The “Magnificent Seven” have been market leaders since 2023 however should not fairly a man-made intelligence (AI)-focused group. Whereas many inside the cohort have AI merchandise, they don’t seem to be pure performs.

As an alternative, I am proposing a brand new group of three that informs traders on how sturdy AI demand is. That group, consisting of Nvidia (NASDAQ: NVDA), which can also be a member of the “Magnificent Seven,” Tremendous Micro Pc (NASDAQ: SMCI), and Taiwan Semiconductor (NYSE: TSM), offers traders a have a look at the {hardware} aspect of AI.

So, should you’re on the lookout for a basket of shares to trace AI infrastructure buildout, this “Terrific Trio” is the way in which to go.

This trio has their palms in most AI merchandise

Beginning on the base, computing {hardware} requires semiconductor chips, and Taiwan Semiconductor produces the overwhelming majority of them. To supply extra highly effective chips, producers place the conductive traces nearer collectively, which permits extra parts to be packed onto a board. To explain these chips, chip producers identify them based mostly on how far aside the traces are. At the moment, the smallest TSMC can go is 3 nanometers (nm), nevertheless it’s already engaged on its 2 nm expertise as properly.

Taiwan Semiconductor makes chips for a number of the world’s greatest firms and is one in all Nvidia’s key suppliers.

Nvidia will get probably the most consideration of this trio, as its parabolic rise since early 2023 resulted within the inventory rising almost 500%. This pleasure is because of Nvidia’s graphics processing items (GPUs), that are best-in-class for coaching AI fashions. GPUs are constructed to course of complicated calculations like coaching AI fashions.

However what advantages Nvidia is the variety of GPUs bought when a supercomputer is constructed. These gadgets require hundreds of GPUs to offer customers with top-end computing energy, and with the rumored value of an H100 GPU coming in at round $30,000 a chunk, that generates a number of income for Nvidia.

Lastly is Tremendous Micro Pc. Haphazardly assembling a couple of hundred or thousand GPUs collectively with out the networking or structure expertise is a recipe for catastrophe. Many firms with out the expertise essential to get probably the most out of their GPUs go to Supermicro to construct their servers.

With Tremendous Micro Pc’s extremely modular system, it may possibly spec in a server of nearly any dimension and focus {that a} shopper might need.

Collectively, these three supply an important pulse on the AI motion, as their merchandise are important desk stakes for moving into the AI sport. However they’ve every had a powerful 2024, so is that this an excellent trio to purchase proper now?

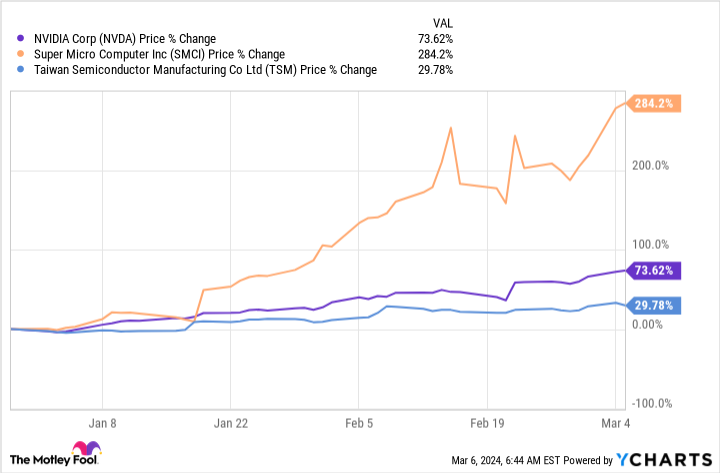

The trio has had a powerful 2024

This group has been a improbable one to personal in 2024. Supermicro’s led the cost, rising greater than 280%.

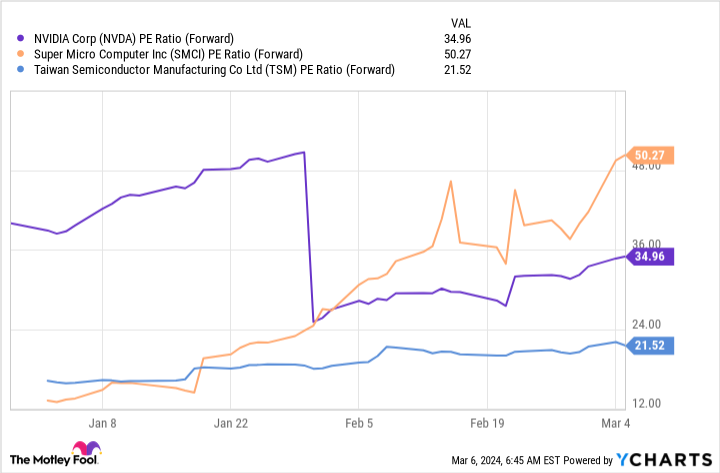

After these numbers, many traders could also be apprehensive about overpaying for any of the shares on this group. Nonetheless, that argument breaks down should you look at the ahead price-to-earnings (P/E) ratio (which makes use of analyst projections over the following 12 months).

The ahead P/E ratio is necessary when the corporate you are assessing goes by means of a large transformation, like these three are resulting from AI demand. Moreover, when evaluating this metric to a extra typical price-to-earnings ratio (which makes use of trailing earnings to worth the corporate), it is best to take a couple of factors off as a result of these are solely projections.

With that in thoughts, it is clear that Nvidia and Taiwan Semiconductor are nonetheless inside the realm of shopping for, though Supermicro has gotten fairly costly. Nonetheless, Nvidia’s inventory additionally traded for greater than 50 occasions ahead earnings in 2023, so Supermicro might develop into its valuation by means of sustained outsize development.

So, do you have to purchase the “Terrific Trio?” I might say sure if you need an absolute pulse on the AI market. However, should you’re trying to maximize your portfolio returns, I might solely purchase Nvidia and Taiwan Semiconductor, as Supermicro is likely to be due for a pullback after its stellar run to begin the 12 months.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 26, 2024

Keithen Drury has positions in Taiwan Semiconductor Manufacturing. The Motley Idiot has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Tremendous Micro Pc. The Motley Idiot has a disclosure coverage.

Overlook the “Magnificent Seven.” Contemplate the “Terrific Trio.” was initially revealed by The Motley Idiot