Federal Reserve Chair Jerome Powell stated Friday that stresses within the banking sector might imply that rates of interest will not need to be as excessive to manage inflation.

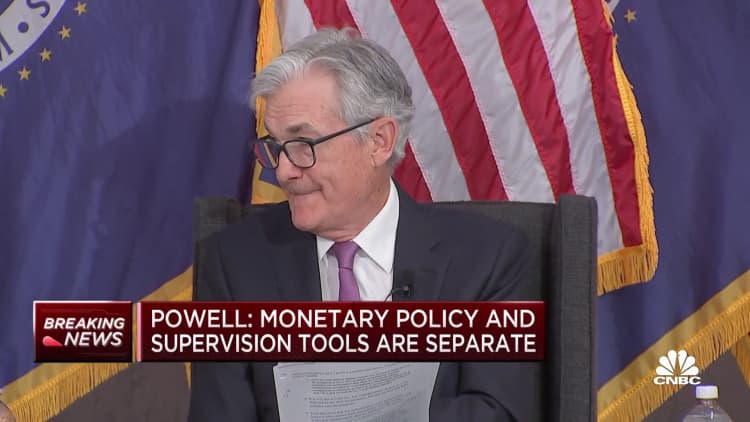

Talking at a financial convention in Washington, D.C., the central financial institution chief famous that Fed initiatives used to take care of issues at mid-sized banks have principally halted worst-case eventualities from transpiring.

However he famous that the issues at Silicon Valley Financial institution and others might nonetheless reverberate by way of the economic system.

“The monetary stability instruments helped to calm circumstances within the banking sector. Developments there, then again, are contributing to tighter credit score circumstances and are more likely to weigh on financial progress, hiring and inflation,” he stated as a part of a panel on financial coverage.

“So in consequence, our coverage price might not have to rise as a lot as it will have in any other case to attain our targets,” he added. “In fact, the extent of that’s extremely unsure.”

Powell spoke with markets principally anticipating the Fed at its June assembly to take a break from the collection of price hikes it started in March 2022. Nevertheless, pricing has been risky as Fed officers weigh the influence that coverage has had and can have on inflation that in the summertime of final yr was working at a 41-year excessive.

On steadiness, Powell stated inflation remains to be too excessive.

“Many individuals are presently experiencing excessive inflation, for the primary time of their lives. It isn’t a headline to say that they actually do not prefer it,” he stated throughout a discussion board that additionally featured former Fed Chairman Ben Bernanke.

“We predict that failure to get inflation down would, wouldn’t solely extend the ache but in addition enhance finally the social prices of getting again to cost stability, inflicting even better hurt to households and companies, and we intention to keep away from that by remaining steadfast in pursuit of our targets,” he added.

Powell characterised present Fed coverage as “restrictive” and stated future choices can be data-dependent versus being a preset course. The Federal Open Market Committee has raised its benchmark borrowing price to a goal of 5%-5.25% from close to zero the place it had sat for the reason that early days of the Covid pandemic.

Officers have confused that price hikes function with a lag of a yr or extra, so the coverage strikes haven’t fully circulated by way of the economic system.

“We’ve not made any choices in regards to the extent to which extra coverage funding can be acceptable. However given how far we have come, as I famous, we will afford to have a look at the info and the evolving outlook,” Powell stated.

Financial coverage largely has been geared towards cooling a scorching labor market by which the present 3.4% unemployment price is tied for the bottom degree since 1953. Inflation by the Fed’s most well-liked measure is working at 4.6%, properly above the two% long-range aim.

Economists, together with these on the Fed itself, have lengthy been predicting that the speed hikes would pull the economic system into at the least a shallow recession, seemingly later this yr. GDP grew at a less-than-expected 1.1% annualized tempo within the first quarter however is on observe to speed up by 2.9% within the second quarter, in response to an Atlanta Fed tracker.

Powell spoke the identical day that the New York Fed launched analysis exhibiting that the long-range impartial rate of interest — one that’s neither restrictive nor stimulative — is actually unchanged at very low ranges, regardless of the pandemic-era inflation surge.

“Importantly, there isn’t any proof that the period of very low pure charges of curiosity has ended,” New York Fed President John Williams stated in ready remarks.