MILAN, March 29 (Reuters) – The typical European financial institution may stand up to a lack of 38% of its deposits with out having to promote at a loss authorities bond holdings or have a fireplace sale of illiquid property, Jefferies analysts mentioned.

The collapse of Silicon Valley Financial institution after deposit withdrawals that pressured the U.S. regional lender to promote Treasury bonds at a loss has targeted traders’ consideration on the potential losses banks face on their authorities bond holdings.

“Following the unravelling of a number of U.S. regional banks and the introduced rescue merger of Credit score Suisse into UBS (UBSG.S), traders have scrambled to search out weak hyperlinks within the system,” Jefferies mentioned in an evaluation of financial institution liquidity.

“Most investor discussions find yourself at deposit flight danger and the extent to which this may be offset,” it added.

Rising rates of interest have pushed down the market value of presidency bonds, however banks don’t must replicate that for the sovereign holdings which they intend to carry to maturity (HTM).

This protects them from taking successful to their capital reserves.

However traders are apprehensive concerning the danger that banks might in some unspecified time in the future be pressured to promote their HTM securities.

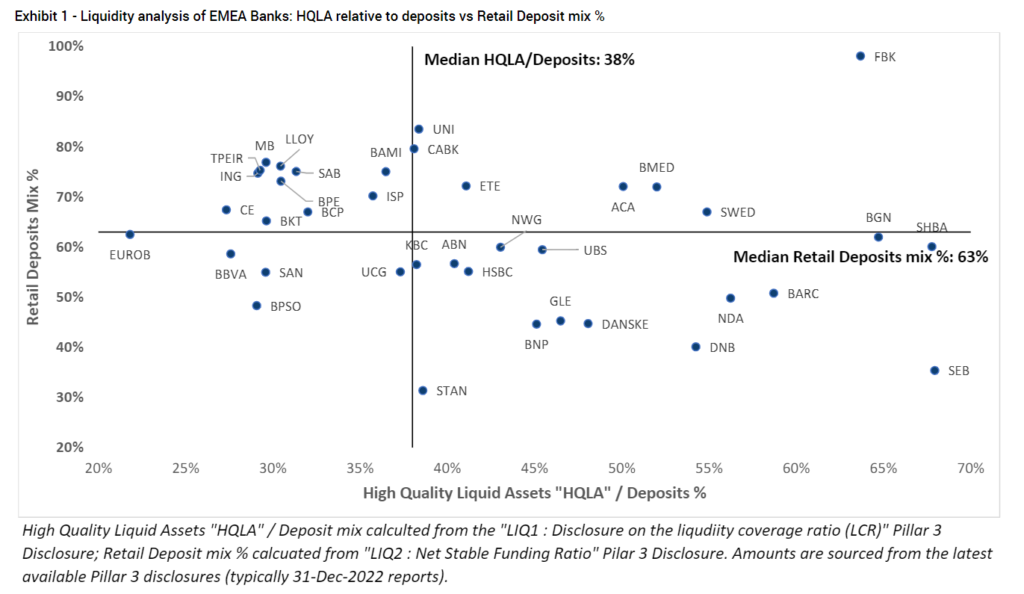

Jefferies calculated that the median European financial institution may lose in idea 38% of its deposits earlier than going through vital danger to capital because of losses on its HTM securities or the sale of different illiquid property.

Quick-term liquidity rules launched after the worldwide monetary disaster “seem like working as meant, no matter traders’ present partial lack of religion in liquidity protection ratios,” the observe mentioned.

Jefferies analysed the flexibility of banks to rapidly cowl deposit outflows with minimal or no losses, towards the extent of retail deposits, which comprise 63% of the median financial institution’s deposit base.

Retail deposits are an necessary supply of funding stability as a result of they’re stickier than company deposits and pose primarily a menace when it comes to value of funding, quite than an outright hazard of outflows.

“Our framework … exhibits Fineco (FBK.MI), Swedbank (SWEDa.ST), Credit score Agricole (CAGR.PA) and Nationwide Financial institution of Greece (NBGr.AT) as screening comparatively effectively,” Jefferies mentioned.

Normal Chartered (STAN.L), Santander (SAN.MC) and BBVA (BBVA.MC) don’t rating notably excessive, Jefferies mentioned, including nevertheless that their geographic diversification needed to be taken into consideration as a mitigating issue.

Following are the outcomes of Jefferies’ liquidity evaluation:

Reporting by Valentina Za and Iain Whithers. Modifying by Jane Merriman

: .