April 28 (Reuters) – The U.S. Federal Deposit Insurance coverage Company (FDIC) is making ready to put First Republic Financial institution (FRC.N) below receivership imminently, an individual accustomed to the matter mentioned on Friday, sending shares of the lender down almost 50% in prolonged buying and selling.

The U.S. banking regulator determined the troubled regional lender’s place has deteriorated and there’s no extra time to pursue a rescue by way of the personal sector, the supply instructed Reuters, requesting anonymity as a result of the matter is confidential.

U.S. officers have coordinated pressing talks to rescue the lender in latest days as private-sector efforts led by the financial institution’s advisers have but to achieve a deal, in response to three sources accustomed to the state of affairs.

The FDIC, Treasury Division and Federal Reserve are amongst authorities our bodies which have orchestrated conferences with monetary firms about placing collectively an answer for the troubled lender, two of the sources mentioned.

The FDIC requested banks together with JPMorgan Chase & Co (JPM.N) and PNC Monetary Companies Group (PNC.N) to submit last bids for First Republic Financial institution by Sunday, Bloomberg Information reported on Saturday.

The banking regulator reached out to banks late Thursday searching for indications of curiosity, together with a proposed worth and estimated price to the company’s deposit insurance coverage fund, the report mentioned.

The FDIC mentioned in an electronic mail: “We’d not touch upon or verify whether or not we’re bidding an open establishment,” in response to a request for remark.

PNC Monetary declined to touch upon the Bloomberg report. JPMorgan didn’t instantly reply to a voicemail and electronic mail searching for remark.

Individually, the Wall Road Journal reported on Friday that JPMorgan and PNC are vying to purchase First Republic following its seizure by the federal government, which may come as quickly as this weekend.

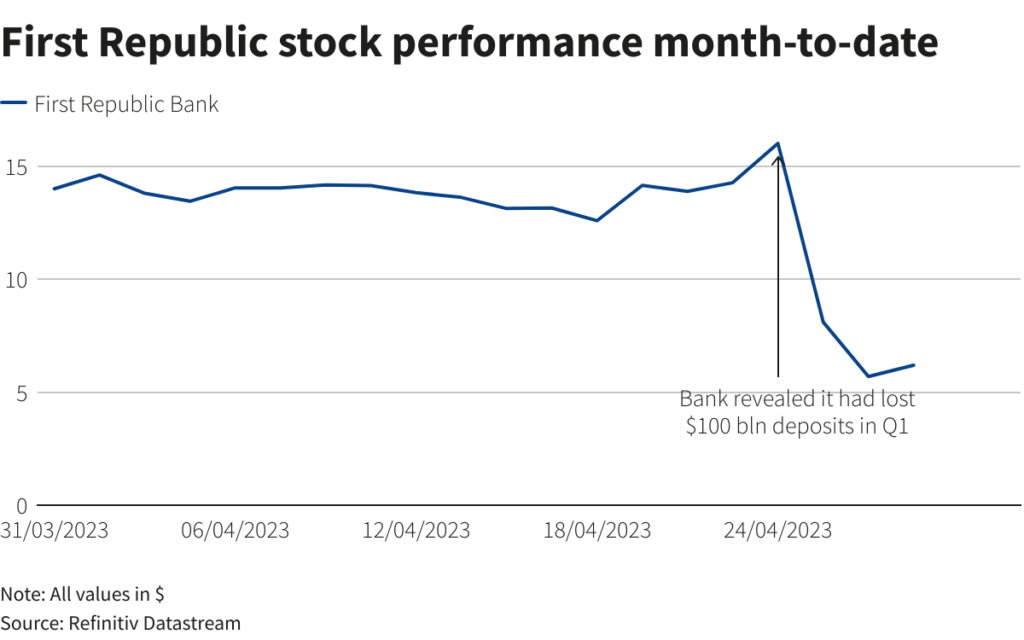

If the San Francisco-based lender falls into receivership, it could be the third U.S. financial institution to break down since March. First Republic mentioned this week its deposits had slumped by greater than $100 billion within the first quarter.

Shares of the financial institution closed down 43%, worsening a inventory rout that has worn out 75% of its worth this week. The inventory misplaced greater than half of its worth on Friday and touched a document low of $2.99.

At its lowest, the financial institution had a market capitalization of almost $557 million, a far cry from its peak valuation of greater than $40 billion in November 2021.

Shares of another regional banks additionally fell, with PacWest Bancorp (PACW.O) down 2% after the bell whereas Western Alliance (WAL.N) was down 0.7%.

Information of the upcoming transfer to place First Republic in receivership got here the identical day the Federal Reserve and FDIC detailed their supervisory lapses earlier than deposit runs induced the collapse of Silicon Valley Financial institution and Signature Financial institution in March.

The Fed’s evaluation of its inadequacies in figuring out issues and pushing for fixes at Santa Clara, California-based SVB got here with guarantees for harder supervision and stricter guidelines for banks.

Giant banks had orchestrated an earlier lifeline for First Republic, injecting into the financial institution $30 billion in mixed deposits from U.S. banking heavyweights, together with Financial institution of America Corp. (BAC.N), Citigroup Inc. (C.N), JPMorgan and Wells Fargo & Co (WFC.N).

However First Republic struggled to search out assist from bigger banks or personal fairness corporations on its proposed transfer to create a so referred to as “unhealthy financial institution” or promote belongings comparable to securities and its mortgage e-book.

The big banks who positioned the deposits both declined to remark or weren’t obtainable to remark.

First Republic, which reported its first-quarter earnings on Monday, had mentioned it plans to shrink its stability sheet and slash bills by chopping govt compensation, paring again workplace area and shedding 20% to 25% of staff within the second quarter.

John Guarnera, senior company analyst at RBC BlueBay Asset Administration, mentioned the First Republic case is an “evolving state of affairs.”

“The remainder of the regional financial institution system feels prefer it’s in a special place than the place FRC is,” he mentioned.

Reporting by Medha Singh in Bengaluru; Modifying by Saumyadeb Chakrabarty

: .