Be part of high executives in San Francisco on July 11-12, to listen to how leaders are integrating and optimizing AI investments for achievement. Be taught Extra

On tempo to defraud monetary and commerce programs by practically $5 billion by 2024, artificial id fraud is among the many most tough to establish and cease. Losses amounted to five.3% of world digital fraud in 2022, growing by 132% final 12 months.

Sontiq, a TransUnion firm, analyzed publicly accessible information to match 2022 information breach volumes and severity to earlier years. TransUnion writes, “These breaches have performed a key position in serving to to gas an explosion in id engineering, with artificial identities turning into a record-setting downside in 2022. Excellent balances attributed to artificial identities for auto, bank card, retail bank card and private loans within the U.S. have been at their highest level ever recorded by TransUnion — reaching $1.3 billion in This autumn 2022 and $4.6 billion for all of 2022.”

All types of fraud devastate clients’ belief and willingness to make use of providers. One of many important components is that 10% of credit score and debit card customers skilled fraud over 12 months.

Pinpointing artificial id fraud is an information downside

Attackers harvest all accessible personally identifiable data (PII), beginning with social safety numbers, beginning dates, addresses and employment histories to create pretend or artificial identities. They then use them to use for brand spanking new accounts that many current fraud detection fashions understand as legit.

Occasion

Remodel 2023

Be part of us in San Francisco on July 11-12, the place high executives will share how they’ve built-in and optimized AI investments for achievement and prevented widespread pitfalls.

Register Now

A standard approach is concentrating on identities with widespread first and final names, which makes attackers much less conspicuous and difficult to establish. The aim is to create artificial identities that mix into the broader inhabitants. Attackers usually depend on a number of iterations to get artificial identities as unassuming and unnoticeable as attainable. Ages, places, residences and different demographic variables are additionally blended to additional idiot detection algorithms.

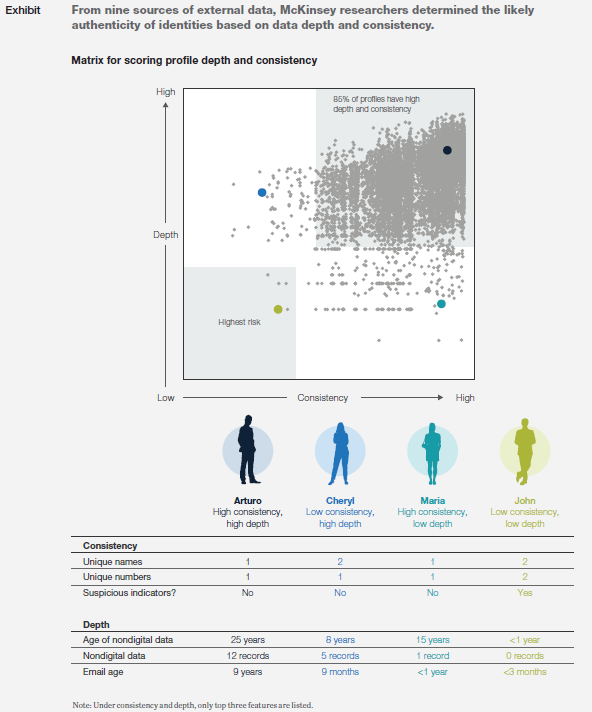

McKinsey undertook a multistep methodology to establish artificial identities. The corporate gathered 15,000 profiles from a consumer-marketing database mixed with 9 exterior sources of knowledge. The research group then recognized 150 options that served as measures of a profile’s depth and consistency that may very well be utilized to all 15,000 folks. An general depth and consistency rating was then calculated for every ID. The decrease the rating, the upper the danger of an artificial ID.

LexisNexis Danger Options discovered that fraud discovery fashions miss 85% to 95% of possible artificial identities. Many fraud detection fashions lack real-time insights and help for a broad base of telemetry information over years of transaction exercise. Mannequin outcomes are inaccurate because of restricted transaction information and real-time visibility.

CISOs inform VentureBeat that they want enhanced fraud prevention modeling apps and instruments which can be extra intuitive than the present era.

5 methods AI helps cease artificial id fraud

The problem each fraud system and platform vendor faces in stopping artificial id fraud is balancing sufficient authentication to catch an try with out alienating legit clients. The aim is to cut back false positives so an organization or model’s risk analysts aren’t overwhelmed, whereas on the identical time utilizing machine studying (ML)-based algorithms which can be able to continuously “studying” from every fraud try. It’s an ideal use case for ML and generative AI that may study from an organization’s real-time information units of fraudulent exercise.

The aim is to coach supervised ML algorithms to detect anomalies not seen by current fraud detection strategies and complement them with unsupervised machine studying to search out new patterns. This market’s most superior AI platforms mix supervised and unsupervised ML.

Main fraud programs and platform distributors who can establish and thwart artificial id fraud embody Aura, Experian, Ikata, Id Guard, Kount, LifeLock, IdentityForce, IdentityIQ and others. Among the many many distributors, Telesign’s danger evaluation mannequin is noteworthy as a result of it combines structured and unstructured ML to offer a danger evaluation rating in milliseconds and confirm whether or not a brand new account is legit.

Beneath are 5 methods AI helps detect and stop rising id fraud.

Designing ML into the core code base

Stopping artificial id fraud throughout each retailer or retail location requires an ML-based platform that’s continuously studying and sharing the most recent insights it finds in all transaction information. The aim is to create a fraud prevention ecosystem that continuously expands its derived information.

Splunk’s method to making a fraud danger scoring mannequin reveals the worth in information pipelines that carry out information indexing, transformation, ML mannequin coaching and ML mannequin software whereas offering dashboarding and investigation instruments. Splunk says that organizations enterprise proactive information evaluation strategies expertise frauds as much as 54% more cost effective and 50% shorter than organizations that don’t monitor and analyze information for indicators of fraud.

Decreasing latency of figuring out artificial fraud in progress by way of cloud providers

One of many limitations of current fraud prevention programs is a comparatively longer latency than present cloud providers. Amazon Fraud Detector is a service that many banking, e-commerce and monetary providers firms use together with Amazon Cognito to tailor particular authentication workflows designed to establish artificial fraud exercise and makes an attempt to defraud a enterprise or client.

AWS Fraud Detector has been designed as a totally managed service that has confirmed efficient in figuring out doubtlessly fraudulent actions. Amazon says that risk analysts and others can use it with none prior ML experience.

Integration of consumer authentication, id proofing and adaptive authentication workflows

CIOs and CISOs inform VentureBeat that counting on too many instruments that don’t combine nicely limits their means to establish and act on fraud alerts. Too many instruments additionally create a number of dashboards and studies, and fraud analysts’ time will get stretched too skinny. To enhance fraud detection requires a extra built-in tech stack to ship ML-based efficacy at scale. Many years of transaction information mixed with real-time telemetry information are wanted to enhance risk-scoring accuracy and establish artificial id fraud earlier than a loss happens.

“Organizations have one of the best probability of figuring out synthetics in the event that they use a layered fraud mitigation method that includes each guide and technological information evaluation,” writes Jim Cunha, safe funds technique chief and SVP on the Federal Reserve Financial institution of Boston. “Additionally, sharing data internally and with others throughout the funds trade helps organizations find out about shifting fraud techniques.”

ML-based danger scores scale back onboarding friction and false positives

Fraud analysts should resolve how excessive to set decline charges to forestall fraud whereas permitting legit new clients to enroll. As an alternative of going by means of a trial-and-error course of, fraud analysts use ML-based scoring strategies that mix supervised and unsupervised studying. False positives, a big supply of buyer friction, are decreased by AI-based fraud scores. This minimizes guide escalations and declines and improves buyer expertise.

Predictive analytics, modeling and algorithmic strategies efficient for real-time identity-based exercise anomaly detection

ML fashions’ fraud scores enhance with extra information. Id fraud is prevented by means of real-time danger scoring. Search for fraud detection platforms that use supervised and unsupervised ML to create belief scores. Probably the most superior fraud prevention and identification verification platforms can construct convolutional neural networks on the fly and “study” from ML information patterns in real-time.

ML helps hold friction and consumer expertise in steadiness

Telesign CEO Joe Burton informed VentureBeat: “Prospects don’t thoughts friction in the event that they perceive that it’s there to maintain them secure.”

Burton defined that ML is an efficient expertise for streamlining the consumer expertise whereas balancing friction. Prospects can achieve reassurance from friction {that a} model or firm has a sophisticated understanding of cybersecurity, and most significantly, defending buyer information and privateness.

Placing the precise steadiness between friction and expertise additionally applies to risk analysts who monitor fraud prevention platforms day by day to establish and take motion towards rising threats. Fraud analysts face the formidable activity of figuring out whether or not an alert or reported anomaly is a fraudulent transaction initiated by a non-existent id or whether or not it’s a legit buyer attempting to purchase a services or products.

Introducing ML offers analysts extra environment friendly workflows and insights and delivers extra accuracy and real-time latency to cease potential fraud earlier than it happens.