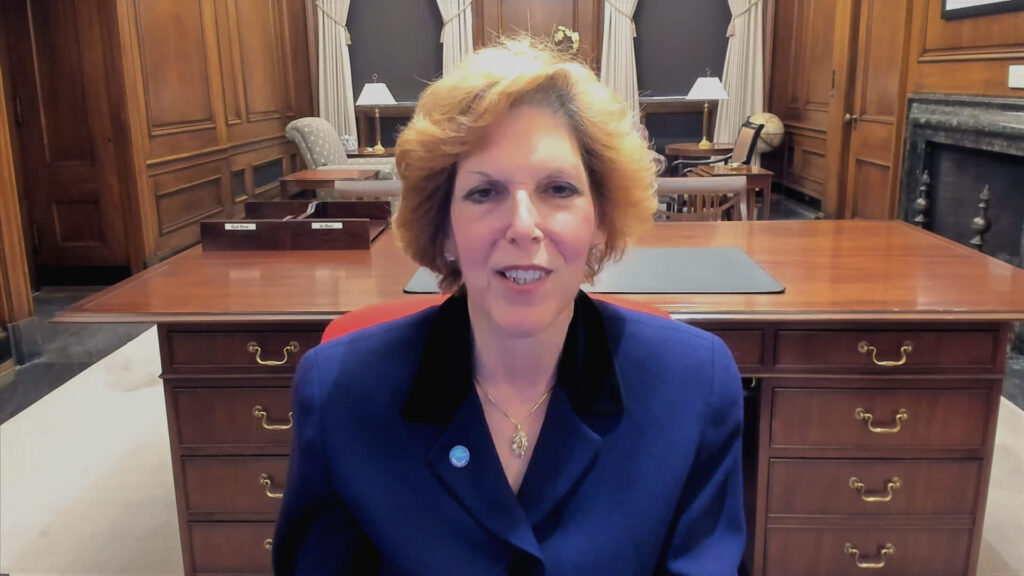

Cleveland Federal Reserve President Loretta Mester stated Tuesday she nonetheless expects rate of interest cuts this yr, however dominated out the following coverage assembly in Could.

Mester additionally indicated that the long-run path is greater than policymakers had beforehand thought.

The central financial institution official famous progress made on inflation whereas the economic system has continued to develop. Ought to that proceed, fee cuts are possible, although she did not provide any steerage on timing or extent.

“I proceed to assume that the more than likely situation is that inflation will proceed on its downward trajectory to 2 p.c over time. However I must see extra knowledge to lift my confidence,” Mester stated in ready remarks for a speech in Cleveland.

Extra inflation readings will present clues as as to whether some higher-than-expected knowledge factors this yr both had been momentary blips or an indication that the progress on inflation “is stalling out,” she added.

“I don’t anticipate I’ll have sufficient data by the point of the FOMC’s subsequent assembly to make that dedication,” Mester stated.

These remarks come practically two weeks after the rate-setting Federal Open Market Committee once more voted to carry its key in a single day borrowing fee in a spread between 5.25%-5.5%, the place it has been since July 2023. The post-meeting assertion echoed Mester’s remarks that the committee must see extra proof that inflation is progressing towards the two% goal earlier than it can begin lowering charges.

Mester’s feedback would appear to rule out a reduce on the April 30-Could 1 FOMC assembly, a sentiment additionally mirrored in market pricing. Mester is a voting member of the FOMC however will depart in June after having served the 10-year restrict.

Futures merchants anticipate the Fed to begin easing in June and to chop by three-quarters of a share level by the tip of the yr.

San Francisco Fed President Mary Daly stated Tuesday that three reductions this yr is a “very affordable baseline” although she stated nothing is assured. Daly is an FOMC voter this yr.

“Three fee cuts is a projection, and a projection shouldn’t be a promise,” she stated, later including, “We’re getting there, however it’s not going to be tomorrow, however it’s not going to be ceaselessly.”

Whereas searching for fee cuts, Mester stated she thinks the long-run federal funds fee will likely be greater than the long-standing expectation of two.5%. As an alternative, she sees the so-called impartial or “r*” fee at 3%. The speed is taken into account the extent the place coverage is neither restrictive nor stimulative. After the March assembly, the long-rate fee projection moved as much as 2.6%, indicating there are different members leaning greater.

Mester famous the speed was very low when the Covid pandemic hit and gave the Fed little wiggle room to spice up the economic system.

“At this level, we’re looking for to calibrate our coverage effectively to financial developments so we are able to keep away from having to behave in an aggressive vogue,” she stated.