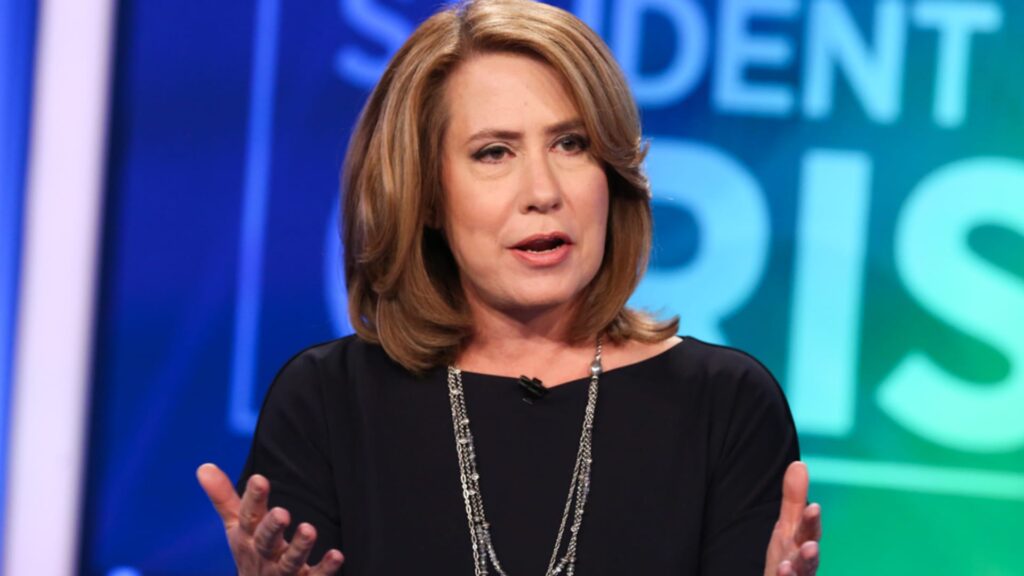

Market optimism over the potential for rate of interest cuts subsequent 12 months is dangerously overdone, in line with former FDIC Chair Sheila Bair.

Bair, who ran the FDIC in the course of the 2008 monetary disaster, advised Federal Reserve Chair Jerome Powell was irresponsibly dovish ultimately week’s coverage assembly by creating “irrational exuberance” amongst traders.

“The main target nonetheless must be on inflation,” Bair advised CNBC’s “Quick Cash” on Thursday. “There is a lengthy option to go on this struggle. I do fear they’re [the Fed] blinking a bit and now making an attempt to pivot and fear about recession, after I do not see any of that danger within the knowledge thus far.”

After holding charges regular Wednesday for the third time in a row, the Fed set an expectation for at the least three charge cuts subsequent 12 months totaling 75 foundation factors. And the markets ran with it.

The Dow hit all-time highs within the last three days of final week. The blue-chip index is on its longest weekly win streak since 2019 whereas the S&P 500 is on its longest weekly win streak since 2017. It is now 115% above its Covid-19 pandemic low.

Bair stated she believes the market’s bullish response to the Fed is on borrowed time.

“It is a mistake. I feel they should hold their eye on the inflation ball and tame the market, not reinforce it with this … dovish dot plot,” Bair stated. “My concern is the prospect of the numerous reducing of charges in 2024.”

Bair nonetheless sees costs for providers and rental housing as severe sticky spots. Plus, she worries that deficit spending, commerce restrictions and an growing older inhabitants can even create significant inflation pressures.

“[Rates] ought to keep put. We have good development traces. We must be affected person and watch and see how this performs out,” Bair stated.

Disclaimer