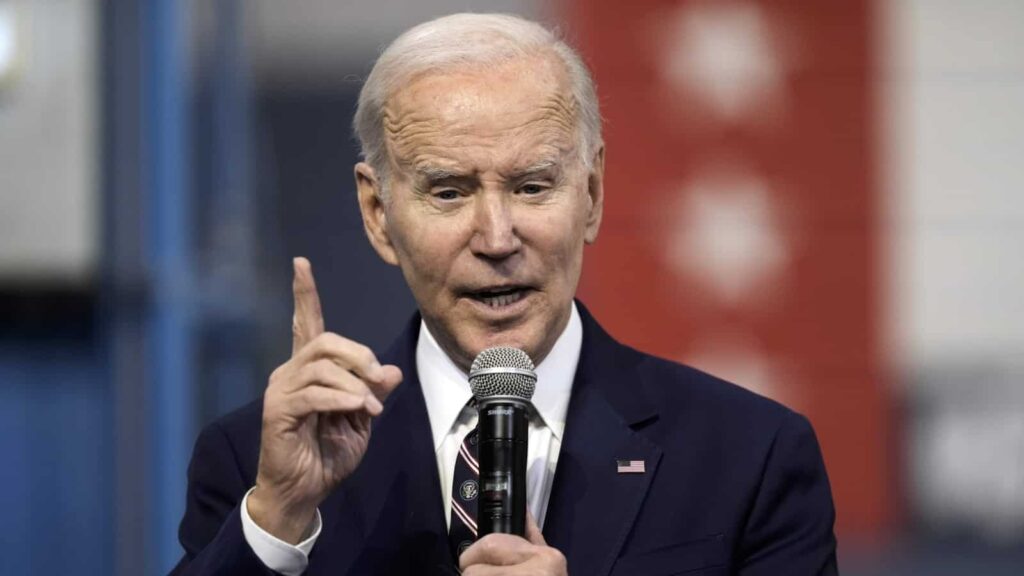

US President Joe Biden on Sunday vowed to carry “absolutely accountable” the individuals chargeable for the failure of Silicon Valley Financial institution and a second monetary establishment, Signature Financial institution. He, nevertheless, sought to reassure People that their deposits are secure.

“I’m firmly dedicated to holding these chargeable for this mess absolutely accountable and to persevering with our efforts to strengthen oversight and regulation of bigger banks in order that we aren’t on this place once more,” Biden stated in an announcement.

“The American individuals and American companies can believe that their financial institution deposits can be there after they want them,” the president added.

Biden stated he deliberate to talk about the US banking system on Monday morning, to reassure People after the failures of Silicon Valley Financial institution and Signature Financial institution.

“I’ll ship remarks on how we’ll keep a resilient banking system to guard our historic financial restoration,” he stated Sunday night time in an announcement that additionally included Biden’s promise of “holding these chargeable for this mess absolutely accountable.”

In a joint assertion, monetary businesses, together with the US Treasury, stated SVB depositors would have entry to “all of their cash” beginning on Monday, March 13.

The “core aim” of the strikes was to reassure financial institution clients they might have their cash “to satisfy payroll to maintain their companies working, and to ensure households are capable of pay the hire or the mortgage or any of their different payments,” US Federal Reserve officers instructed reporters Sunday night time.

The Fed introduced it might make further funding obtainable to banks to assist them meet the wants of depositors, which would come with withdrawals.

“We’re taking decisive actions to guard the US financial system by strengthening public confidence in our banking system,” the businesses stated.

Why US regulators shut Signature Financial institution?

Signature Financial institution, a New York state-chartered business financial institution that’s FDIC-insured, had whole belongings of about $110.36 billion and whole deposits of roughly $88.59 billion as of December 31, the New York Division of Monetary Providers stated in a separate assertion.

Signature Financial institution representatives didn’t instantly reply to a request for remark.

Silicon Valley Financial institution abruptly grew to become the most important US lender to fail in additional than a decade on Friday, unraveling in lower than 48 hours after outlining a plan to shore up capital. The financial institution took an enormous loss on gross sales of its securities amid rising rates of interest, spooking traders and depositors who quickly started pulling their cash. On Thursday alone, traders and depositors tried to yank about $42 billion.

US regulators are racing in opposition to the clock to search out options for failed Silicon Valley Financial institution and cease a possible contagion from spreading to different lenders.

(With inputs from AFP, Reuters, Bloomberg)