(Bloomberg) — Federal Reserve Financial institution of St. Louis President James Bullard left open the likelihood that the central financial institution would increase rates of interest by 75 foundation factors at every of its subsequent two conferences in November and December, whereas saying it was too quickly to make that decision.

Most Learn from Bloomberg

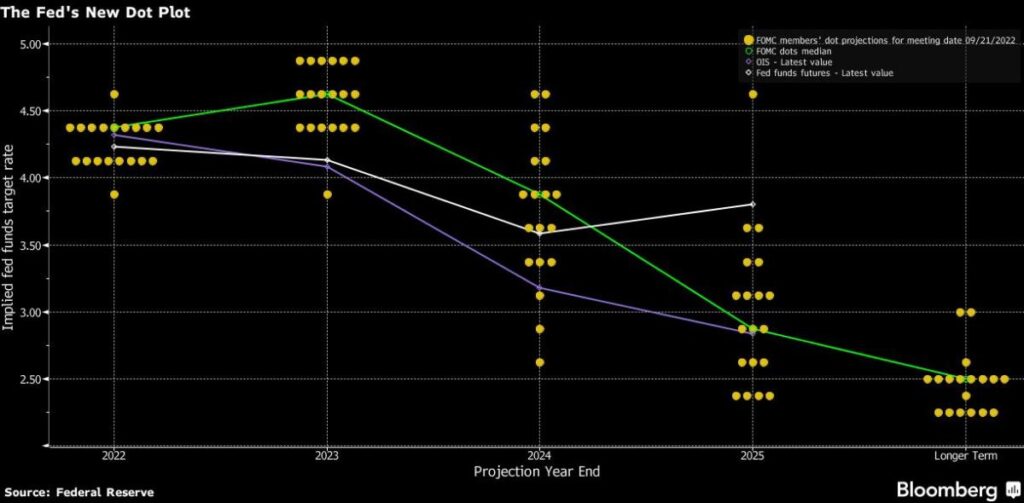

The Fed hiked charges by 75 foundation factors for the third straight assembly final month, to a goal vary of three% to three.25%. Officers projected 125 foundation factors of tightening for the remainder of the 12 months, suggesting a 75 basis-point transfer in November and 50 foundation factors in December. An extra 25 foundation factors of tightening was penciled in for 2023, in line with their median estimate.

“Whether or not the committee would need to pull some proposed or thought-of policy-rate will increase from 2023 into the December assembly, I believe that’s a judgment that’s untimely to make,” he mentioned Saturday in Washington throughout an occasion on the sidelines of the annual assembly of the Worldwide Financial Fund and World Financial institution.

The US central financial institution is elevating rates of interest on the most speedy tempo for the reason that Nineteen Eighties to curb inflation at 40-year highs. Traders now see a strong likelihood the Fed will increase charges 75 foundation factors in each November and December after knowledge Thursday confirmed core client costs rising greater than anticipated in September.

Projections launched Sept. 21 by the Fed confirmed officers anticipating charges to rise to 4.4% this 12 months and 4.6% subsequent, in line with their median estimate.

Bullard mentioned it most likely didn’t make a lot distinction from a macroeconomic perspective if that extra tightening occurred later this 12 months or within the first quarter of 2023. However he reminded the viewers that he has been a fan of “frontloading” fee will increase by quickly shifting coverage to a degree that restrains inflation, at which level officers can pause and take inventory.

“You need to get the place that you must be after which after you possibly can react to knowledge,” he mentioned, including that there was a “bullish case” for subsequent 12 months if declines in inflation forecast by each the central financial institution and personal sector economists are proved appropriate.

“If that dynamic is available in it’s going to look superb, and we’ll be capable of mainly keep the place we’re and watch the inflation come down,” he mentioned. “However there may be plenty of threat additionally that inflation goes nonetheless increased after which now we have to react to that.”

Bullard additionally backed persevering with to shrink the central financial institution’s stability sheet on the present tempo for a while.

“It’s approach too early to say that we might change this coverage any time quickly,” Bullard mentioned throughout a panel dialogue, in response to a query about whether or not the Fed would alter its balance-sheet runoff, at present at a tempo of a most $95 billion a month.

Bullard votes on financial coverage this 12 months and has been one of many extra hawkish officers on its 19-member coverage committee.

He mentioned he’s glad that the Fed’s 75 basis-point fee will increase hadn’t precipitated any important market turmoil. “We’ve managed to get this far with comparatively low monetary stress,” Bullard mentioned.

Responding to questions, he mentioned strikes within the greenback in response to Fed fee hikes had been “not shocking.” The buck has surged 16.4% within the 12 months, in line with the Bloomberg Greenback Spot Index.

“It is not going to all the time be this manner,” Bullard mentioned. “If the Fed can get to a spot the place the committee thinks that we’re placing significant downward strain on inflation with the extent of the coverage fee that now we have,” and different central banks change their insurance policies and maybe grow to be extra aggressive, “you would possibly see different actions within the greenback.”

(Updates with Bullard feedback from third paragraph.)

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.