(Bloomberg) — Economists see US inflation operating hotter by subsequent yr than they did a month in the past and recession odds proceed to mount towards a backdrop of rising borrowing prices.

Most Learn from Bloomberg

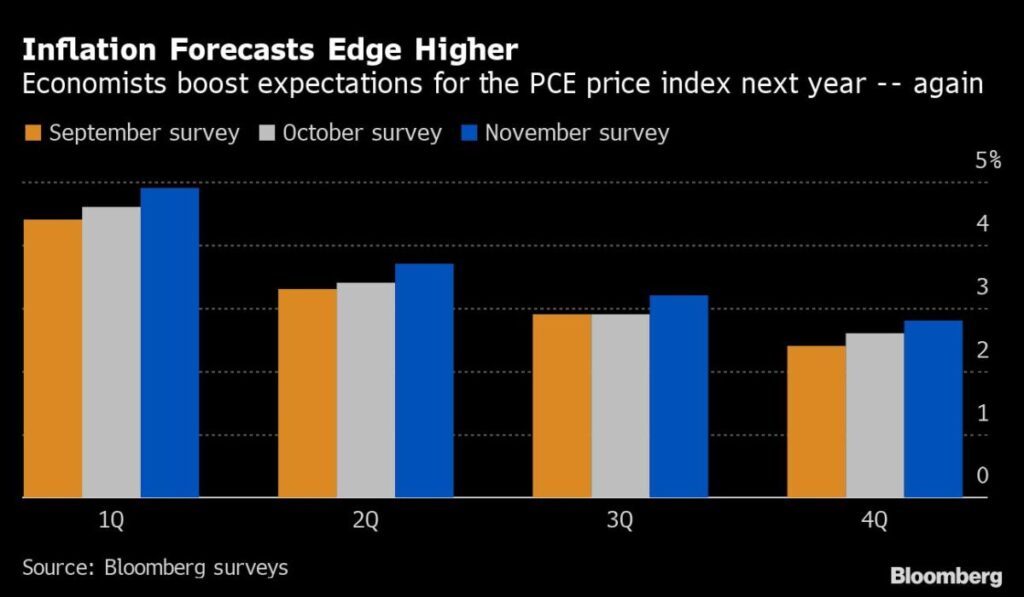

Projections for the non-public consumption expenditures worth index — the Federal Reserve’s most popular inflation metric — have been raised for every quarter of 2023. Nonetheless, worth pressures are seen cooling sharply over the course of the yr. By the ultimate three months, the PCE worth index will common 2.8% within the wake of sluggish financial exercise and better rates of interest.

The figures are based mostly on the median forecast of 65 economists in a Bloomberg survey carried out Nov. 4-11. Roughly half of the responses have been collected previous to the Nov. 10 launch of the patron worth index, which confirmed inflation rose at a slower-than-expected tempo in October.

Forecasters additionally boosted quarterly expectations for the so-called core PCE worth measure, which strips out meals and vitality prices, and the patron worth index. Meantime, the possibility of recession over the approaching yr continued to climb, rising to 65% from 60% in October.

Estimates for the PCE worth index within the fourth quarter of 2023 have been wide-ranging. For example, Barclays Plc forecast a mean improve of two% whereas Deutsche Financial institution AG projected 3.6% within the newest survey.

The Fed can be anticipated to succeed in the next goal vary of 4.75-5% within the first quarter of 2023 and wait longer to chop charges. Forecasters now anticipate the central financial institution to start slicing charges within the remaining three months of subsequent yr.

Inflation has proved to be broader and extra persistent than many on Wall Road — or the Fed — had anticipated. Underpinned by a robust labor market and better wages, client spending has largely held up within the face of the quickest worth progress in a era.

However many economists anticipate excessive inflation and the Fed’s aggressive coverage response to tip the financial system into recession subsequent yr.

Fed Chair Jerome Powell mentioned earlier this month that rates of interest will probably go increased than coverage makers had projected earlier however the path could quickly contain smaller hikes. The central financial institution is anticipated to lift the benchmark charge by 50 foundation factors at their December assembly.

Economists trimmed already dismal estimates for the financial system within the first half of subsequent yr. Gross home product is anticipated to flat line in each quarters amid softer client spending earlier than resuming tepid progress within the again finish of the yr.

(Provides choose companies’ PCE worth projections in fifth paragraph)

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.