(Bloomberg) — International buyers are on observe to show sellers of Chinese language equities for the primary time ever for the yr, as considerations a couple of lack of supportive insurance policies from the Occasion congress and a renewed Covid Zero push spook markets.

Most Learn from Bloomberg

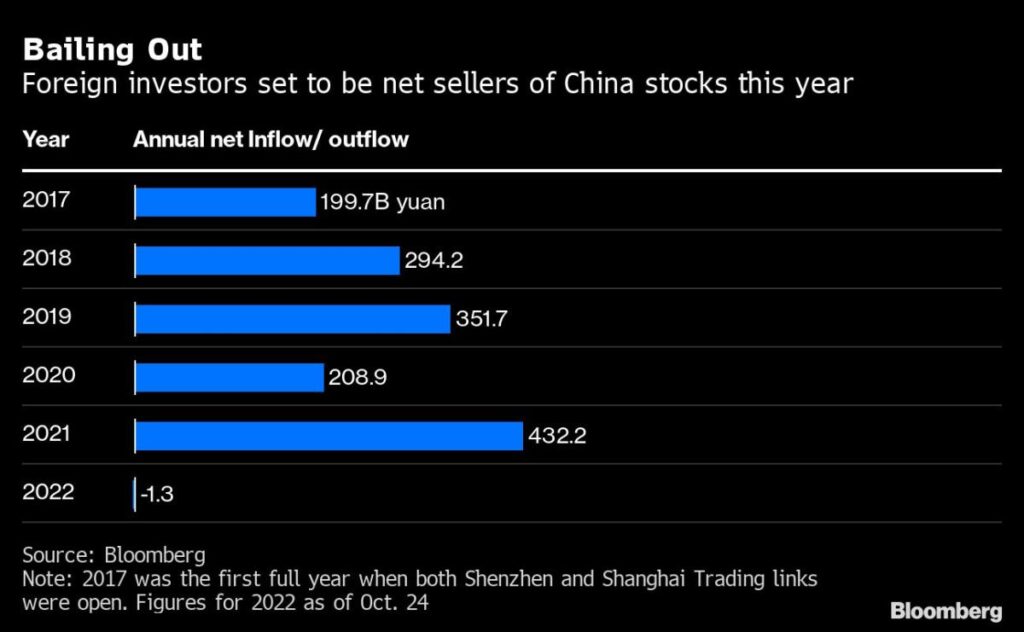

Abroad buyers offered a report web 17.9 billion yuan ($2.5 billion) of mainland shares through buying and selling hyperlinks with Hong Kong on Monday, in accordance with Bloomberg knowledge, tipping the year-to-date stage right into a small web outflow. If that holds via yr finish, it will be the primary annual decline for the reason that inventory join program was launched in 2014.

Learn: Xi’s Energy Seize Spurs Historic Market Rout as Foreigners Flee

Panic promoting hit markets on Monday following the nation’s twice-a-decade political occasion, with the Grasp Seng China Enterprises Index tumbling to the bottom stage for the reason that 2008 monetary disaster. President Xi Jinping’s consolidation of energy was seen as a significant danger, with expectations that the management reshuffle would carry a continuation of key insurance policies like Covid Zero.

“International sentiment on Chinese language shares is low now,” because the occasion congress signaled no imminent adjustments to Covid insurance policies, stated Marvin Chen, an analyst with Bloomberg Intelligence. “Markets may have to attend to nearer to the Central Financial Work Convention in December to see how the brand new management will handle China’s financial challenges.”

China bears are rising by the day as merchants flip skeptical over the nation’s financial progress because of its Covid-Zero coverage and a heavily-battered property sector. The benchmark CSI 300 Index dropped 2.9% on Monday amid the broader selloff regardless of the nation posting better-than-expected third quarter gross home product knowledge.

Traders are actually looking forward to whether or not the brand new management can ship much-needed stimulus to stem additional losses. Two financial gatherings later this yr – the Politburo assembly and the Central Financial Work Convention – shall be carefully watched for such insurance policies.

–With help from April Ma.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.