Minneapolis Federal Reserve President Neel Kashkari stated Tuesday that explosive jobs progress in January is proof that the central financial institution has extra work to do with regards to taming inflation.

Which means persevering with to hike rates of interest, as he sees a chance that the Fed’s benchmark borrowing fee ought to rise to five.4% from its present goal vary of 4.5%-4.75%.

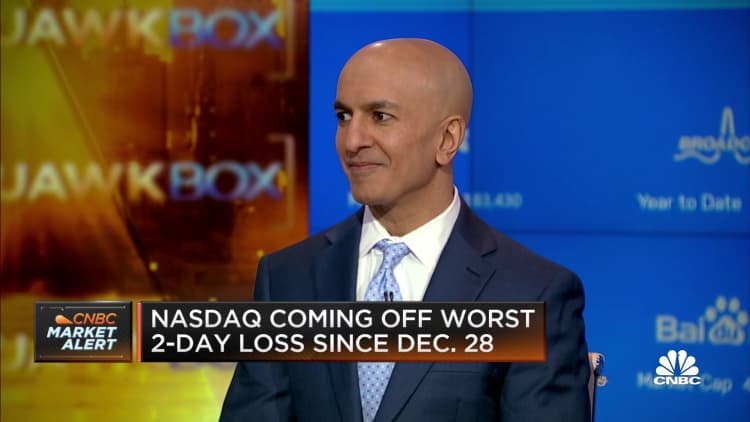

“Now we have a job to do. We all know that elevating charges can put a lid on inflation,” Kashkari informed CNBC throughout a Tuesday morning interview on “Squawk Field.” “We have to elevate charges aggressively to place a ceiling on inflation, then let financial coverage work its manner by way of the economic system.”

Kashkari spoke just some days after the Labor Division reported that nonfarm payrolls grew by 517,000 in January, almost triple the Wall Road expectation and the strongest progress for the primary month of the 12 months since 1946.

The robust jobs progress got here regardless of the Fed’s efforts to make use of greater rates of interest to right what officers have termed “imbalances” within the labor market between provide and demand. There are almost two open jobs for each out there employee, and common hourly earnings rose 4.4% in January from a 12 months in the past, a tempo the Fed considers unsustainable and inconsistent with its 2% inflation purpose.

The info “tells me that to date we’re not seeing a lot of an imprint of our tightening up to now on the labor market. There’s some proof that it is having some impact, however it’s fairly muted to date,” Kashkari stated.

“I have never seen something but to decrease my fee path, however I am clearly protecting my eyes open and we’ll see how the info is available in,” he added.

Kashkari’s indication that the fed funds fee must rise to five.4% places him in a extra aggressive slot in contrast along with his fellow policymakers, who indicated in December that they see the “terminal fee,” or finish level of hikes, round 5.1%. The funds fee is what banks cost one another for in a single day lending however feeds into a large number of shopper debt devices equivalent to automobile loans, mortgages and bank cards.

Kashkari is a voting member this 12 months of the rate-setting Federal Open Market Committee.

Since March 2022, the Fed has raised its benchmark funds fee eight occasions, after inflation hit its highest fee in additional than 40 years. The latest enhance got here final week with 1 / 4 share level hike that was the smallest because the preliminary transfer.

Together with the speed rises, the central financial institution has been permitting as much as $95 billion a month in proceeds from its bond holdings to roll off its steadiness sheet, leading to an extra almost $450 billion of tightening.

Nonetheless, inflation ranges, although easing, are nicely forward of the Fed’s goal, and policymakers have indicated that extra fee will increase are on the way in which.

“I am not seeing that we have made sufficient progress but to declare victory,” Kashkari stated.