Wetter, extra harmful hurricanes, just like the back-to-back storms that pummeled Florida this fall, are pushing the state’s owners insurance coverage market to the brink of collapse.

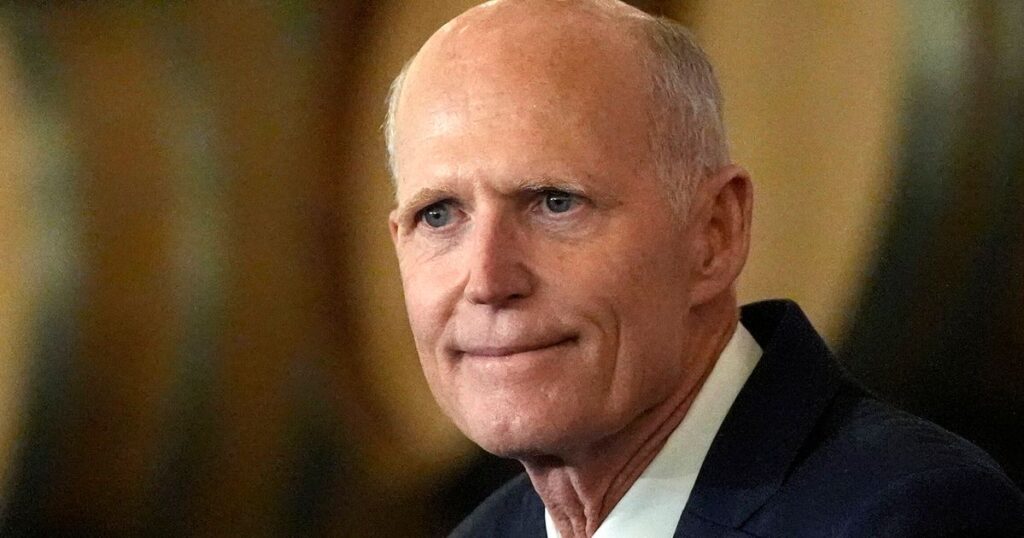

When requested by Florida Atlantic College pollsters in June who was most accountable for the excessive price of insurance coverage within the state, the biggest share of surveyed voters blamed Republican Gov. Ron DeSantis. But it surely was his Republican predecessor, Rick Scott, now a U.S. senator, who lured low-quality insurance coverage firms to the state and left Florida’s publicly owned insurer-of-last-resort company struggling to supply for extra owners as personal insurers went bust or refused to resume insurance policies in hurricane-prone areas.

Now Scott’s Democratic challenger for Senate, former Rep. Debbie Mucarsel-Powell, is hoping voters could make the connection between Scott’s eight years as governor and the monetary squeeze precipitated as insurers more and more fail to pay to restore properties broken in hurricanes Helene and Milton.

As a part of a years-long campaign to drive extra Floridians into the personal insurance coverage market, Scott raised premiums and rescinded reductions from the Residents Property Insurance coverage Corp., the government-backed nonprofit insurer, all whereas giving personal firms further incentives and protections to function within the state.

Now that warming-fueled storms are routinely inflicting billions of {dollars} in harm throughout Florida, personal insurers are fleeing the state, forcing prospects again to Residents. However now the offers the general public insurer affords include greater premiums and worse protection.

Throughout her two years in Congress representing a district stretching west of Miami, Mucarsel-Powell helped internet $200 million for Everglades restoration. She’s tried for the reason that begin of her Senate marketing campaign to focus on the distinction between her personal pressing considerations over local weather change and Scott’s rejection of fundamental local weather science and his votes to eradicate rules to curb planet-heating air pollution.

Lynne Sladky/Related Press

However Mucarsel-Powell stated campaigning this month in components of Florida the place hurricane winds scattered tree branches and refuse and tornadoes leveled total properties opened her eyes to how determined the scenario is turning into for owners.

“What these storms did is… actually awoke folks to the truth that we’re experiencing increasingly more extreme climate occasions,” Mucarsel-Powell advised JHB by cellphone whereas driving between marketing campaign stops.

“It has raised the alarm to the truth that the local weather is altering and nobody has completed something to convey down the impacts,” she stated. “Politicians have been mendacity to so many Floridians by not giving them the best info and by promoting them on fraudulent insurance policies by a few of these insurance coverage firms they’ve introduced right here.”

She stated Scott’s administration did not oversee insurers by inspecting whether or not firms stored sufficient funds obtainable to pay out giant numbers of claims after large disasters, leaving them successfully “unregulated.”

As soon as voters draw the hyperlink between the devastation and the shortcoming to get inexpensive protection, “you’re going to see folks right here within the state push again very, very strongly towards these electeds which have been right here and completed nothing,” she stated.

“It’s borderline legal,” she added. “Individuals are so indignant, annoyed and exhausted. Helene introduced flooding. Then Milton made all the things worse.”

A spokesperson for the Scott marketing campaign didn’t reply to a request for remark.

Scott has confronted blowback over environmental points earlier than.

Scott slashed environmental rules and reduce funding for Florida’s water administration company by $700 million, setting the stage for a poisonous algae bloom that decimated fisheries and the coastal tourism enterprise in 2018. Scott’s critics skewered him with the nickname “pink tide Rick,” and the difficulty harm the Republican within the polls. That very same disregard for the results of local weather change, Mucarsel-Powell stated, was on show when Scott attracted speculative personal insurers to a state the place coastal dwelling was getting riskier.

“He was ‘pink tide Rick’… Individuals dwelling in Florida for a really very long time know him very effectively,” Mucarsel-Powell stated.

“The owners insurance coverage disaster that we’re dealing with proper now began below Rick Scott,” she stated.

Simply after taking workplace in 2011, Scott signed laws eliminating Residents’ caps on premium will increase, inflicting the price of protection to skyrocket.

Residents then launched a marketing campaign to re-audit properties that state-sanctioned inspectors had already deemed prepared for a significant storm as a part of a course of to qualify for an insurance coverage low cost. Of the greater than 250,000 owners Residents double-checked, three out of 4 misplaced reductions, the Tampa Bay Instances reported in 2012.

The Scott administration then created further incentives for personal insurers to tackle Residents’ prospects. The governor went so far as to permit sure insurers to hand-select the least dangerous plans in Residents’ portfolio and veto the laws unanimously handed within the Florida Legislature to permit owners to return to Residents if personal charges went too excessive.

Greater than half of the 25 firms that state information present had been authorised to tackle Residents prospects from 2013 to 2018 both left Florida, in the reduction of on companies or folded, the Miami Herald present in a brand new evaluation that concluded Scott’s efforts “didn’t assist create a steady insurance coverage market.”

Of the 14 firms put below state receivership and liquidated over the previous decade, Florida authorities knowledge reveals, all are insurance coverage firms, and 6 went bust in simply the final two years.

Mike Stewart by way of Related Press

Throughout that point, among the nation’s largest insurers both pulled out of Florida or declined to resume tens if not a whole bunch of hundreds of insurance policies at a time. That compelled owners to return in giant numbers to Residents, however this time with greater charges and worse protection.

“I believe most individuals know Residents has not been solvent,” DeSantis stated at a information convention in March final yr. “Should you did have a significant hurricane hit with a number of Residents property holders, it could not have loads to pay out.”

In December, the U.S. Senate Banking Committee opened an investigation into whether or not Residents has sufficient cash available to pay out claims in future disasters.

Residents advised CNN on the time that, if it had been to pay out all reserves and reinsurance after a significant storm, “it’s required by Florida regulation to levy surcharges and assessments on its policyholders and all Florida insurance coverage customers till any deficit is eradicated.”

In 2021, Residents introduced {that a} 1-in-100-year storm may put Florida insurance coverage holders “on the hook for $24 billion in assessments tacked onto month-to-month premiums for years.” However as extra owners flip to Residents after personal insurers go away, reinsurance firms projected the quantity could possibly be as excessive as $162 billion, CNN reported.

The Miami Herald famous that main components within the rise in insurance coverage prices had been exterior Scott’s management, together with post-COVID inflation driving up housing prices and the regular development of high-priced properties in areas vulnerable to worsening hurricanes.

In August, Scott proposed a invoice to permit owners to deduct as a lot as $10,000 in dwelling insurance coverage bills from federal taxes. Mucarsel-Powell, in the meantime, backed a proposal from Rep. Jared Moskowitz (D-Fla.) to cut back how a lot reinsurance insurers want to purchase, a price that will get handed on to owners shopping for insurance policies.

Help Free Journalism

Help JHB

Already contributed? Log in to cover these messages.

She additionally pledged to advocate for stronger constructing codes. The Biden administration has made greater than $1 billion obtainable to states to assist elevate constructing codes on new properties and make homes and residences extra vitality environment friendly and able to withstanding excessive climate. However the DeSantis administration refused to just accept the funding final yr. And Sen. Marco Rubio (R-Fla.) launched a invoice final yr to dam the federal authorities from modernizing the constructing codes it makes use of as a benchmark for dwelling loans.

If elected, Mucarsel-Powell stated, she would attempt “to sit down down with Marco Rubio” and “work collectively to supply options.” However she stated that stronger constructing codes are simply a part of the difficulty and that the federal authorities ought to cease offering financing to property builders constructing in areas which can be forecast to face extra flooding as seas rise.

“We have to be accountable in offering mortgage loans for brand new properties or loans to builders which can be constructing realizing they’re constructing in areas that might be inclined to flooding and constructing in a state the place we all know we now have skilled extreme hurricanes,” she stated. “That ought to have already been modified years in the past.”

To begin, she stated, Florida may elect a senator who will present up at hearings investigating Residents’ funds and vote for insurance policies that crack down on firms she stated are benefiting from the market.

“There must be oversight,” Mucarsel-Powell stated. “And it’s completely not going to occur below Rick Scott.”