BEIJING/HONG KONG, April 14 (Reuters) – Liu Baoxiang, who runs a mahjong parlour in a metropolis on China’s rust belt, not splurges on extravagant trend objects after seeing the 2 flats he owns lose roughly a 3rd of their worth over the previous two years.

“I used to be beforehand thought of rich within the space,” stated Liu, who additionally owns some business property within the northeastern metropolis of Liaoyuan.

“I used to purchase mink coats within the tens of 1000’s of yuan, however I’ve hardly bought any and have not travelled recently.”

Whereas pockets of China’s property market, which is answerable for roughly 1 / 4 of financial exercise, are displaying tentative indicators of stabilising, the impression of the sector’s sharp downturn since 2021 continues to be rippling throughout the financial system, and clouding its restoration.

Economists name it the wealth impact: asset house owners who really feel poorer after a pointy fall in costs have a tendency to chop down on spending to rebuild their fortunes.

In play now in China, the place round 70% of family wealth is in property, this phenomenon is weighing on the post-pandemic restoration of family consumption, which Chinese language policymakers have vowed to make a extra outstanding driver of financial development.

Capital Economics estimates internet family wealth declined 4.3% total final yr, as a consequence of falling home and inventory costs, the primary decline since not less than 2001.

“Households seem to have reduce their consumption in response to unfavorable wealth results,” stated Julian Evans-Pritchard, head of China economics on the analysis agency.

“Current homebuyers with massive mortgages may have suffered essentially the most and subsequently doubtless reduce essentially the most.”

SMALL TOWN BLUES

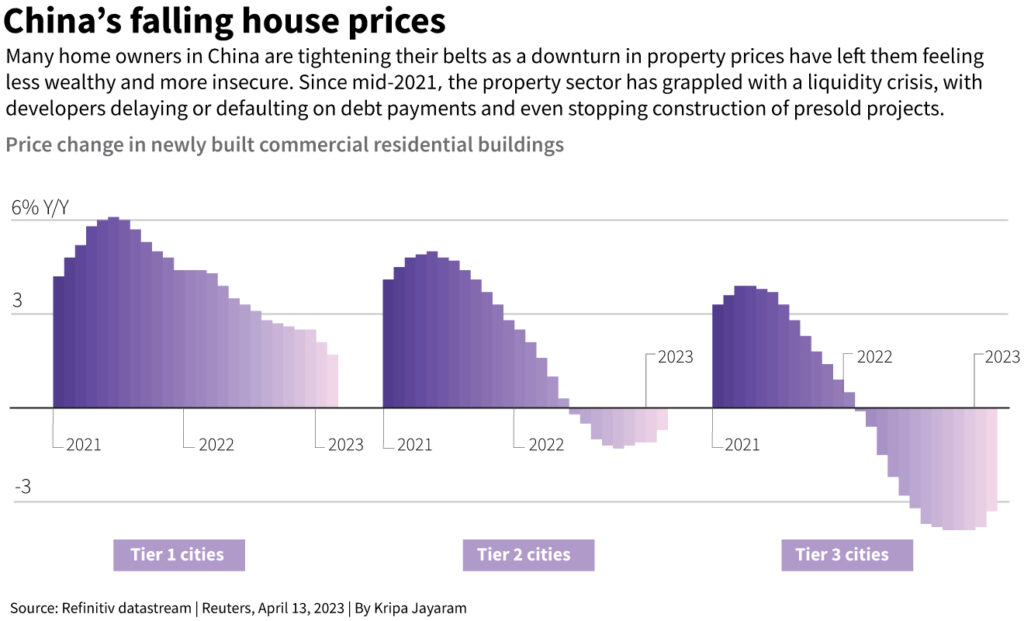

Residents of smaller cities are feeling extra ache than these residing in massive centres like Shanghai or Beijing, the place dwelling costs have been extra steady.

Common new dwelling costs within the 35 smallest cities among the many 70 surveyed by the statistics bureau, generally known as ‘tier 3’, noticed their thirteenth consecutive month of year-on-year declines in February.

The bureau doesn’t launch the precise costs, however actual property brokers say they’re 20-30% off peaks in a few of these cities and even additional off in smaller ones not coated by the official survey, reminiscent of Liaoyuan.

For brand new houses, the nationwide common value per sq. metre was 10,558 yuan ($1,543) for gross sales in January-February this yr, 6.0% off its peak in January-February 2021, separate information from the statistics bureau confirmed.

A resident within the northern metropolis of Langfang stated her flat is now priced at 8,000 yuan per sq m, lower than half the 18,000 yuan she paid for it three years in the past.

“I’ve paid a whole bunch of 1000’s of yuan for a downpayment, paid off over 1 million yuan in loans and at the moment have over 1 million yuan in loans to repay,” stated Emily, who solely gave her first title for privateness causes.

“I am not going to spend cash on something this yr. I have to tighten the belt. The struggling is insufferable.”

WEAK CONFIDENCE

To make certain, family consumption has picked up since China dismantled its draconian COVID curbs in December, with home tourism, cinemas and the catering trade main the best way. Automobile gross sales, however, had been flat year-on-year in March.

Client confidence, whereas nonetheless under the vary set over the previous twenty years, can be recovering from final yr’s report lows.

Retail gross sales had been up 3.5% year-on-year in January-February and are anticipated to speed up in coming months compared with final yr’s smaller base, which was harm by COVID curbs and lockdowns. March information might be launched on Tuesday.

However some economists – pointing to an increase in family financial institution deposits of 17.8 trillion yuan ($2.60 trillion) final yr – had anticipated a a lot quicker resurgence in family spending, as seen within the West after COVID-19 curbs had been lifted.

Knowledge up to now, together with subdued inflation numbers, recommend many of the anticipated pent-up demand from the pandemic has but to be unleashed.

Certainly, deposits rose an additional 9.9 trillion yuan within the first quarter of this yr. Many Chinese language are utilizing financial savings to repay mortgages early.

The lastest central financial institution survey discovered that within the first three months of the yr, the share of respondents saying they most popular to save lots of fell by 3.8 share factors from the prior quarter however was nonetheless comparatively excessive at 58%.

Nie Wen, an economist at Hwabao Belief, says report financial savings are unlikely to be transformed into vital spending till the tip of this yr or 2024 as uncertainty about China’s development outlook inside a slowing world financial system stays excessive.

“Center-class residents, accounting for 50% of consumption, stay cautious,” Nie stated.

Social media content material creator Jane would have felt extra like a center class particular person had her 1.5 million yuan downtown house within the southwestern metropolis of Chongqing not fallen in worth by some 14%.

“We do not purchase new garments anymore and we do not exit,” she stated, referring to her and husband. “It seems like we have purchased a jail for ourselves.”

($1 = 6.8376 Chinese language yuan renminbi)

Further reporting by Shuyan Wang; Enhancing by Marius Zaharia and Kim Coghill

: .