NEW YORK, Could 24 (Reuters) – EF Hutton, the small funding financial institution that organized a deal for the inventory market itemizing of Donald Trump’s social media enterprise, is dominating preliminary public providing (IPO) league tables as firms maintain again on massive offers dealt with by main Wall Avenue banks.

The New York-based financial institution, which launched in its present type three years in the past, has been topped probably the most prolific IPO underwriter by deal quantity by Dealogic for 3 of the final 4 quarters, together with the primary quarter of 2023.

Conventional IPO powerhouses, then again, akin to Goldman Sachs Group Inc (GS.N), JPMorgan Chase & Co Inc (JPM.N) and Morgan Stanley (MS.N), have struggled to make it even within the prime 5 of the league tables up to now two quarters.

It is because EF Hutton focuses on advising shell companies referred to as particular function acquisition firms (SPAC) which are used to listing within the inventory market via a merger, in addition to different small firms that change into penny shares.

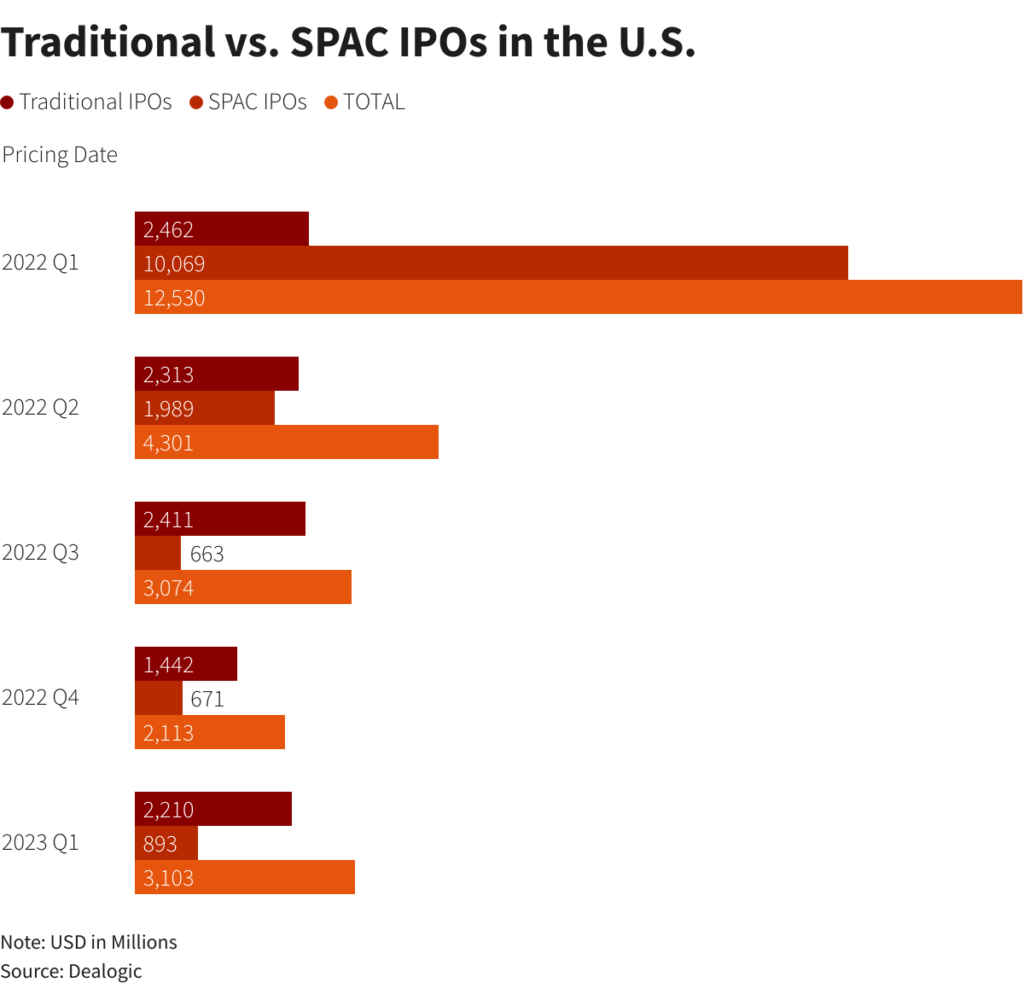

SPACs have fallen out of favor due to their poor general monetary efficiency and regulatory scrutiny, and their IPO quantity is now a fraction of main IPO offers. But the absence of the latter, throughout a persistent bout of market volatility, has made SPACs and penny shares the principle driver of inventory market listings.

EF Hutton helped firms increase $231 million in IPO proceeds within the first quarter, based on Dealogic. Within the fourth quarter of 2021, the final quarter earlier than Russia’s invasion of Ukraine and rampant inflation triggered a significant slowdown within the IPO market, the highest underwriter, Financial institution of America Corp (BAC.N), had helped raised greater than $5 billion.

EF Hutton, Goldman Sachs, JP Morgan, Morgan Stanley and Financial institution of America both declined to remark or didn’t reply to requests for remark.

EF Hutton, based in 1904, turned certainly one of Wall Avenue greatest brokerages earlier than slowly falling aside within the Eighties and Nineties following a collection of economic scandals and mergers. It was resurrected as a model by KingsWood Holdings Ltd (KWG.L), a London-listed funding agency, which acquired the rights to the EF Hutton identify in 2021, a few 12 months after the funding financial institution was launched.

One in every of EF Hutton’s most well-known offers was main the IPO of Digital World Acquisition Corp (DWAC.O), the SPAC that went on to agree a $1.25 billion merger in 2021 with Trump Media & Expertise Group. The deal has been held up by U.S. regulators scrutinizing it, and its future is doubtful.

Reporting by Echo Wang in New York; Enhancing by Richard Chang

: .