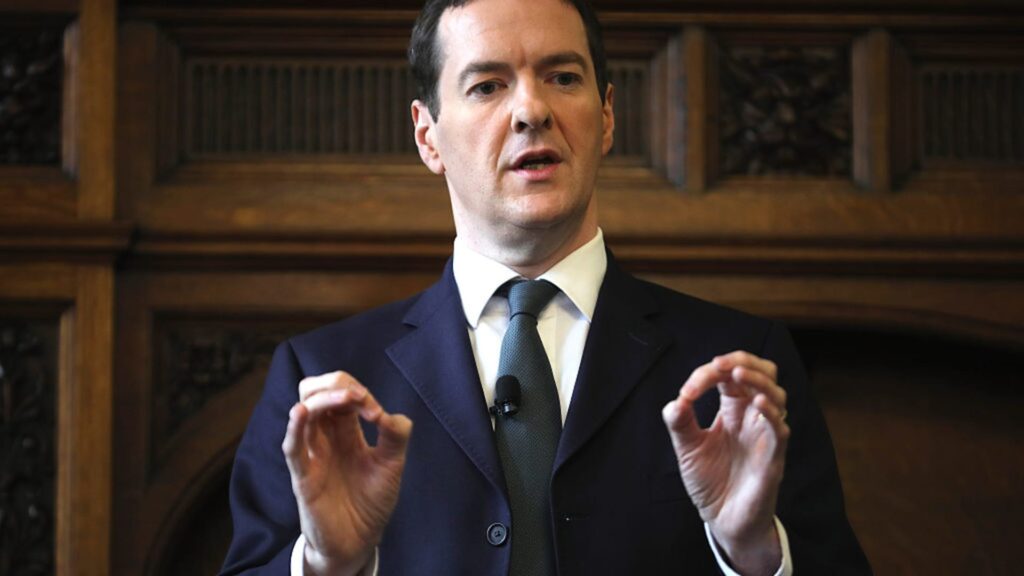

Former British Chancellor George Osborne addresses company throughout a go to to the Manchester Chamber of Commerce on July 1, 2016 in Manchester, England.

Christopher Furlong | Getty Pictures

LONDON — A former British finance minister on Wednesday joined cryptocurrency change Coinbase as a world advisor, beefing up the corporate’s regulatory bargaining energy at a time when it faces extreme scrutiny stateside.

Coinbase introduced that George Osborne, who served as Britain’s chancellor of the exchequer from 2010 to 2016, will be part of the corporate on its international advisory council.

He’ll be part of the likes of Mark Esper, the previous U.S. Secretary of Protection and Patrick Toomey (R-PA) on the council, which is in place to “advise Coinbase on our international technique as we develop our attain world wide.”

Faryar Shirzad, Coinbase’s chief coverage officer, stated the corporate was “happy to have George be part of our council at an thrilling time for us within the U.Ok. and globally.”

“George brings with him a wealth of expertise in enterprise, journalism and authorities. We stay up for counting on his insights and experiences as we develop Coinbase world wide,” Shirzard added.

Osborne will serve in an advisory capability at Coinbase, serving to join the corporate with politicians and regulators to assist additional the reason for forming crypto-friendly rules.

Whereas chancellor of the exchequer, Osborne launched a slew of austerity insurance policies geared toward decreasing the price range deficit, together with freezing little one advantages, decreasing housing advantages, and implementing a two-year pay freeze for public sector employees. He additionally tried to stimulate enterprise exercise by slicing company tax.

Osborne was quickly editor-in-chief at London’s Night Normal newspaper after finishing his tenure as Britain’s finance minister. He’s presently a companion at Robey Warshaw LLP, a boutique funding financial institution.

“There’s an enormous quantity of thrilling innovation in finance proper now,” Osborne stated. “Blockchains are remodeling monetary markets and on-line transactions.”

“Coinbase is on the frontier of those developments. I stay up for working with the crew there as they construct a brand new future in monetary providers,” Osborne continued.

Osborne’s ties with Coinbase aren’t new

Solutions of a rising relationship between Osborne and Coinbase first emerged final yr, when Coinbase’s CEO Brian Armstrong spoke onstage in a hearth moderated by Osborne at a fintech occasion in London.

Osborne subsequently spoke with Coinbase’s chief monetary officer, Alesia Haas, at a hearth chat within the Belvedere Lodge in the course of the World Financial Discussion board in Davos, Switzerland.

It comes as Coinbase has made one thing of a land seize throughout Europe, increasing in a number of nations over the previous couple of months with new licenses in place. The corporate was granted a digital asset service supplier license in France final month, paving the way in which for growth of its providers there. It has additionally just lately secured licenses in Spain, Singapore, and Bermuda.

Coinbase is presently dealing with a harsh regulatory crackdown within the U.S. the place the Securities and Change Fee has accused the corporate of violating securities legal guidelines. Coinbase denies the allegations.

Final yr, Coinbase chief Armstrong appeared on stage with Osborne on the Innovate Finance World Summit convention in London. On the occasion, Armstrong stated he was open to investing extra overseas, together with relocating from the U.S. to the U.Ok. or elsewhere if the regulatory strain on crypto corporations continues.

“I feel if various years go by the place we do not see regulatory readability round us … we might have to contemplate investing extra elsewhere on this planet. Something together with, you already know, relocating,” Armstrong informed Osborne.

He informed CNBC’s Arjun Kharpal on the time that Coinbase was “taking a look at different markets” because it considers its place from a regulatory standpoint.

Armstrong did later make clear in an interview with CNBC’s Dan Murphy that Coinbase had no formal plans to relocate from its U.S. headquarters in San Francisco. “Coinbase shouldn’t be going to relocate abroad,” Armstrong stated. “We’re at all times going to have a U.S. presence … However the U.S. is a little bit bit behind proper now.”