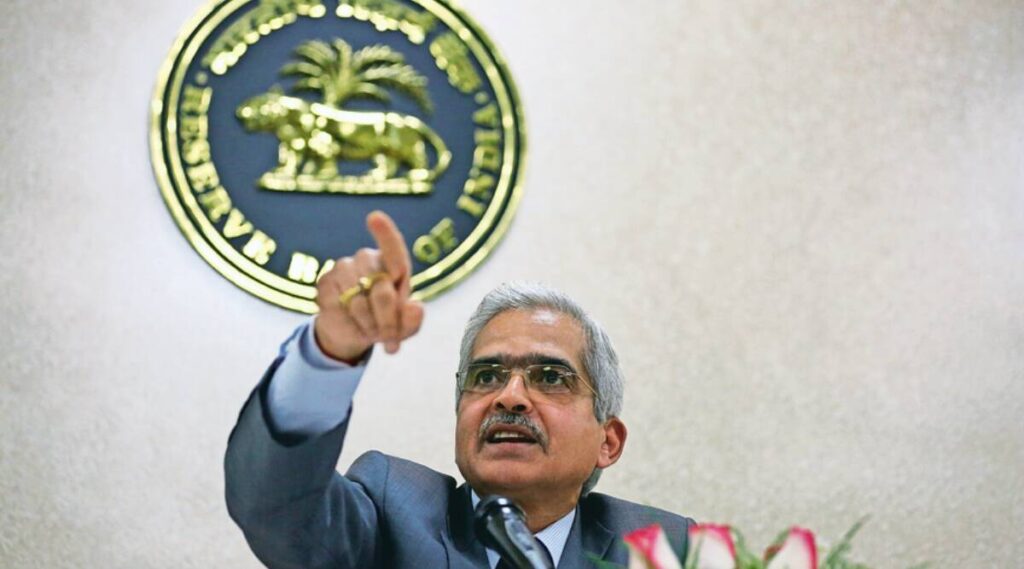

RBI Governor Shaktikanta Das, Digital Rupee Launch: The Reserve Financial institution of India (RBI) Governor Shaktikanta Das on Wednesday mentioned that e-rupee launch was a landmark second within the historical past of forex within the nation and it’ll remodel the way in which enterprise is completed and the way in which transactions are carried out.

Talking at FICCI’s Banking Convention – FIBAC 2022, Das mentioned that the RBI needs to iron out all facets of Central Financial institution Digital Forex (CBDC) earlier than launch. He added that the central financial institution hopes to launch digitised Kisan Credit score Card loans in a full fledged method by CY 2023.

He famous that there isn’t a goal date for full fedged launch of the digital rupee.

In his tackle to the Indian bankers, Das mentioned that the value stability, sustained development and monetary stability needn’t be mutually unique. he additionally famous that the transparency shouldn’t be compromised in any method by not releasing letter to be written by RBI to authorities for lacking inflation goal.

Talking on the convention, Das mentioned that with financial coverage actions and stances present process a regime shift within the superior nations, monetary circumstances have tightened throughout markets and accentuated monetary stability dangers. He famous that in an unsure atmosphere, Indian financial system has been rising steadily drawing energy from its macroeconomic indicators and buffers. He mentioned that India right now presents an image of resilience and optimism for the world.

On the inflation entrance, the RBI chief mentioned the central financial institution is intently monitoring inflation developments and the affect of earlier actions. He mentioned that the RBI is seeing appreciable enchancment in gross sales of white items in festive season.

“In mine and the RBI’s view, value stability, sustained development, and monetary stability needn’t be mutually unique,” he mentioned.

Das added that there’s plenty of hypothesis in regards to the MPC’s November 3 assembly. “We are going to put together a report on and ship it to the federal government,” he mentioned.

The RBI governor mentioned that MPC’s decision is supposed for your complete financial system and markets and residents ought to know in regards to the MPC’s resolution. Nonetheless, he added {that a} letter to the federal government is shipped beneath regulation.

“I don’t have the privilege or authority or luxurious to launch it to the media earlier than the addressee will get it… The contents of the letter is not going to be beneath the wraps eternally. It will likely be launched sooner or later… The primary proper of receiving the letter lies with the federal government,” he mentioned.

Das defined that if the RBI had began technique of tightening earlier, what would have been the counterfactual situation?

“We didn’t need to upset technique of restoration. We wished financial system to securely attain the shores after which deliver down inflation,” he mentioned. “There was a slippage in sustaining inflation goal. But when we might have tightened earlier, the nation would have paid a excessive value for it.”

-with PTI inputs