FRANKFURT, March 30 (Reuters) – German savers are getting chilly ft about deposits held overseas regardless of juicier rates of interest for worry of getting embroiled in a disaster just like the one which hit Silicon Valley Financial institution, knowledge compiled for Reuters reveals.

German households, who’ve Europe’s deepest pockets with 2 trillion euros held in money, had been searching for larger returns on their money by opening deposits on-line at small banks in weaker economies resembling Lithuania, Malta, Italy and Portugal.

However that pattern turned abruptly on March 10, when the collapse of Silicon Valley Financial institution sparked turmoil within the banking sector, in accordance with knowledge offered by two German comparability web sites.

Demand for international deposits with a set maturity dropped by 15%-20% since March 10 in comparison with February, in accordance with knowledge from on-line platforms Check24 and Biallo, which work with banks to market these and different merchandise.

In contrast, German banks, that are perceived as safer due to their authorities’s excessive credit standing and two separate security nets on deposits, noticed a rise in demand, each platforms stated.

Germans’ retreat to safer floor mimics, on a small scale, the exodus of U.S. depositors from small to giant banks within the wake of SVB’s collapse and will increase funding prices for lenders in weaker European economies that have been hoping to faucet Germany’s huge pool of money.

“Investor sentiment modified after March 10,” Moritz Felde, a managing director at Examine 24, advised Reuters. “I see a rise in demand for banks situated in triple-A international locations.”

A spokesman for Biallo stated queries about deposit insurance coverage schemes quadrupled since March 10 on its platform.

Sibylle Miller-Trach of the German shopper affiliation in Bavaria stated “time period deposits aren’t essentially protected” and savers ought to collect details about the creditworthiness of the financial institution and its nation.

SPREAD SEEN WIDENING

Check24 and competing platforms don’t publish figures about their volumes of enterprise so it’s onerous to inform how a lot cash Germans have deposited overseas.

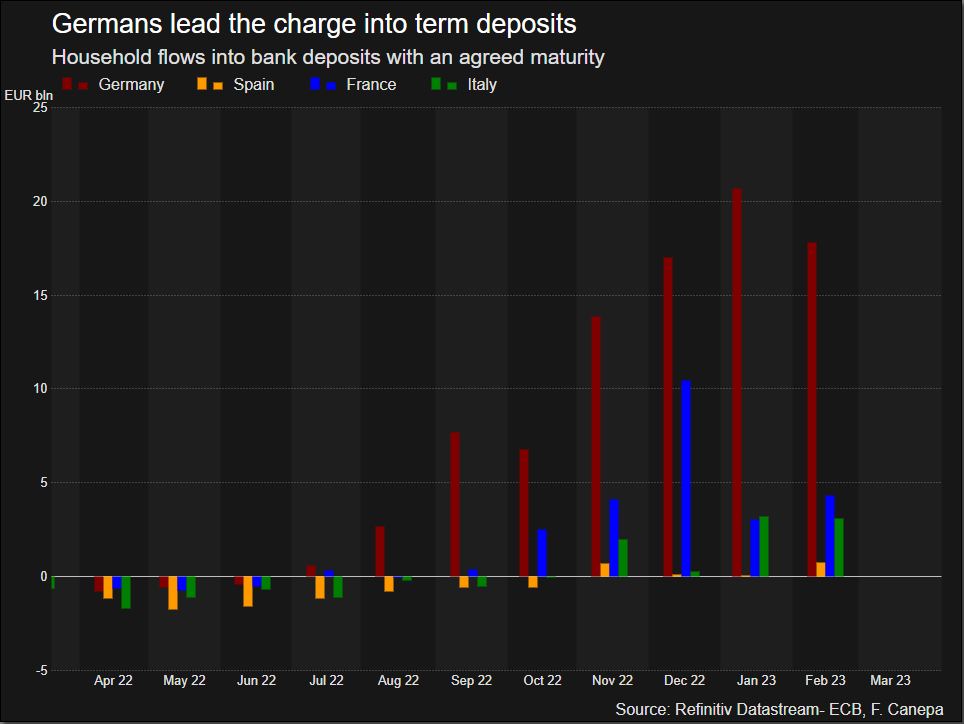

But when international banks had secured simply 10% of the 83 billion euros that Germans poured into home time period deposits up to now six months, lacking out on that sort of cash sooner or later can be vital for smaller banks on the receiving finish.

Small Italian funding financial institution Sensible Financial institution was paying the very best price on a 12-month deposit on Thursday at 3.5%, adopted by Malta’s Izola Banka and Croatia’s Banka Kovanika at 3.45%, in accordance with the most recent provides on main German comparability platforms.

In contrast, probably the most that savers might get from a German financial institution was 2.55% from on-line lender SWK Financial institution.

Whereas charges on time period deposits have typically gone up over the previous month, the rise has been extra pronounced for international banks, a Biallo spokesperson stated, including the platform anticipated this unfold to widen additional.

“The present disaster is main clients to maintain their deposits with their native financial institution,” stated Christian van Beek, a director on the Scope Scores company.

Identified in German as Festgeld, time period deposits pay savers curiosity for locking in cash at a financial institution for various months or years and had been a staple for Germans till a collapse in charges a decade in the past made them unappealing.

With charges rising once more as a part of the European Central Financial institution’s battle towards inflation, German households have been rekindling their long-lost love for Festgeld since September, ECB knowledge confirmed.

The euro zone banking system continues to be awash with the money pumped by the ECB over the previous decade, which the central financial institution is simply withdrawing at a reasonable tempo.

The ECB additionally stays on faucet to offer banks with limitless liquidity for so long as they’ve collateral.

“Behind the system there are sturdy states and a robust central financial institution,” stated Daniel Bauer, chair of the German affiliation for investor safety. “I do not see any trigger for concern right here, so long as you have a look at the boundaries of deposit insurance coverage.”

Reporting by Francesco Canepa; Enhancing by Christina Fincher and Alison Williams

: .