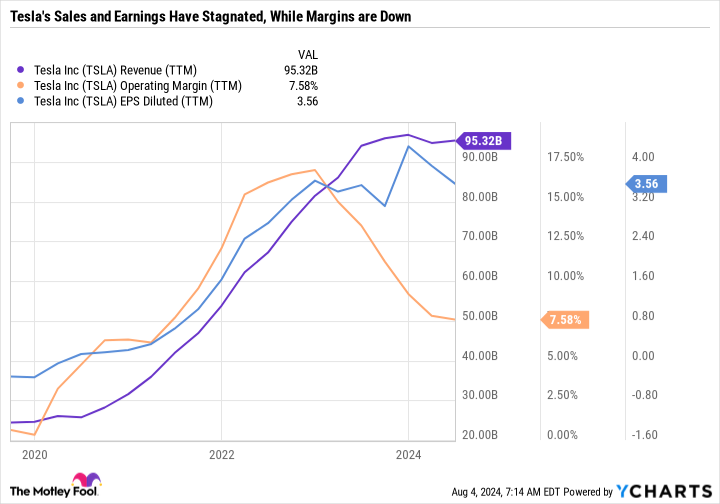

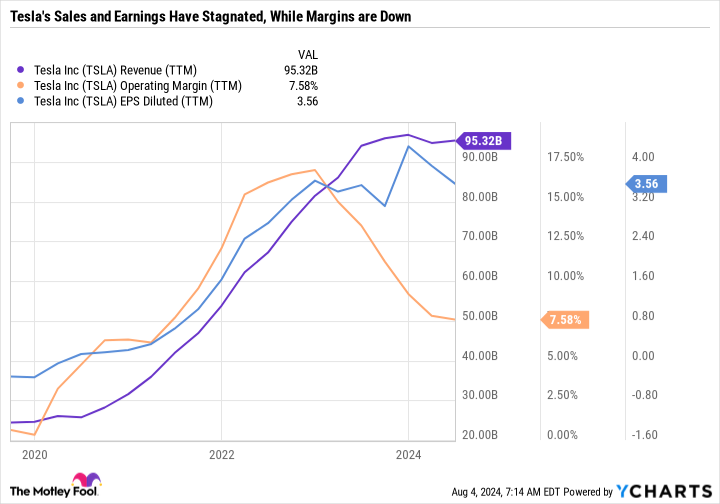

As you possibly can see within the chart, income and earnings have stagnated, and margins are noticeably down from peak ranges. The tempo of electrical car (EV) adoption has slowed, which is difficult the notion that customers would flock to inexpensive EVs and the world would transfer previous the inner combustion engine. Tesla is speaking much less about EVs in its earnings calls and extra about huge concepts like robotaxis, robotics, synthetic intelligence, its Optimus robotic, and extra.

Morgan Stanley analyst Adam Jonas is valuing the core auto enterprise at $59 per share and the total firm at $310 a share. When you’re a Tesla bull, that is not a giant deal as a result of the worth goal implies round a 50% leap within the inventory worth. However suppose you might be extra skeptical of Tesla’s capability to monetize its moonshot concepts. In that case, there is a important draw back danger if Tesla’s auto enterprise actually is value lower than a 3rd of its present valuation.

In years previous, Tesla’s valuation was based mostly on the mass-market sale of EVs. It succeeded, the inventory has been a long-term winner, and Tesla has impacted the worldwide auto trade. However right this moment, the basic funding thesis has as soon as once more modified. With development slowing and a P/E ratio of 58.5, shopping for Tesla inventory now could be a wager on its innovation. The excellent news is Tesla has a rock-solid stability sheet and may generate free money movement to fund its concepts.

On this vein, Tesla is vastly totally different from an up-and-coming start-up that may tackle debt or dilute its inventory to fund concepts. Tesla has the dry powder to take leaps — but when the funding thesis relies on the efficiency of these leaps, it would want a minimum of one to be a giant hit.

When you’re prepared to leap into the unknown with Tesla, then the inventory could possibly be value shopping for now. However if you happen to choose extra certainty, on the lookout for different alternatives is a better option.

Close to-term weak point is making a shopping for alternative at Cognex

Lee Samaha (Cognex): The machine imaginative and prescient firm’s income comes from its clients’ capital spending plans. It is an ideal place to be when its clients’ finish markets are in development mode and ramping up manufacturing of smartphones, cars, EVs, batteries, and many others. Nonetheless, it’s totally difficult when their finish markets are weak, and so they deal with chopping development plans.

Sadly, this can be a 12 months of the latter, and based mostly on administration’s outcomes and commentary on the second-quarter earnings name, it is getting worse. Its logistics (e-commerce warehousing) and semiconductor finish markets are the one vibrant spots. Nonetheless, its conventional inner combustion engine (ICE) automotive and EV battery enterprise seems to have taken one other leg down these days quite than bottoming out. CEO Rob Willett mentioned he had continued “to have tempered expectation for funding in 2024” from client electronics.

Nonetheless, when you find yourself shopping for a inventory, you might be shopping for its worth, not making a vote on its near-term prospects. Furthermore, the heavy discounting within the inventory creates a shopping for alternative, given the corporate’s long-term development trajectory. There’s little doubt that automation and machine imaginative and prescient are the way forward for manufacturing, as merchandise have gotten extra complicated, and producers wish to enhance high quality management and productiveness by utilizing automated processes that require machine imaginative and prescient.

The fact is that Cognex has all the time had extremely unstable however uptrending long-term income development, and it is usually time to purchase when traders are feeling pessimistic concerning the close to time period, as they’re now.

Plug Energy has grown income at a gradual clip… however there’s extra to the story

Scott Levine (Plug Energy): Plummeting greater than 81% over the previous 12 months, Plug Energy inventory is, undoubtedly, on the radar of these on the lookout for probabilities to scoop up development shares on a budget. Take a step again and take into account the hydrogen inventory’s efficiency over the previous three years — a interval throughout which it has dropped greater than 90% — and it could appear much more ripe for a shopping for alternative. However whereas traders can decide up shares whereas they sport a inexpensive price ticket, it does not imply they need to rush to take action.

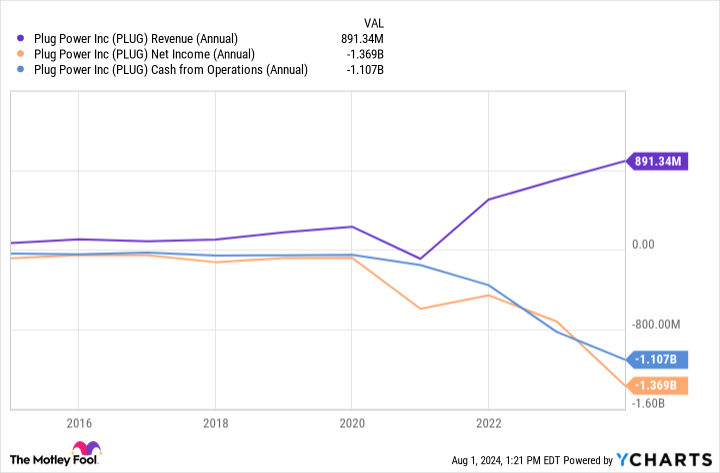

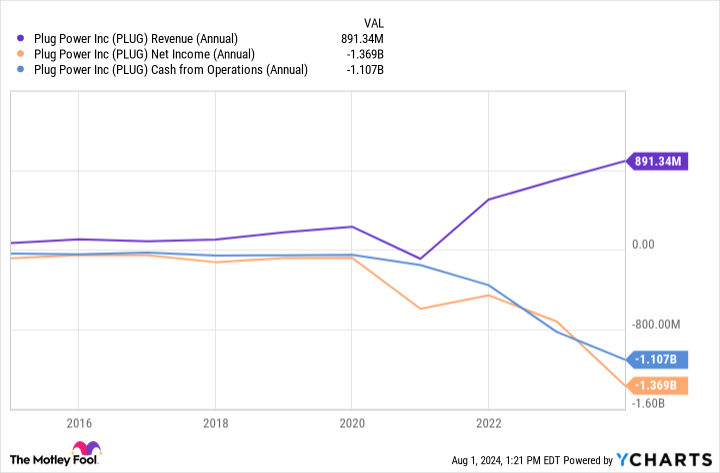

To Plug Energy’s credit score, it has carried out a powerful job of more and more promoting clients on its gasoline cell and hydrogen merchandise. In 2023, Plug Energy reported income of $891.3 million, a 27% year-over-year improve. The persistent drawback for Plug Energy is not on the prime of the earnings assertion, although — it is on the backside. Regardless of the corporate’s income development success, it has did not generate related revenue development. Equally, it has did not generate constant constructive money movement.

Consequently, it has steadfastly relied on elevating capital by issuing debt and fairness to maintain the lights on. Most not too long ago, this was demonstrated when the corporate introduced it could promote about 78 million shares to boost about $200 million.

Till the corporate can present important (and sustained) progress towards attaining profitability and constructive money movement, traders ought to look elsewhere to scratch their itches for hydrogen shares or development shares typically.

Do you have to make investments $1,000 in Tesla proper now?

Before you purchase inventory in Tesla, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Tesla wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $641,864!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 6, 2024

Daniel Foelber has no place in any of the shares talked about. Lee Samaha has no place in any of the shares talked about. Scott Levine has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Cognex and Tesla. The Motley Idiot has a disclosure coverage.

Down Between 29% and 82% From Their 52-Week Highs, Ought to You Purchase the Dip on Tesla, Cognex, Or Plug Energy Inventory? was initially printed by The Motley Idiot