Most traders considering Vitality Switch (NYSE: ET) are drawn to its excessive yield, which presently sits round 7.9%. The corporate presently pays a $0.32 quarterly distribution and is trying to enhance that by between 3% to five% a yr shifting ahead.

That’s enticing in and of itself, however I additionally assume the pipeline operator’s inventory might practically double over the subsequent 5 years.

This may occur by way of a mix of development tasks, in addition to modest a number of growth, which is when traders assign the next valuation metric to a inventory.

Let us take a look at why I feel Vitality Switch’s inventory can greater than double within the subsequent 5 years.

Progress alternatives

Vitality Switch is without doubt one of the largest midstream corporations within the U.S., with an expansive built-in system that traverses the nation. It is concerned in practically all points of the midstream sector, transporting, storing, and processing varied hydrocarbons throughout its methods. The dimensions and breadth of its methods give it many growth venture alternatives.

This yr, the corporate plans to spend between $3 billion to $3.2 billion in development capital expenditures (capex) on new tasks. Shifting ahead, spending between $2.5 billion to $3.5 billion in development capex a yr would enable it to pay its distribution whereas having cash left over from its money stream to pay down debt and/or purchase again inventory.

Given this, and the early alternatives that Vitality Switch is seeing in energy technology because of elevated energy wants from information facilities stemming from the rise in synthetic intelligence (AI), it is most likely protected to say that the corporate might spend about $3 billion in development capex a yr over the subsequent 5 years.

Most corporations within the midstream area are in search of no less than 8x construct multiples on new tasks. Which means that the tasks would pay for themselves in about eight years. For instance, a $100 million venture with an 8x a number of would generate a median return of $12.5 million in EBITDA (earnings earlier than curiosity, taxes, depreciation, and amortization) a yr.

Primarily based on that kind of return on development tasks, Vitality Switch ought to be about in a position to see its adjusted EBITDA rise from $15.5 billion in 2024 to about $17.4 billion in 2029 if it continues to spend $3 billion a yr on development tasks.

A number of growth alternatives

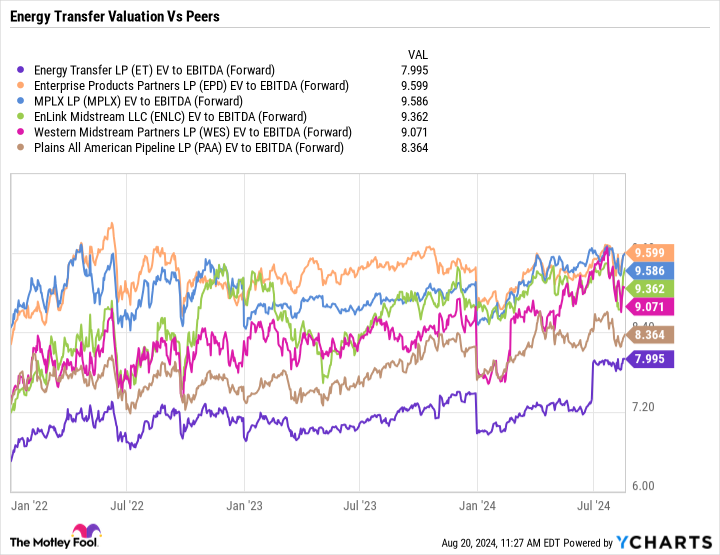

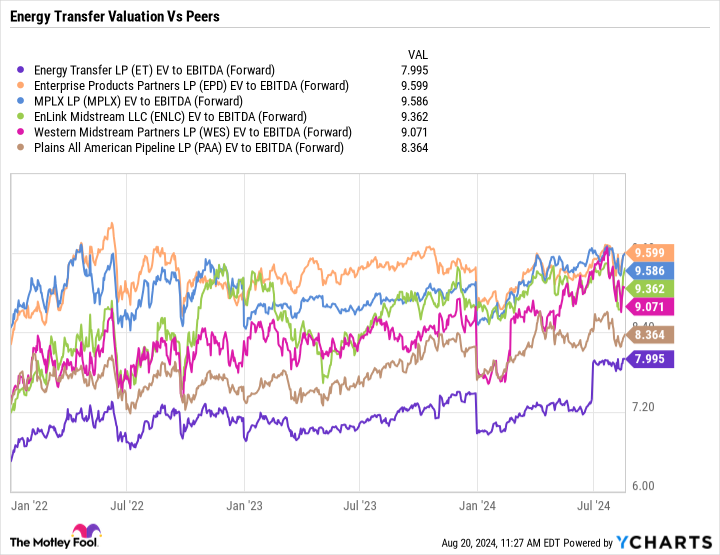

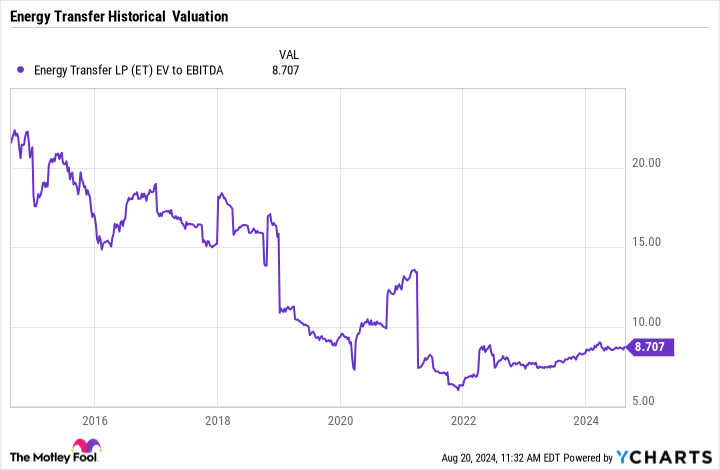

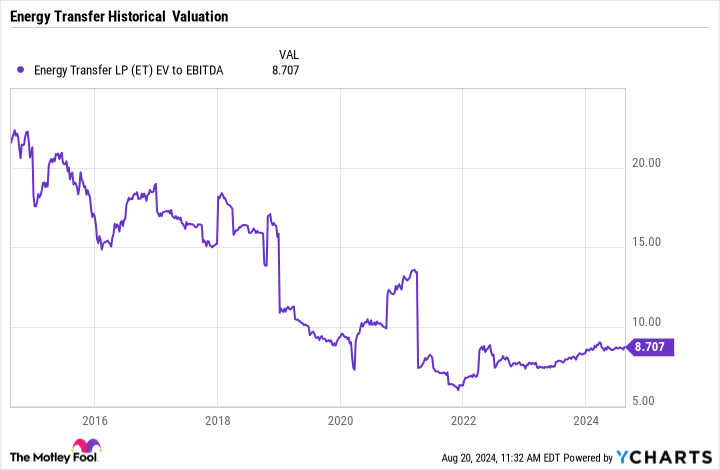

From a valuation perspective, Vitality Switch is the most cost effective inventory amongst its grasp restricted partnership (MLP) midstream friends, buying and selling at 8x on a ahead enterprise value-to-adjusted EBITDA foundation. This metric takes into consideration an organization’s web debt whereas taking out non-cash gadgets and is essentially the most extensively used approach to worth midstream corporations. On the identical time, it trades at a a lot decrease valuation than it has traditionally.

MLP midstream shares averaged a 13.7x EV/EBITDA a number of between 2011 and 2016, so the trade as an entire has seen its a number of come down. Nonetheless, with demand for pure gasoline on the rise because of AI and electrical automobile demand waning, the transition to renewables seems like it could take for much longer than anticipated. If so, these shares ought to be capable of command the next a number of than they presently do, as this reduces the concern that hydrocarbon demand will begin to materially decline within the years forward.

How Vitality Switch inventory practically doubles

If Vitality Switch grows its EBITDA as anticipated, the inventory might attain $30 in 2029 if it will probably command a 10x EV/EBITDA a number of. That’s up from the 8x ahead and eight.7x trailing a number of it presently instructions, nevertheless it’s nonetheless nicely under the place the MLP midstream area has traded up to now.

|

|

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

|---|---|---|---|---|---|---|

|

Adjusted EBITDA |

$15.5 billion |

$15.88 billion |

$16.25 billion |

$16.63 billion |

$17.0 billion |

$17.38 billion |

|

Worth at 8x a number of |

|

$17 |

$18 |

$19 |

$20 |

$21 |

|

Worth at 9x a number of |

|

$21.50 |

$22.50 |

$23.50 |

$24.50 |

$25.50 |

|

Worth at 10x a number of |

|

$26 |

$27 |

$28 |

$29 |

$30 |

* Enterprise worth is predicated on 3.42 billion shares excellent, $57.6 billion in debt, $3.9 billion in most popular fairness, $3.9 billion in investments in unconsolidated associates and money, and $11.6 billion in minority curiosity.

Nonetheless, Vitality Switch and a number of other different midstream corporations look like very nicely positioned to be stealth AI winners because of growing pure gasoline energy demand. Energy corporations and information facilities have already been approaching Vitality Switch about pure gasoline transmission tasks, and there might be a pure gasoline quantity increase coming. Given this development alternative, along with the corporate’s strengthened steadiness sheet and constant distribution development, I might see Vitality Switch’s a number of increase modestly over the subsequent 5 years and the inventory practically doubling.

Nonetheless, even when its a number of would not increase, traders can nonetheless get a really strong return on their funding by way of a mix of distributions (presently $0.32 per unit 1 / 4) and extra modest worth appreciation. With no a number of growth and over $7 in distributions between now and the top of 2029 (assuming a 4% enhance a yr), the inventory would nonetheless generate an over 75% return throughout that stretch.

Must you make investments $1,000 in Vitality Switch proper now?

Before you purchase inventory in Vitality Switch, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Vitality Switch wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $792,725!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 22, 2024

Geoffrey Seiler has positions in Vitality Switch, Enterprise Merchandise Companions, and Western Midstream Companions. The Motley Idiot recommends Enterprise Merchandise Companions. The Motley Idiot has a disclosure coverage.

Prediction: Vitality Switch Inventory Will Almost Double in 5 Years was initially printed by The Motley Idiot