LONDON, March 28 (Reuters) – Turbulence in Europe’s banks following the implosion of 167-year-old Credit score Suisse (CSGN.S) and runs on regional banks within the U.S. has targeted consideration on the position performed by credit score default swaps in all of the turmoil.

Buyers, nervous about which financial institution may be subsequent, have hammered the shares and bonds of a few of Europe’s greatest recognized banking names, together with Deutsche Financial institution (DBKGn.DE), Germany’s largest lender.

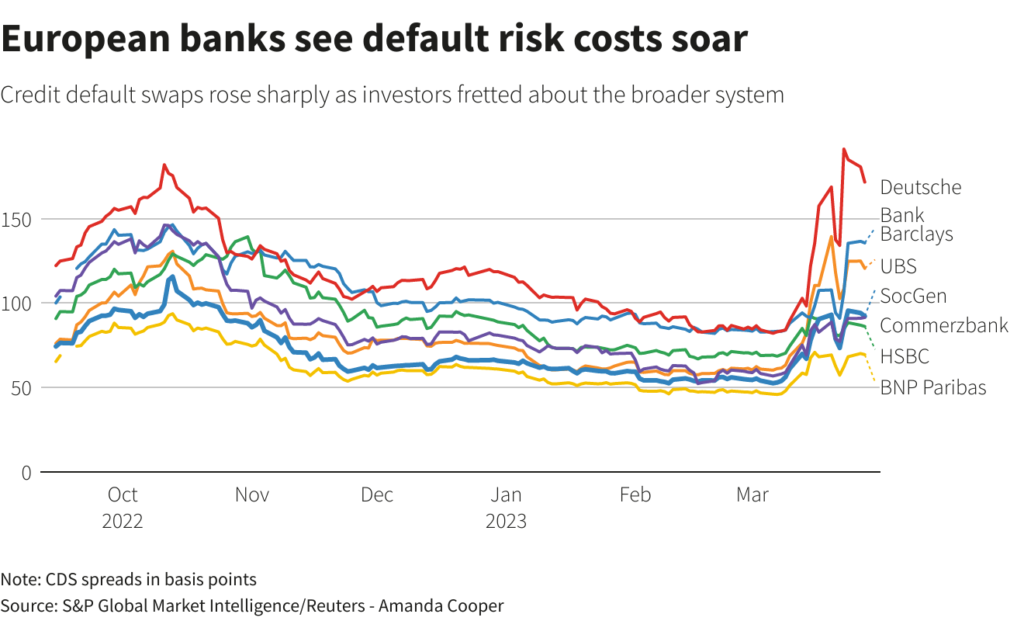

The strikes adopted a surge in the price of insuring Deutsche Financial institution’s debt in opposition to default by way of credit score default swaps (CDS) to a greater than four-year excessive final week.

Andrea Enria, the banking supervisory chief on the European Central Financial institution, highlighted the volatility in Deutsche Financial institution’s securities – together with CDS – as a worrying signal of how simply buyers could possibly be spooked.

“There are markets just like the single-name CDS market that are very opaque, very shallow and really illiquid, and with a number of million (euros) the concern spreads to the trillion-euro-assets banks and contaminates inventory costs and in addition deposit outflows.”

WHAT IS A CDS ANYWAY?

Credit score default swaps are derivatives that supply insurance coverage in opposition to the chance of a bond issuer – comparable to an organization, a financial institution or a sovereign authorities – not paying their collectors.

Bond buyers hope to obtain curiosity on their bonds and their a refund when the bond matures. However they haven’t any assure both of this stuff will occur and so need to bear the chance of holding that debt.

CDS assist to mitigate the chance by offering a type of insurance coverage.

The CDS market is price round $3.8 trillion, in keeping with the Worldwide Swaps and Derivatives Affiliation. However the market is effectively beneath the $33 trillion of its heyday in 2008, based mostly on ISDA information.

The CDS market is small relative to equities, overseas trade or the worldwide bond markets, the place there are greater than $120 trillion bonds excellent. Common each day quantity in overseas trade is near $8 trillion, based mostly on Financial institution for Worldwide Settlements information.

Buying and selling in these derivatives will be skinny. The variety of common each day CDS trades, even for big corporations, can typically be in single digits, based mostly on information from the Depositary Belief & Clearing Company (DTCC).

This makes the market tough to navigate and creates a scenario the place even a small CDS commerce can have an outsized value affect.

WHO BUYS CDS?

Buyers in bonds issued by corporations, banks or governments can purchase CDS insurance coverage by way of an middleman, typically an funding financial institution, which finds a monetary agency to problem an insurance coverage coverage on the bonds. These are “over-the-counter” offers which don’t undergo a central clearing home.

The customer of the CDS can pay a payment frequently to their counterparty, which then takes on the chance. In return, the vendor of the CDS pays out a certain quantity if one thing goes mistaken, similar to an insurance coverage payout.

CDS are quoted as a credit score unfold, which is the variety of foundation factors that the vendor of the by-product prices the client for offering safety. The higher the perceived danger of a credit score occasion, the broader that unfold turns into.

The proprietor of a CDS quoted at 100 foundation factors must pay $1 to insure each $100 of bonds that they maintain.

WHAT COULD TRIGGER CDS?

A CDS payout is triggered by a so-called credit score occasion – which might embody a chapter of a debt issuer, or a failure to make a cost on bonds.

In 2014, a brand new class of credit score occasion was launched, so-called “Governmental Intervention”, to handle investor issues that CDS wouldn’t cowl measures taken by governments to help struggling entities, particularly banks.

Like several monetary asset, CDSs are actively traded. If the notion of danger will increase round a debt issuer, demand for its CDS rises, widening the unfold.

The largest CDS market is for governments. Brazil tops the charts, with an each day notional common of $350 million trades every day, based mostly on DTCC information.

Credit score Suisse’s CDSs have been probably the most actively traded on the company entrance within the final quarter of 2022, with $100 million traded every day, DTCC information reveals.

LEADING ROLE IN 2008 CRISIS

CDSs have been one of many monetary devices on the centre of the 2008 monetary disaster.

Bear Stearns and Lehman Brothers have been among the many many banks that issued CDS to buyers on mortgage-backed securities (MBS) – mortgages bundled collectively into one bundle – amongst different forms of by-product.

When U.S. rates of interest rose sharply all through 2007 this brought on a wave of mortgage defaults, rendering billions of {dollars} in MBS and different bundled securities nugatory. This triggered hefty CDS payouts for banks comparable to Lehman and Bear Stearns.

A REPEAT OF 2008?

No. Rather a lot has modified since then. Many derivatives, together with CDS, have been much more broadly used at the moment and lined a broader vary of property, a lot of which went bitter.

The present turmoil doesn’t replicate a steep drop within the worth of the securities that underlie the CDS. It’s extra the notion of danger, fairly than precise danger.

In Deutsche Financial institution’s case, CDS on its five-year debt rose above 200 bps final week from 85 bps simply two weeks in the past, as buyers fretted in regards to the stability of the broader European banking system.

The ECB’s Enria argued that central clearing for CDS would enhance transparency, lowering the chance of volatility.

“Having these sort of markets centrally cleared fairly than having OTC, opaque transactions … would already be an enormous progress,” he stated.

Reporting by Amanda Cooper and Karin Strohecker in London and Davide Barbuscia in New York; Modifying by Elisa Martinuzzi and Jane Merriman

: .