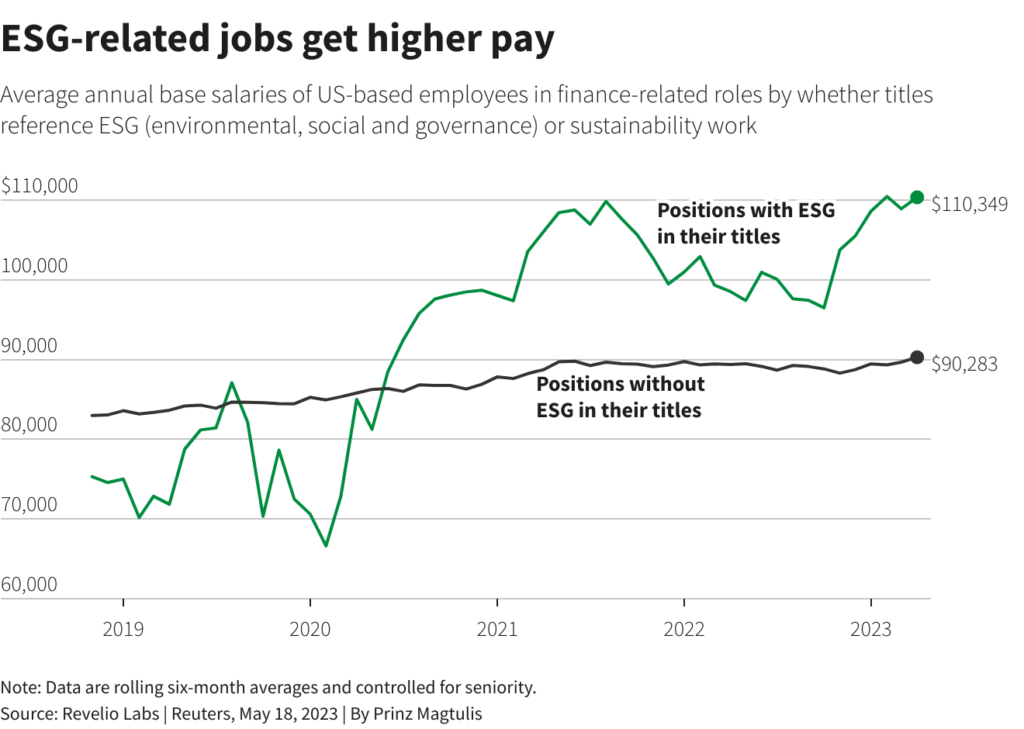

NEW YORK, Might 19 (Reuters) – U.S.-based bankers and cash managers whose job titles embody “ESG” or “sustainability” earn on common round 20% larger base salaries than colleagues of the identical seniority with out these labels, in line with evaluation of wage knowledge shared with Reuters.

Greater than $30 trillion in capital has been dedicated to environmental, social and company governance-related investments because the world seems to be to curb greenhouse fuel emissions and firms face stress on points corresponding to office variety and social justice.

This has sparked a scramble to seek out bankers and asset managers for these roles, resulting in larger base salaries than for equal professionals in non-ESG associated capabilities, the evaluation performed for Reuters by New York-based knowledge startup Revelio Labs exhibits.

“Salaries of ESG and non-ESG personnel began to diverge in 2020, consistent with the spike in hiring in ESG roles as a result of rising give attention to ESG and sustainable investing within the finance sector,” mentioned Loujaina Abdelwahed, an economist on the firm.

The sturdy demand for skilled expertise comes amid a political backlash towards ESG in elements of the Western world, particularly in america, the place it has culminated in numerous legal guidelines to take away environmental and social concerns from enterprise in some states.

Revelio Labs scraped on-line skilled profiles for folks with finance roles in industrial and funding banking and asset administration and cut up them into these with ESG or sustainability of their job titles and people with out.

They then utilized their wage mannequin which is educated on publicly accessible knowledge from three sources: roughly 2 million H1B paperwork, through which firms declare salaries they pay to non-U.S. residents, round 25 million job postings that included salaries, and about 1 million self-reported salaries.

Since 2019, the speed of base wage development for ESG roles has been about 38 share factors larger than non-ESG personnel, Abdelwahed mentioned.

ESG-tagged roles overtook non-ESG on a six-month transferring common foundation in June 2020 and in August 2021 surged to peak round $109,846, totally $20,000 larger than non-ESG.

The evaluation doesn’t have in mind the discretionary bonuses typically awarded to bankers and asset managers for his or her efficiency, as this knowledge shouldn’t be accessible from the general public sources consulted by Revelio Labs.

The hole shrank within the second half of 2021 however grew once more into this 12 months: in April 2023 common ESG salaries have been $110,348 versus $90,283.

Reporting by Isla Binnie; Enhancing by Simon Jessop and Christopher Cushing

: .