WASHINGTON, Might 1 (Reuters) – A key U.S. banking regulator on Monday laid out a spread of choices for reforming the federal deposit insurance coverage system and concluded that considerably rising the backstop for financial institution accounts used for enterprise functions was the “most promising.”

Within the wake of March’s lightning-fast financial institution failures, increasing protection for accounts used to cowl payroll, invoices and different giant enterprise transactions has emerged because the Federal Deposit Insurance coverage Corp’s most well-liked route for balancing monetary stability and depositor safety, relative to its price.

So as to impact any change to the federal government deposit safety scheme that has largely remained intact since its debut within the Nice Despair within the Nineteen Thirties, Congress would want to put in writing a brand new statute describing what kinds of accounts would obtain any extra protection, FDIC officers stated throughout a briefing with reporters.

The 76-page report additionally thought of backstopping all accounts it doesn’t matter what the quantity, an possibility that will do essentially the most to forestall financial institution runs, the report stated, however would even have important implications for market disruptions and will improve financial institution risk-taking.

Retaining the present system, the place protection is restricted to $250,000 per-person per-bank, was the third possibility thought of. Whereas it could entail the least market disruption, it “fails to deal with the monetary stability challenges” of enormous concentrations of uninsured deposits, the report stated.

FDIC Chair Martin Gruenberg requested employees to undertake an evaluation and evaluate of choices for reform of the deposit insurance coverage system after the collapse of Silicon Valley Financial institution and Signature Financial institution in March, when regulators ended up backstopping all deposits to forestall contagion to the banking system.

Deposits at First Republic Financial institution, which was seized by regulators on Monday and offered to JPMorgan Chase & Co (JPM.N), didn’t require any formal authorities backstop, although the FDIC stated the transaction would price it $13 billion, on high of the $22.5 billion hit is has already taken from the SVB and Signature Financial institution failures.

The FDIC’s deposit insurance coverage fund helps to satisfy the company’s assure of financial institution deposits as much as $250,000 per individual. Within the occasion an insured financial institution fails, the FDIC makes use of the deposit insurance coverage fund to pay again prospects who maintained accounts beneath the restrict.

That $250,000 restrict was enshrined in legislation by the 2010 Dodd-Frank reform legislation handed following the 2008 monetary disaster, upped from what was earlier than a $100,000 cap.

However following the collapse of SVB and Signature, there have been requires a rethink.

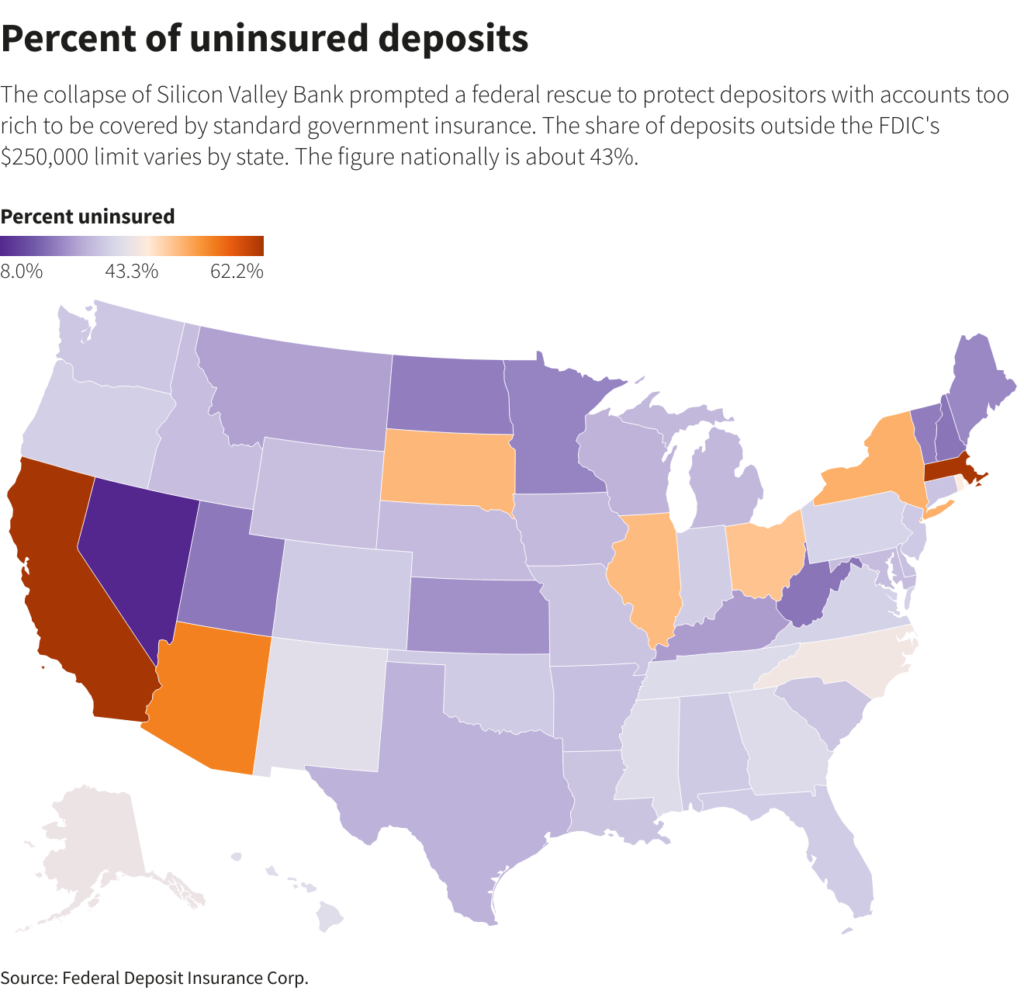

Some 99% of U.S. financial institution accounts are totally insured beneath present FDIC limits. However uninsured deposits have grown quickly lately, tripling since 2009 to $7.7 trillion. Massive concentrations of uninsured deposits will increase the potential for financial institution runs and might threaten monetary stability, as was seen with SVB and Signature, each giant banks with greater than $100 billion in belongings.

However even banks that many would take into account mid-sized or small have change into closely reliant on easily-runnable uninsured deposits, the report confirmed: greater than half of deposits at 40% of banks with belongings of $57 billion are uninsured.

Among the improve, the report famous, could also be a short lived impact of the deposit surge from COVID-19 pandemic authorities assist. However to the extent these giant deposits are payroll or different enterprise cost accounts, the report stated, they might be “comparatively extra delicate to hostile developments affecting banks.”

An insurance coverage scheme that will give such enterprise accounts drastically elevated and even limitless protection may improve monetary stability by making it a lot much less possible these depositors would flee a financial institution en masse.

However it could even have challenges, the report stated, together with defining what accounts qualify and conserving depositors and banks from making an attempt to bypass the principles and acquire protection for which they should not be eligible. It might additionally possible price extra, with increased assessments levied on banks, the report stated.

U.S. Federal Reserve Chair Jerome Powell informed Republican lawmakers in March that Congress ought to re-evaluate limits on the dimensions of federally insured financial institution deposits.

Democratic Senator Elizabeth Warren informed CBS’s “Face The Nation” in March that lifting the cap can be ” transfer,” and Republican Senator Mike Rounds has questioned whether or not the $250,000 restrict remains to be applicable.

AN EXPLICIT GUARANTEE

These in favor of eliminating the cap argue that the federal government’s full backstop of SVB and Signature deposits already indicators an implicit assure of all financial institution deposits.

Eliminating the cap altogether may very well be costly and will find yourself undermining monetary stability, the report stated, as a result of banks may take larger dangers if their deposit bases are thought of extra secure.

Any adjustments would want laws from a deeply divided Congress. The Republican Home Freedom Caucus stated in a March assertion that its members would oppose any common federal assure on financial institution deposits above the present $250,000 restrict.

Reporting by Hannah Lang and Ann Saphir in Washington; Modifying by Andrea Ricci and Nick Zieminski

: .