ZURICH, June 12 (Reuters) – With its Credit score Suisse takeover formally wrapped up, UBS should now make good on its promise that the government-orchestrated rescue will ship each for shareholders and Swiss taxpayers.

The world’s greatest banking deal because the 2008 monetary disaster has solid a wealth supervisor with an unrivalled international attain and $5 trillion in belongings underneath administration, handing UBS an in a single day lead it might in any other case have taken years to attain in key markets.

Organized over a weekend in March to stave off a broader banking disaster, and backed by as much as 250 billion Swiss francs ($281 billion) in public funds – the tie-up now poses enormous challenges and potential rewards for Switzerland and its greatest financial institution.

Switzerland should now cope with a financial institution whose stability sheet is twice as massive as its economic system, whereas Sergio Ermotti, who was introduced again in as CEO to supervise the mega merger, faces powerful strategic choices as UBS integrates its smaller rival in opposition to an unsure financial backdrop.

THE SWISS BANK

Presumably the primary hurdle is a politically fraught determination on Credit score Suisse’s “crown jewel”, its home enterprise.

Bringing this into UBS and mixing largely overlapping networks may produce important financial savings and Ermotti has prompt doing so was the bottom state of affairs for the mixing.

However UBS must weigh that in opposition to public stress to maintain the Credit score Suisse enterprise separate with its personal model, identification and, critically, workforce. The unit had nearly 7,300 employees on the finish of 2022 and a 1.43 billion Swiss franc working revenue whereas the complete group suffered heavy losses.

A mixed enterprise would have a dominant place within the Swiss mortgage market, whereas public unease over a Swiss mega-bank, may result in even harder regulation and capital necessities.

UBS has stated all choices, which may embody an preliminary public providing, are open, with a call due inside months.

BLEEDING STAFF, CLIENTS?

UBS has burdened its intention to maneuver shortly to stop employees and buyer departures, with Chairman Colm Kelleher not too long ago signalling web good points in enterprise in some areas.

Nonetheless, insiders speak of rivals aggressively wooing Credit score Suisse shoppers and staff. One stated about 200 folks have been leaving the financial institution every week.

Buyers, finance consultants and analysts say protecting, and rising, enterprise whereas bettering employees morale is perhaps the largest problem of all.

Purchasers who would sometimes financial institution each with UBS and Credit score Suisse to unfold their threat, would possibly now take a few of that enterprise elsewhere.

“One plus one is not going to equal two. A sizeable portion of the belongings will probably be misplaced and that may have an effect on the profitability for UBS of the deal,” stated Alan Mudie, chief funding officer at Woodman Asset Administration.

Furthermore, such a fancy operation dangers the financial institution turning inwards, on the expense of innovation and customer support.

“My consumer relationship supervisor goes to be extra apprehensive about protecting their job than servicing my wants,” stated Arturo Bris, Professor of Finance on the Worldwide Institute for Administration Improvement (IMD) in Lausanne.

‘CULTURAL FILTER’

UBS, which has stated it goals to complete the 2 banks’ integration in three to 4 years, additionally made clear its mixed workforce – now at round 120,000 – might want to shrink.

UBS Chairman Kelleher has brazenly spoken about fears of “cultural contamination” and making use of a “cultural filter” to employees from Credit score Suisse’s funding financial institution, citing insufficient threat controls and unchecked development and capital spending.

All that contributes to uncertainty, which may make it more durable for the mixed group to maintain high performers and recruit new employees, some observers warn.

“An overhaul creates nervousness amongst all staff, additionally among the many high performers,” stated Lars Schweizer, professor of finance at Frankfurt College, including they usually get approached by headhunters with provides from rivals.

SKELETONS?

Whereas UBS has already supplied a monetary snapshot of the mixed group and earmarked tens of billions of {dollars} for value and doable losses arising from the tie-up, it has additionally warned the numbers may change materially over time.

UBS stated it had discovered no skeletons in Credit score Suisse’s books, however solely now will it achieve full perception right into a financial institution which has suffered from years of scandals, free oversight and in March an admission of fabric weaknesses in its controls.

One potential threat stems from authorized challenges to the choice by Swiss authorities to jot down off particular AT1 bonds issued by Credit score Suisse. Whereas UBS is just not a celebration to those authorized actions, it may add to its funding prices.

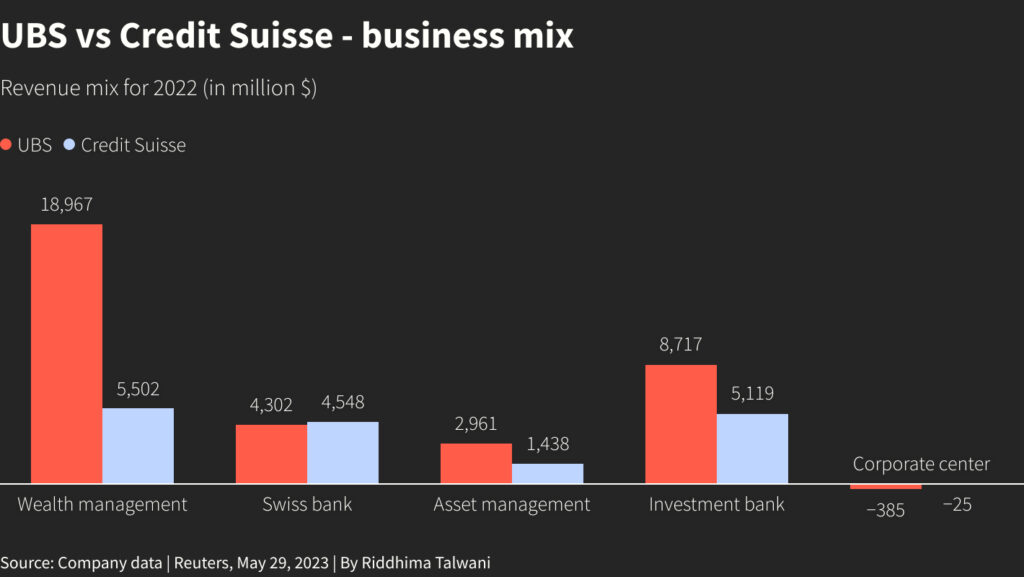

INVESTMENT BANK HEADACHE

UBS executives stated they goal to radically shrink Credit score Suisse’s funding financial institution. But there are questions over how far and the way shortly UBS will run down the enterprise and at what value.

The Swiss authorities is offering a assure of as much as 9 billion Swiss francs for potential losses associated to Credit score Suisse’s funding financial institution on high of as much as 5 billion francs in losses UBS has agreed to imagine.

‘POISONED CHALICE’

Ermotti promised his workforce would “work very exhausting” to keep away from any penalties for taxpayers and analysts say that with Swiss federal elections due in October, UBS must tread rigorously.

On paper, UBS doesn’t appear to wish any public funds, with an almost $35 billion monetary cushion from shopping for Credit score Suisse at a fraction of its e book worth.

Nonetheless, talks on the backstop held because the deal was introduced on March 19, counsel UBS was eager to safe what Barclays referred to as a “poisoned chalice” due to potential for political backlash.

Whereas Ermotti has performed down issues UBS will get too massive, Switzerland’s second-largest political occasion has proposed drastically shrinking its belongings, saying the lender’s scale and an implicit state assure raised the danger of one other costly rescue.

($1 = 0.8889 Swiss francs)

Reporting by John Revill and Oliver Hirt; Further reporting by Noele Illien;

Writing by Tomasz Janowski

Modifying by Elisa Martinuzzi and Alexander Smith

: .