March 20 (Reuters) – Euro zone authorities bond yields reversed a few of their earlier sharp falls on Monday, as a rush into safe-haven property slowed, and buyers warmed as much as the concept that the newest measures might need lowered the dangers of a banking disaster in Europe.

UBS (UBSG.S) pays 3 billion Swiss francs ($3.2 billion)for Credit score Suisse (CSGN.S), and the Swiss central financial institution (SNB) mentioned it could provide substantial liquidity to the merged financial institution.

In the meantime, high central banks joined forces in a coordinated motion to boost the supply of liquidity by their standing U.S. greenback swap line preparations.

The bloc’s banks borrowed simply $5 million from the ECB on Monday through an enhanced greenback swap facility.

German authorities bond yields hit their lowest since mid-December, with the 10-year yield , the bloc’s benchmark, dropping as a lot as 20 foundation factors (bps) at one stage to 1.923%. It was final down 2 bps at 2.11%.

Bond yields transfer inversely to costs.

“Buyers’ flight to high quality would possibly proceed however extra reasonably after current developments,” mentioned Massimiliano Maxia, a senior fixed-income strategist at Allianz International Buyers.

“The market will quickly shift focus to the U.S. banking system forward of this week’s Fed coverage assembly,” he added.

Italy’s 10-year yield dropped 6 bps to 4%, which pushed the unfold between Italian and German 10-year yields to 186 bps, having earlier hit its widest degree since early January at 205.6 bps.

“There may be uncertainty concerning the price outlook as we do not know the extent of contagion amongst banks, and we do not know whether or not it can influence the actual financial system affecting the ECB coverage path,” mentioned Antoine Bouvet, head of European charges technique at ING.

“Central banks’ measures are useful for liquidity and for the banking system,” he added.

DOWNGRADING EXPECTATIONS

Goldman Sachs lowered its 2023 financial development forecast for the euro zone on Monday, citing ongoing stress within the international banking system.

Markets saved expectations for the following ECB strikes round final week’s lows, displaying they had been cautious about current statements from the central financial institution.

President Christine Lagarde mentioned on Monday monetary market turbulence wouldn’t stand in the best way of the ECB’s struggle towards inflation because it has totally different instruments to take care of each points.

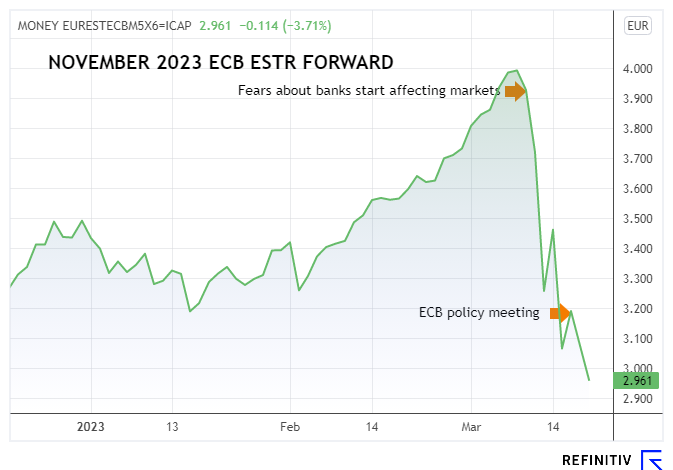

The August 2023 ECB euro short-term price ahead dropped as little as 3.0%, implying expectations for a deposit price peak at 3.1% by summer season. The ahead was final at 3.1%.

The November 2023 ahead had risen above 4% earlier than fears of a banking disaster began hurting markets on March 10.

The ECB deposit price is at present at 2.5%.

Brief-end euro space yields continued to slip as markets pare again expectations for price hikes.

Germany’s two-year yield , which is most delicate to adjustments in rate of interest expectations, was down 8 bps at 2.353%, after earlier falling to its lowest since Dec. 13, 2022.

Italy’s two-year yield dropped 15 bps to 2.897%, hitting its lowest since Jan. 19.

In the meantime, ECB policymakers from Austria and Belgium pressed the case for extra price hikes over the weekend.

Market focus will shift to the Federal Reserve coverage assembly, which ends on Wednesday.

Most analysts anticipate a 25 bps hike, however they reckon a lot will rely upon whether or not a modicum of stability returns to monetary markets, particularly for regional banks.

Reporting by Stefano Rebaudo, extra reporting by Samuel Indyk, modifying by Ed Osmond, Hugh Lawson and Ken Ferris

: .