Nvidia (NASDAQ: NVDA) was the speak of the city in 2023, and it continues to be a Wall Road darling in 2024. It is arguably the one most necessary inventory behind the substitute intelligence pattern at the moment fueling the market.

As Nvidia has climbed greater and the broad market additionally reaches new all-time highs, skeptics have sounded the alarm for a inventory market bubble. And whereas the market is stretched thinner than in years previous, there’s nonetheless motive to imagine Nvidia shouldn’t be essentially overvalued, regardless of its 439% acquire for the reason that starting of 2023.

Purple scorching development

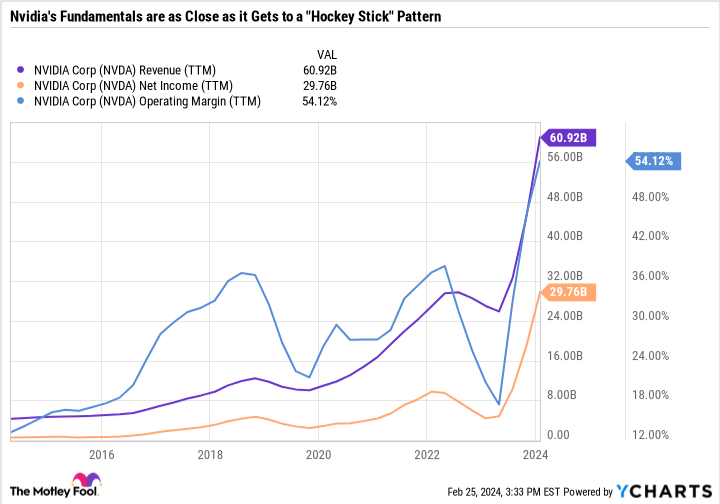

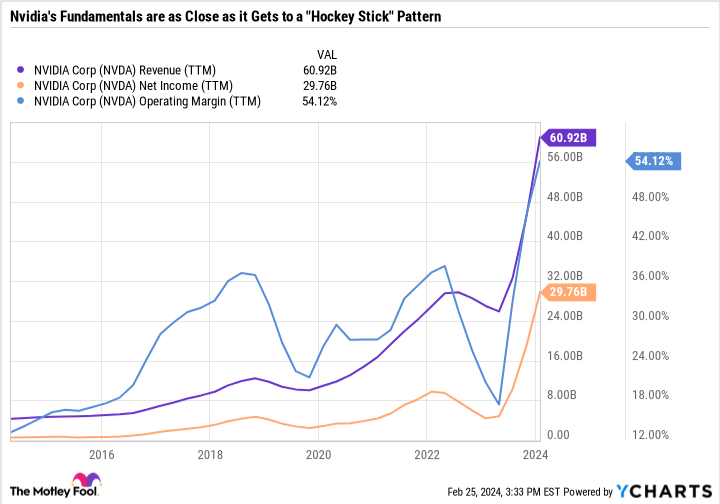

Say what you need about Nvidia inventory’s epic rise, however the firm is delivering on each measure with a one-two punch of excessive income development and increasing margins.

Income has greater than tripled within the final 12 months, whereas internet earnings is up over 500%. That degree of development for a corporation as large as Nvidia is unbelievable.

An comprehensible valuation

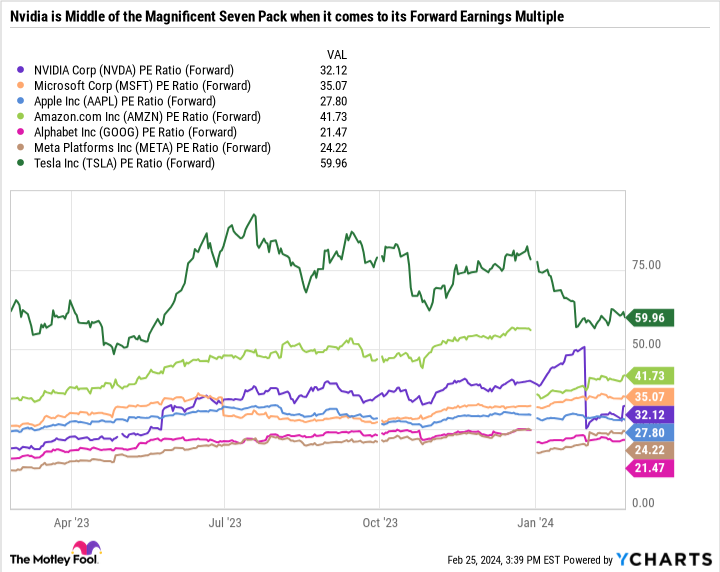

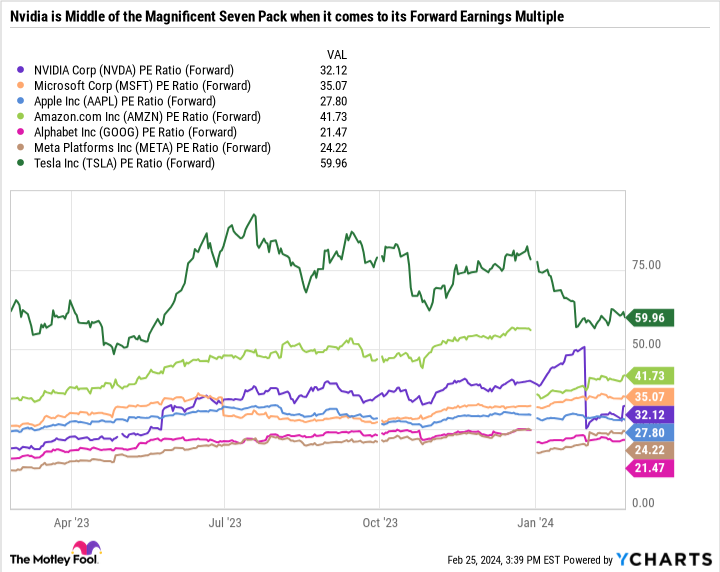

The previous 12 months of good points has additionally pushed Nvidia to commerce with a 66.2 price-to-earnings (P/E) ratio, a steep premium to even its “Magnificent Seven” friends. Nonetheless, the common analyst estimate for Nvidia’s fiscal 2025 earnings per share is $23.92, roughly double final 12 months’s consequence.

The surge in anticipated earnings provides Nvidia a way more affordable ahead P/E ratio. In truth, Nvidia has a decrease forward-looking valuation than Tesla, Amazon, and Microsoft.

You’d be hard-pressed to discover a development inventory that has practically quadrupled within the final 12 months with that low of a ahead P/E ratio.

The pitfalls of cyclical shares

On the similar time, there are just a few the explanation why focusing solely on ahead P/E is harmful for a corporation like Nvidia. First, Nvidia nonetheless has to double its earnings within the present fiscal 12 months — a excessive bar for any firm, not to mention one this dimension. The much more important danger to contemplate is that Nvidia operates in a cyclical trade.

Sometimes, cyclical shares have low P/E ratios throughout an enlargement and excessive P/E ratios throughout a downturn. The thought is that traders will not pay too excessive of a value throughout instances of elevated earnings but in addition will not unload a inventory simply because there is a contraction within the cycle. Over time, the median P/E ratio works itself out to one thing extra affordable.

instance is agriculture and development big Deere. The corporate’s earnings are slowing as the present enlargement interval nears an finish. Nonetheless, Deere’s P/E ratio is simply 10.6 as a result of its trailing earnings are excessive, however investor sentiment is unfavorable (shares are down 14% prior to now 12 months). Its 10-year median P/E ratio is a a lot greater 17.1 — which is smart — the long-term median ought to be greater than Deere’s present valuation. However in a downturn, traders can count on Deere’s P/E to climb greater than that long-term baseline.

The alternative is going on with Nvidia. Its 66.1 P/E is greater than its 46.7 10-year median. However once more, you might argue Nvidia deserves a a lot greater valuation given its scorching scorching development fee and earnings outlook for this 12 months.

The story is getting higher, nevertheless it’s nonetheless a narrative

Nvidia is thrilling as a result of it is rising rapidly, and it is already such a helpful firm that it will probably drive the entire market. Nvidia has already develop into a little bit of a narrative inventory, an organization valued primarily based extra on its hype and potential than its fundamentals. However Nvidia is not priced for perfection, both — its 32.1 ahead P/E ratio is cheap, particularly relative to the opposite “Magnificent Seven” shares. In any case, Nvidia has nearly at all times carried a premium, and there is no motive that ought to change on this a part of its development journey.

Personally, I might choose to purchase Nvidia when the expectations are decrease, and there is extra margin for error. Nvidia’s short-term efficiency might take a flip for the more serious attributable to macroeconomic circumstances and elements exterior its management. And with the inventory sitting at its peak, there is a heavy expectation its development will march on uninterrupted. A ahead P/E ratio above 30 is suitable for a corporation prone to double its earnings this 12 months, however that may change rapidly if the corporate fails to ship.

Potential traders ought to be cautious about these expectations, in addition to the habits patterns of cyclical shares. The straightforward cash has already been made, and with Nvidia’s market cap reaching $2 trillion, anticipating the inventory to once more triple within the close to time period is not practical.

As a person investor contemplating Nvidia to your portfolio, it is as much as you to determine what sort of value you are prepared to pay for the inventory and what you count on from the enterprise at that value.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Nvidia wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 26, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Daniel Foelber has the next choices: lengthy June 2024 $400 calls on Deere. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends Deere and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Even After Rallying 239% in 1 Yr, Nvidia Inventory Nonetheless Is not Costly In accordance with This Key Metric was initially revealed by The Motley Idiot