Nvidia (NASDAQ: NVDA) is the discuss of the inventory market nowadays. The factitious intelligence (AI) inventory has hit a $3 trillion valuation and it seems unstoppable. However the hazard in leaping aboard that bandwagon is that eventually, the joy stops, and you might discover out to procure shares close to or on the peak.

Buyers have fallen into bother with thrilling progress shares prior to now, shopping for COVID shares, meme shares, metaverse shares, and different thematic shares solely to see these investments falter. Perhaps Nvidia will show to be the exception, however there are arguably higher valued progress shares to purchase proper now.

One healthcare inventory that appears promising in case you’re a long-term investor is Intuitive Surgical (NASDAQ: ISRG). You are still investing in next-gen applied sciences, and this can be a magnificent inventory that would have lots extra room to run sooner or later.

The corporate’s latest system is AI-ready

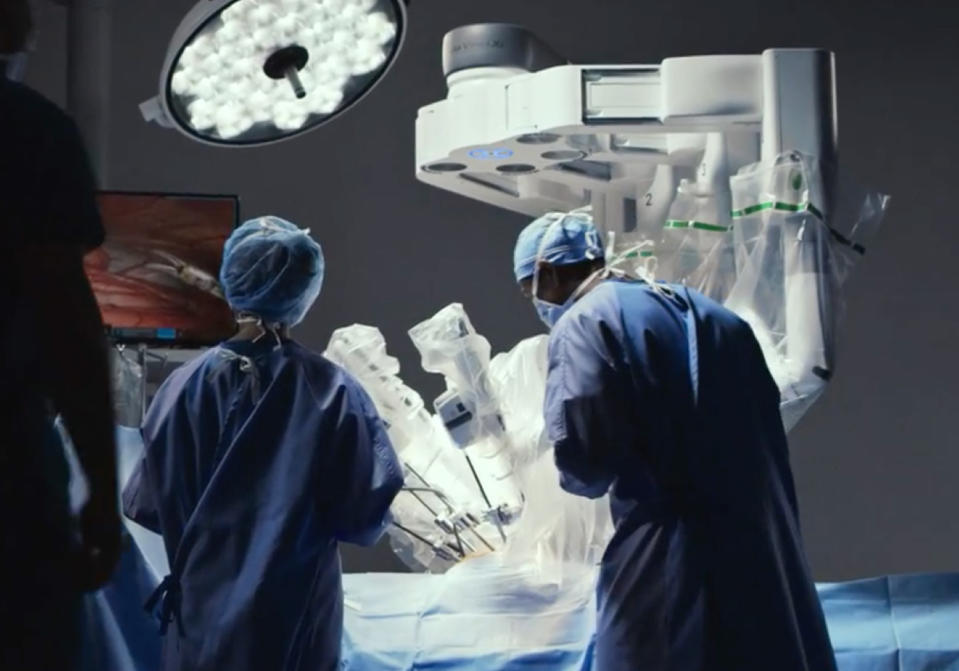

Intuitive Surgical makes robotic-assisted surgical programs. This 12 months, it unveiled its newest iteration, the da Vinci 5. It options sensible 3D imaging, improved depth notion, improved ergonomics, and has greater than 150 design improvements it believes will assist enhance effectivity and throughput for its customers.

The corporate’s transformative programs have the potential to revolutionize the healthcare trade by making surgical procedure much less invasive, faster, and extra correct. It might assist surgeons save time whereas main to raised outcomes for sufferers. The brand new system additionally has considerably extra computing energy than its predecessor, as it may well profit from developments in AI and machine studying.

In March, the Meals and Drug Administration (FDA) supplied the da Vinci 5 system with the required 510(ok) clearance. And the corporate already positioned eight of the programs through the first quarter.

Process progress continues to be sturdy

A key metric for Intuitive buyers is the variety of procedures used on its surgical programs. It is an essential metric that helps to gauge the rising recognition of the programs and it is also a income for the enterprise. Intuitive makes between $800 and $3,600 per surgical process as its devices and equipment have restricted life spans. The surgical programs themselves can price as a lot as $3.1 million and plenty of of them find yourself being leased out.

In Q1, Intuitive reported 11% income progress, and the variety of da Vinci procedures grew at a charge of 16% 12 months over 12 months. And the expansion charge in procedures was 21% within the earlier interval. It is an ideal signal of persistently sturdy demand for the enterprise.

Over the previous 5 years, the corporate’s income has practically doubled from $3.7 billion in 2018 to $7.1 billion in 2023. Income have additionally risen by round 60% throughout that time-frame. And the trade remains to be rising at a quick charge. Analysts from Meticulous Analysis mission that by 2030, the marketplace for surgical robots will probably be price greater than $25 billion, primarily based on a compound annual progress charge of 15.4%.

The inventory is not low cost, however could be a superb long-term purchase

At 75 occasions its trailing earnings, buyers are paying a hefty premium for Intuitive’s inventory. However with a whole lot of progress on the horizon and a stable revenue margin of 25% final 12 months, this may be top-of-the-line progress shares you possibly can spend money on for the lengthy haul.

Intuitive’s game-changing robotic programs are an effective way to take a position not solely within the healthcare trade’s long-term progress, but additionally in AI, which is prone to unlock new purposes for the programs and doubtlessly make them much more helpful for surgeons sooner or later.

Must you make investments $1,000 in Intuitive Surgical proper now?

Before you purchase inventory in Intuitive Surgical, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Intuitive Surgical wasn’t one among them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $767,173!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 10, 2024

David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Intuitive Surgical and Nvidia. The Motley Idiot has a disclosure coverage.

Neglect Nvidia, Purchase This Magnificent Progress Inventory As an alternative was initially printed by The Motley Idiot