(Bloomberg) — Income and losses aren’t normally considered a consideration for central banks, however quickly mounting purple ink on the Federal Reserve and plenty of friends dangers changing into extra than simply an accounting oddity.

Most Learn from Bloomberg

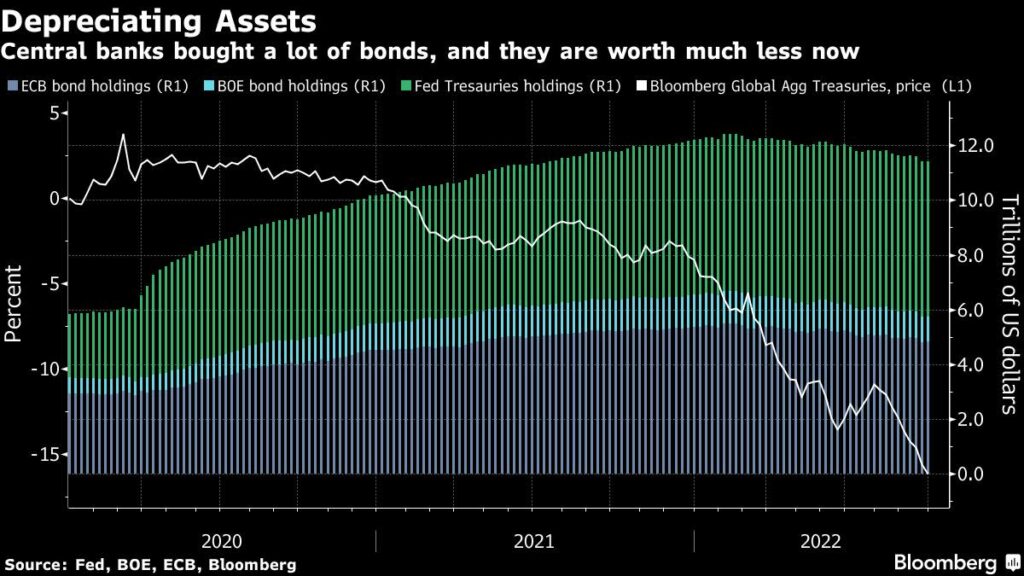

The bond market is enduring its worst selloff in a era, triggered by excessive inflation and the aggressive interest-rate hikes that central banks are implementing. Falling bond costs, in flip, imply paper losses on the large holdings that the Fed and others accrued throughout their rescue efforts lately.

Charge hikes additionally contain central banks paying out extra curiosity on the reserves that industrial banks park with them. That’s tipped the Fed into working losses, making a gap that will in the end require the Treasury Division to fill through debt gross sales. The UK Treasury is already getting ready to make up a loss on the Financial institution of England.

Britain’s transfer highlights a dramatic shift in international locations together with the US, the place central banks are now not important contributors to authorities revenues. The US Treasury will see a “gorgeous swing,” going from receiving about $100 billion final yr from the Fed to a possible annual loss fee of $80 billion by year-end, in line with Amherst Pierpont Securities LLC.

The accounting losses threaten to gasoline criticism of the asset buy packages undertaken to rescue markets and economies, most not too long ago when Covid-19 shuttered massive swathes of the worldwide financial system in 2020. Coinciding with the present outbreak in inflation, that would spur calls to rein in financial coverage makers’ independence, or restrict what steps they will take within the subsequent disaster.

“The issue with central financial institution losses usually are not the losses per se — they will at all times be recapitalized — however the political backlash central banks are more likely to more and more face,” stated Jerome Haegeli, chief economist at Swiss Re, who beforehand labored at Switzerland’s central financial institution.

The next figures illustrate the scope of working losses or mark-to-market balance-sheet losses now materializing:

-

Fed remittances owed to the US Treasury reached a unfavorable $5.3 billion as of Oct. 19 — a pointy distinction with the optimistic figures seen as not too long ago as the top of August. A unfavorable quantity quantities to an IOU that might be repaid through any future revenue.

-

The Reserve Financial institution of Australia posted an accounting lack of A$36.7 billion ($23 billion) for the 12 months via June, leaving it with a A$12.4 billion negative-equity place.

-

Dutch central financial institution Governor Klaas Knot, warned final month he expects cumulative losses of about 9 billion euro ($8.8 billion) for the approaching years.

-

The Swiss Nationwide Financial institution reported a lack of 95.2 billion francs ($95 billion) for the primary six months of the yr as the worth of its foreign-exchange holdings slumped — the worst first-half efficiency because it was established in 1907.

Whereas for a growing nation, losses on the central financial institution can undermine confidence and contribute to a common exodus of capital, that type of credibility problem isn’t seemingly for a wealthy nation.

As Seth Carpenter, chief world economist for Morgan Stanley and a former US Treasury official put it: “The losses don’t have a cloth impact on their skill to conduct financial coverage within the close to time period.”

RBA Deputy Governor Michele Bullock stated in response to a query final month in regards to the Australian central financial institution’s negative-equity place that “we don’t imagine that we’re impacted in any respect in our capability to function.” In any case, “we are able to create cash. That’s what we did once we purchased the bonds,” she famous.

However there can nonetheless be penalties. Central banks had already develop into politically charged establishments after, by their very own admission, they did not anticipate and act shortly in opposition to budding inflation over the previous yr or extra. Incurring losses provides one other magnet for criticism.

ECB Implications

For the European Central Financial institution, the potential for mounting losses comes after years of purchases of presidency bonds performed regardless of the reservations of conservative officers arguing they blurred the strains between financial and financial coverage.

With inflation operating at 5 occasions the ECB’s goal, stress is mounting to get rid of the bond holdings — a course of known as quantitative tightening that the ECB is at present getting ready for even because the financial outlook darkens.

“Though there aren’t any clear financial constraints to the central financial institution operating losses, there’s the chance that these develop into extra of a political constraint on the ECB,” Goldman Sachs Group Inc. economists George Cole and Simon Freycenet stated. Significantly in northern Europe, it “could gasoline the dialogue of quantitative tightening.”

President Christine Lagarde hasn’t given any indication that the ECB’s choice on QT will probably be pushed by the prospect of incurring losses. She instructed lawmakers in Brussels final month that producing income isn’t a part of central banks’ activity, insisting that combating inflation stays policymakers’ “solely function.”

As for the Fed, Republicans have up to now voiced opposition to its apply of paying curiosity on surplus financial institution reserves. Congress granted that authority again in 2008 to assist the Fed management rates of interest. With the Fed now incurring losses, and the Republicans probably taking management of no less than one chamber of Congress within the November midterm elections, the controversy could resurface.

The Fed’s turnaround could possibly be notably notable. After paying as a lot as $100 billion to the Treasury in 2021, it might face losses of greater than $80 billion on an annual foundation if policymakers increase charges by 75 foundation factors in November and 50 foundation factors in December — as markets anticipate — estimates Stephen Stanley, chief economist for Amherst Pierpont.

With out the revenue from the Fed, the Treasury then must promote extra debt to the general public to fund authorities spending.

“This can be too arcane to hit the general public’s radar, however a populist might spin the story in a method that might not replicate nicely on the Fed,” Stanley wrote in a observe to purchasers this month.

–With help from Garfield Reynolds.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.