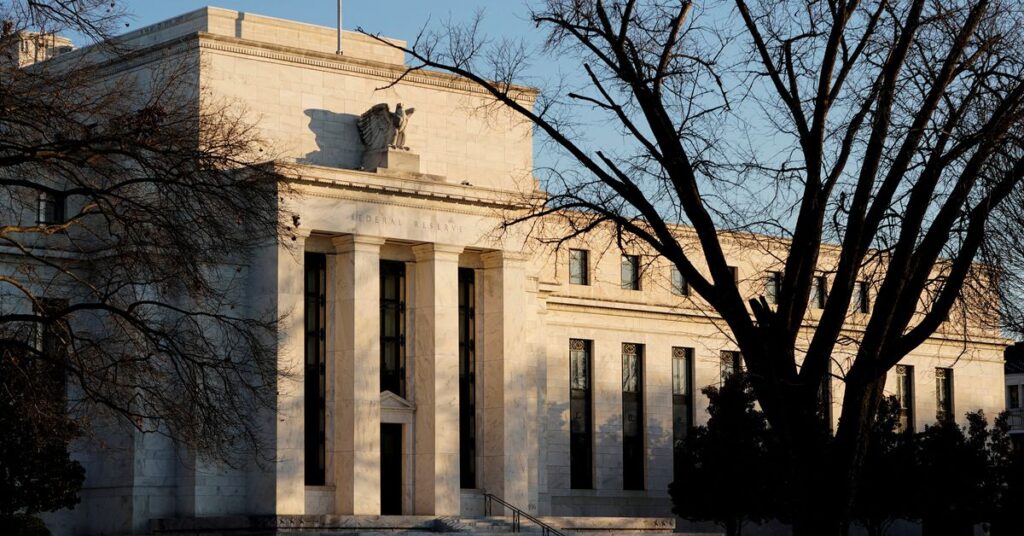

WASHINGTON, Jan 18 (Reuters) – The Federal Reserve’s present construction, with the Washington-based Board of Governors and 12 quasi-autonomous regional banks, has “created a sturdy and credible public establishment,” outgoing Kansas Metropolis Fed President Esther George mentioned in protection of an association criticized typically as unwieldy.

The product of compromises meant to stability central management in a federal system with regional affect, George mentioned it had created “boardrooms … the place a labor chief and producer; banker and non-profit government; tribal chief and power CEO, sit facet by facet.”

“For a Fed policymaker, these discussions are clearly invaluable. Not solely do our administrators present fiduciary oversight and vital insights on financial and monetary circumstances, however they create a stage of engagement and understanding that might not in any other case exist,” George mentioned in ready remarks to the Exchequer Membership of Washington, D.C.

George’s remarks are anticipated to be her final as head of the Kansas Metropolis Fed. She is retiring on Jan. 31 after turning 65 this month, the obligatory retirement age for Fed regional presidents.

A substitute has not but been introduced.

George is not going to attend the Jan. 31-Feb. 1 Fed coverage assembly, and her ready remarks didn’t replace her views in regards to the financial system or financial coverage.

Relatively, George mentioned she was talking “from the angle of a profession central banker within the nation’s heartland,” somebody who started as a financial institution examiner and rose to the Fed’s policymaking ranks.

George cited proposals floated often to both trim the variety of regional banks, or to make financial institution presidents political appointees, as are members of the Fed’s seven-member Board of Governors.

However she mentioned she felt the present system added to the Fed’s political insulation when it got here to creating powerful choices about rates of interest, and in addition stored it extra in contact with native points – such because the destiny of group banks, an space of explicit curiosity in her Midwest area.

Throughout an inflation outbreak within the Nineteen Seventies and Eighties, “it’s exhausting to think about a state of affairs the place a extra politically managed central financial institution would have been keen to take the very troublesome and painful measures that finally proved mandatory to revive financial and worth stability for the nation,” she mentioned.

“Immediately, the U.S. is once more experiencing excessive inflation and the Federal Reserve is aggressively tightening financial coverage. And, as soon as once more, the advantages of central financial institution independence are obvious.”

Reporting by Howard Schneider; Modifying by Paul Simao

: .