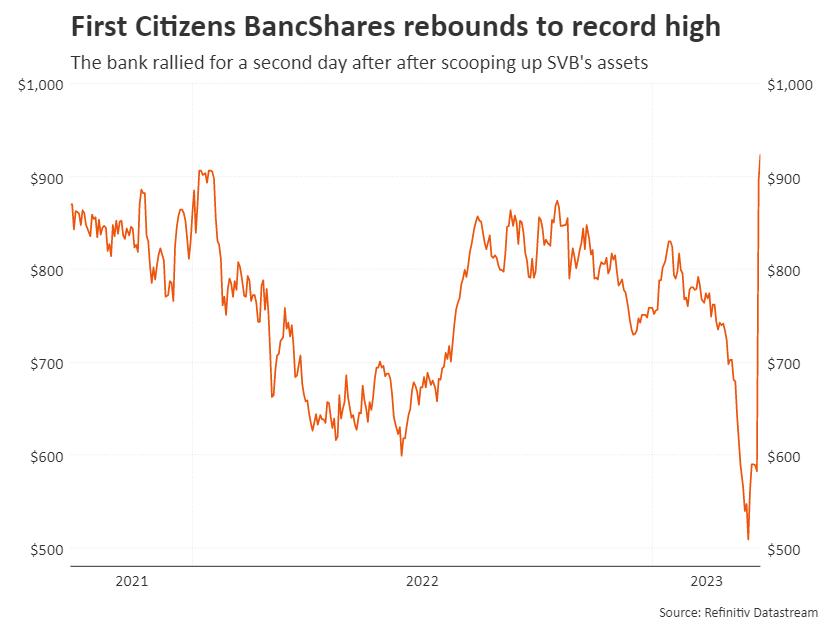

March 28 (Reuters) – Shares of First Residents BancShares Inc (FCNCA.O) climbed to a document excessive on Tuesday, extending beneficial properties for a second day after scooping up the belongings of failed peer Silicon Valley Financial institution.

First Residents rallied as a lot as 7.2%, briefly hitting an all-time peak of $959.99 earlier than paring beneficial properties. It was final up virtually 2%.

Buying and selling in different financial institution shares on Wall Road remained tepid, with the S&P 500 banks index (.SPXBK) dipping 0.1% and down over 20% in March.

First Residents, which has constructed a repute of shopping for troubled rivals, on Monday purchased all of SVB’s loans and deposits, giving the Federal Deposit Insurance coverage Corp (FDIC) fairness rights in its inventory value as a lot as $500 million in return.

Buyers despatched a document internet $236 million into the iShares Regional Financial institution ETF (IAT.P) over the past two weeks, proof that some buyers are betting on a rebound in essentially robust regional lenders following the current sell-off. The ETF was up 0.3% on Tuesday.

SVB’s collapse has triggered the worst banking shock because the 2008 disaster. Policymakers, regulators and central banks have emphasised that the turmoil shouldn’t be a precursor to a different international monetary disaster.

“Basically, the danger mannequin was by no means aligned with actuality,” Michael Barr, the Federal Reserve’s vice chairman for supervision, advised lawmakers on Tuesday, talking of SVB.

Shares of SVB Monetary Group , which operated Silicon Valley Financial institution, traded on Tuesday as an over-the-counter inventory and had been final at 28 cents per shares, down from about $268 earlier than the financial institution’s collapse, an all however full loss for its shareholders.

Reporting by Noel Randewich

Enhancing by Marguerita Choy

: .