NEW YORK, June 8 (Reuters) – Worries which have dogged U.S. shares for months are fading, pushing some Wall Avenue companies to lift their outlooks for equities and beckoning traders who’ve remained on the sidelines.

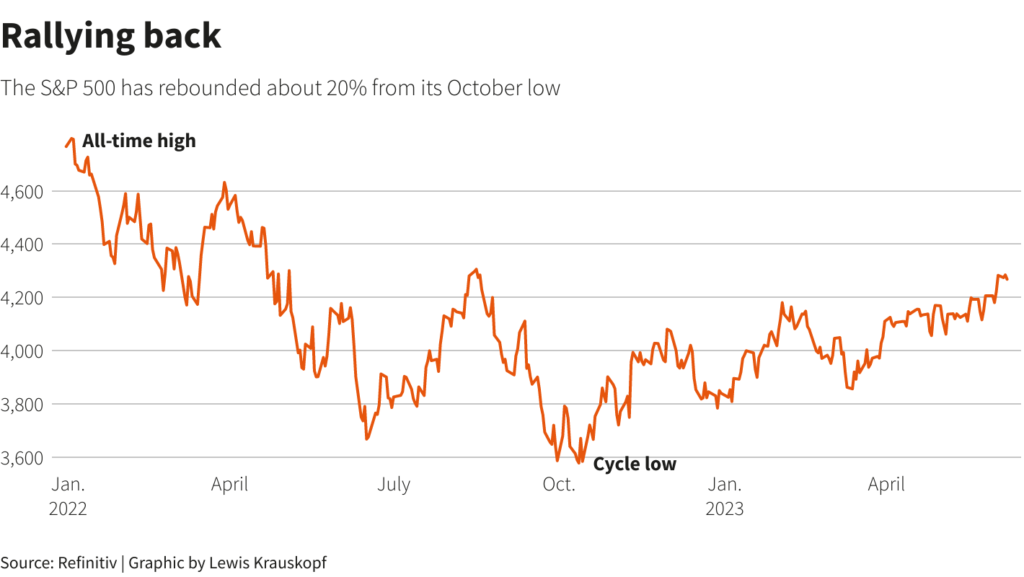

Indicators of power within the economic system, reduction over a deal to lift the U.S. debt ceiling and an rate of interest climbing cycle that could be nearing its finish have heartened traders and pushed the benchmark S&P 500 (.SPX) up practically 20% from its October low – one definition of a bull market.

Additional beneficial properties could hinge on whether or not traders who reduce inventory allocations to the bone over the past 12 months return to the market. Money on the sidelines is plentiful: U.S. cash market fund belongings hit a brand new report of $5.8 trillion final month, whereas money ranges amongst international fund managers stay excessive relative to historical past, in response to the newest survey from BofA International Analysis.

And whereas computer-driven methods have been piling into the marketplace for months, in response to Deutsche Financial institution, positioning amongst discretionary traders — a cohort that features everybody from lively mutual funds to retail traders — is lighter than it has been 74% of the time since 2010, the financial institution’s information confirmed.

“There definitely appears to be a little bit of a extra optimistic ring to the market,” stated Chuck Carlson, chief govt officer at Horizon Funding Companies. “Additional power may beget additional power due to the FOMO issue,” he added, utilizing the favored acronym for “concern of lacking out.”

DISSIPATING RISKS

A stronger-than-expected U.S. economic system is one cause for investor optimism, after many spent months girding for a broadly anticipated recession.

Knowledge on Friday confirmed U.S. job progress accelerated in Might, even because the unemployment charge rose to a seven-month excessive – bolstering the case for these betting the Fed can include inflation with out badly damaging progress.

“Inflation has clearly subsided, and but labor market power has remained intact,” wrote BMO Capital Markets chief funding strategist Brian Belski in a current observe.

Whereas a extreme recession was his largest fear at first of the 12 months, now “the anticipated recipe for catastrophe is solely not current.”

BMO raised its year-end S&P 500 worth goal to 4,550 from 4,300. The index, which is up 11% year-to-date, closed at 4,267.52 on Wednesday. It’s up 19.3% since Oct 12.

Different companies which have issued rosy targets in current days embrace Evercore ISI, which now sees the S&P 500 at 4,450 at 12 months finish, up from its prior view of 4,150, and Stifel, which anticipates the index will attain 4,400 by the third quarter. BofA late final month raised its year-end goal for the index to 4,300 from 4,000.

One other key threat dissipated final week when Congress handed a invoice to droop the debt ceiling, averting a doubtlessly catastrophic U.S. default.

“Shifting previous the debt ceiling and not less than having some financial information that appears okay is definitely sufficient to get some individuals ,” stated Keith Lerner, co-chief funding officer at Truist Advisory Companies.

Lerner on Monday shifted his anticipated S&P 500 vary for this 12 months as much as 3,800-4,500, from 3,400-4,300 beforehand, citing bettering earnings developments amongst different elements.

On the identical time, traders have been cheered by alerts that the Fed is unlikely to ship many extra of the speed will increase that shook markets over the past 12 months. Bets in futures markets confirmed traders projecting the Fed would go away charges unchanged at its June 13-14 financial coverage assembly and lift them solely as soon as extra this 12 months.

In fact, loads of skeptics stay.

John Lynch, chief funding officer for Comerica Wealth Administration, stated the S&P 500 may retest its October lows with “elevated rates of interest and tighter credit score requirements weighing on financial exercise for the rest of the 12 months.”

One other worrisome sign is the truth that the S&P 500’s acquire this 12 months has been spurred by only a handful of megacap shares like Microsoft (NVDA.O) and Nvidia (NVDA.O), which have been fueled partly by pleasure over advances in synthetic intelligence, whereas giant areas of the market have languished.

For Hans Olsen, chief funding officer at Fiduciary Belief Co, that’s an ominous signal. Olsen believes alerts such because the inverted yield curve present recession dangers stay “fairly excessive” and his agency is sustaining greater than typical money ranges.

“We’ve one highly effective rally inside a bear market that has but to be totally resolved,” he stated.

Reporting by Lewis Krauskopf; Enhancing by Ira Iosebashvili and Diane Craft

: .