Costco Wholesale (NASDAQ: COST) has captured the highlight with its $15 particular dividend, which shall be paid to shareholders as of file on the shut of enterprise on Dec. 28. At first look, a $15 per share particular dividend looks as if loads. In any case, that is greater than the inventory worth of some firms.

However on the time of this writing, Costco is a $661 inventory. And even when we assume Costco barely raises its peculiar dividend subsequent 12 months, it’s nonetheless more likely to pay lower than $20 and even $19 per share in dividends — good for a ahead yield underneath 3%.

In the meantime, rival retailer Goal (NYSE: TGT) has raised its dividend yearly for over 50 years. It does not pay particular dividends. However its peculiar dividend alone has a ahead yield of three.2% — higher than Costco with out even counting on particular dividends.

Here is why Goal is a greater all-around purchase than Costco proper now — and a much better dividend inventory for 2024.

Totally different approaches to dividend funds

Goal is a standard dividend-paying inventory. It makes use of free money circulation (FCF) to help dividend development. And even throughout downturns, when it does not have the FCF to help dividends, it may possibly lean on money reserves or the power of its steadiness sheet to pay dividends and fulfill its promise to traders.

Like Goal, Costco pays an peculiar dividend. But it surely’s solely $1.02 per share. Granted, Costco has raised its peculiar dividend considerably over time (it has practically doubled within the final 5 years). Besides, Costco’s yield from its peculiar dividend alone is simply 0.6%.

As soon as Costco’s money reaches an “extreme” degree on its steadiness sheet, it tends to pay out a particular dividend. This has occurred 4 occasions over the previous decade.

Within the chart, you’ll be able to see Costco’s 4 particular dividends during the last decade, which coincide with a excessive level within the money place, apart from the particular dividend in 2017 (which was extra a results of supposed development).

Particular dividends are overrated

On the floor, Costco’s technique makes loads of sense. When there’s room to pay a particular dividend, it is smart to reward your shareholders by immediately placing cash of their pockets. Particular dividends have the “plop issue” that an peculiar divined merely cannot compete with in the identical means.

However I would argue that particular dividends are overrated. The worth of a high quality dividend-paying firm is not handy out cash to shareholders when occasions are good, however to repeatedly pay a rising quarterly payout it doesn’t matter what the financial system or the enterprise is doing. That is what makes a Dividend King like Goal so beneficial. It constantly raises its dividend even when the enterprise faces challenges, which has definitely been the case currently.

Within the case of Costco, the enterprise has been doing extraordinarily nicely, and the inventory has been a juggernaut. So returning $6.7 billion to shareholders within the type of a particular dividend is not actually an excellent use of capital. A greater use could be to reinvest within the enterprise to help future development.

Valuation issues

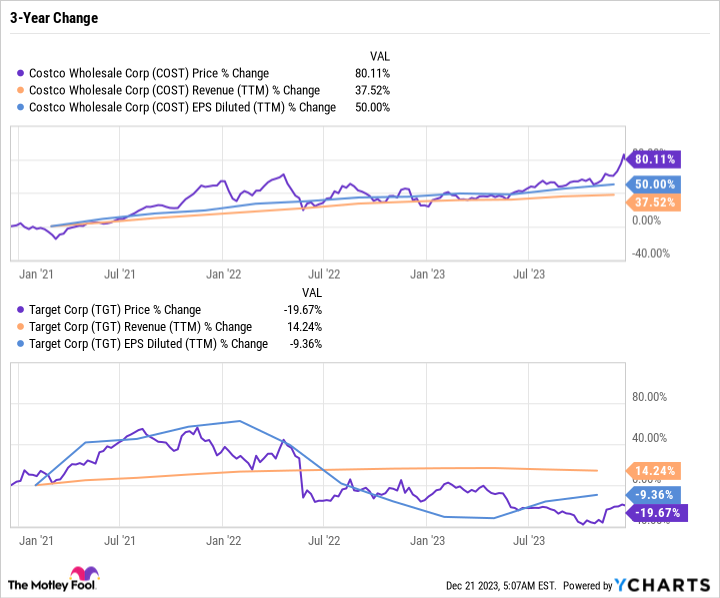

Costco’s inventory worth has outpaced the earnings and income development.

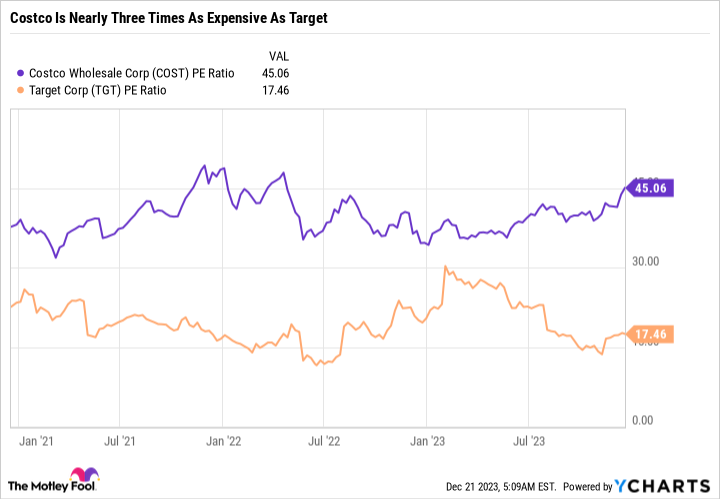

As you’ll be able to see within the chart, Costco inventory is up 80% during the last three years, whereas Goal is down practically 20%. Costco, as a enterprise, has carried out significantly better than Goal, so the inventory deserves to have outperformed. However to the extent that it has leaves room for hazard. Actually, Costco’s price-to-earnings ratio is now 45.1 in comparison with simply 17.5 for Goal.

That is an costly worth for a wholesale retailer. In investing, you usually do not need to purchase one inventory over the opposite simply because it’s cheaper. Or as Warren Buffett famously stated, “It’s miles higher to purchase an exquisite firm at a good worth than a good firm at an exquisite worth.”

However within the case of Costco and Goal, we have now two nice companies the place one is much cheaper than the opposite. Granted, Costco will in all probability proceed rising sooner than Goal. However to not the purpose the place it ought to commerce at that a lot of a premium.

The case for Goal

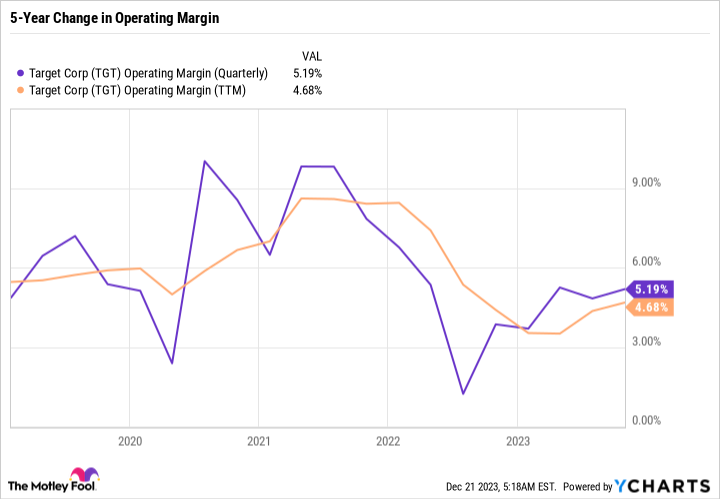

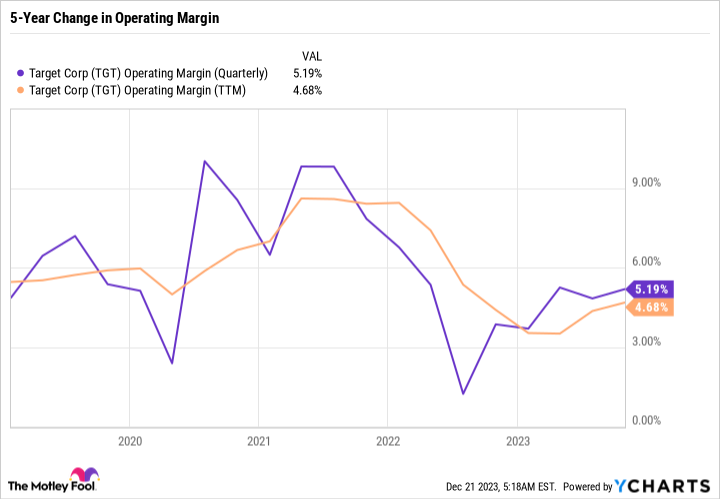

The (very abridged) model of why Goal has lagged the market in recent times has to do with its mismanagement of client demand, poor stock forecasting, and poor provide chain administration. As a retailer, the worst factor you are able to do is over-order, after which must low cost objects to maneuver merchandise off the cabinets. That is a recipe for margin compression, precisely what occurred to Goal.

The excellent news is the worst is over. Goal has labored on loads of its stock complications. It’s now conserving a far leaner stock, even through the vacation season. Goal stays a superb model that has what it takes to develop over time, with its Goal Circle rewards program, enlargement of on-line ordering and curbside pickup, and engagement with its app.

The reliability of Goal’s dividend, paired with its upside potential and cheap valuation, makes it a inventory price proudly owning for the long run.

Do not swoon over particular dividends

Costco’s particular dividend is mainly a 2.2% increase to the inventory worth — which is what can occur any day available in the market. Solely it prices the corporate billions of {dollars} and is not the results of the market bidding up the corporate’s worth.

I view dividends as an anchor of an funding thesis — one thing you’ll be able to depend on it doesn’t matter what is going on available in the market. Additionally they function a helpful monetary planning device for constructing passive revenue and retirement financial savings. Alternatively, capital good points, or the expansion in worth of an organization, ought to outcome from the corporate’s enhancements being acknowledged by the market.

A particular dividend is like compelled capital good points, if that is smart. If I have been a Costco shareholder, I’d both need to see the next peculiar dividend and the elimination of particular dividends, or I’d need to see Costco reinvest the cash it could have spent on particular dividends again into the enterprise.

The inventory could be very costly and must justify the valuation with earnings development. That $6.7 billion may have gone a great distance towards driving future development. As a substitute, it is going to be distributed and taxed to traders as a one-time cost meaning little or no in the long term.

Do you have to make investments $1,000 in Costco Wholesale proper now?

Before you purchase inventory in Costco Wholesale, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 finest shares for traders to purchase now… and Costco Wholesale wasn’t considered one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

Daniel Foelber has positions in Goal and has the next choices: lengthy November 2024 $130 calls on Goal and quick November 2024 $135 calls on Goal. The Motley Idiot has positions in and recommends Costco Wholesale and Goal. The Motley Idiot has a disclosure coverage.

Even With Its $15 Particular Dividend, Costco Nonetheless Will not Yield as A lot as This Dividend King in 2024 was initially revealed by The Motley Idiot