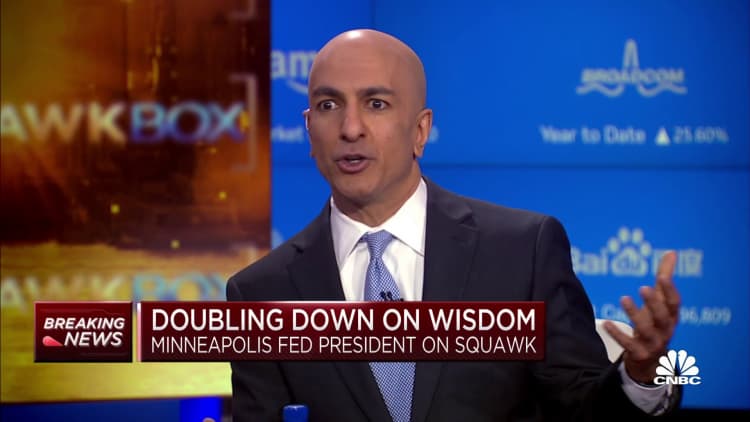

Minneapolis Federal Reserve President Neel Kashkari on Monday stated he is open to holding off on one other rate of interest hike subsequent month, however cautioned in opposition to studying an excessive amount of right into a pause.

“Proper now it is a shut name both means, versus elevating one other time in June or skipping,” the central financial institution official stated on CNBC’s “Squawk Field.” “A few of my colleagues have talked about skipping. Necessary to me shouldn’t be signaling that we’re executed. If we did, if we have been to skip in June, that doesn’t imply we’re executed with our tightening cycle. It means to me we’re getting extra data.”

Markets at the moment are placing about an 83% chance that the rate-setting Federal Open Market Committee holds off on what could be an eleventh consecutive enhance when it convenes June 13-14, in keeping with the CME Group’s FedWatch tracker of futures costs. Kashkari is a voting member on the FOMC this 12 months.

Past that, merchants see the Fed possible slicing about half a share level off charges earlier than the tip of the 12 months, a nod towards inflation transferring decrease and the economic system slowing.

Central financial institution officers have been unified in saying they do not count on cuts this 12 months. Kashkari stated that if inflation does not come down, he could be in favor of accelerating charges once more.

“Can we then begin elevating once more in July? Doubtlessly, and in order that’s crucial factor to me is that we’re not taking it off the desk,” he stated.

“Markets appear very optimistic that charges are going to fall now. I believe that they consider that inflation goes to fall, after which we’re going to have the ability to reply to that. I hope they’re proper,” he added. “However no one ought to be confused about our dedication to getting inflation again all the way down to 2%.”

Minneapolis Fed President Neel Kashkari on Tuesday reiterated the central financial institution’s dedication to bringing inflation underneath management by financial coverage tightening, and stated his greatest concern is that the persistence of value pressures is underestimated.

Anjali Sundaram | CNBC

Fed Chair Jerome Powell on Friday urged that the latest stresses within the banking system may decelerate the economic system sufficient that policymakers can afford to be much less aggressive.

Kashkari stated that is attainable, although he added that to date there have been solely scant indicators of a extra macroeconomic influence from the latest banking issues.

“That is essentially the most unsure time we have had by way of understanding the underlying inflationary dynamics. So I am having to let inflation information me and I believe we’re letting inflation information us. It could be that now we have to go north of 6%” on the fed funds price, he stated. “If the banking stresses begin to deliver inflation down for us, then possibly … we’re getting nearer to being executed. I simply do not know proper now.”

The Fed’s benchmark funds price is at the moment set in a goal vary between 5%-5.25%. Along with a price determination, the June assembly will function an replace on the central financial institution’s forecasts for inflation, GDP and unemployment, in addition to the “dot plot” that exhibits the governors’ future price expectations.