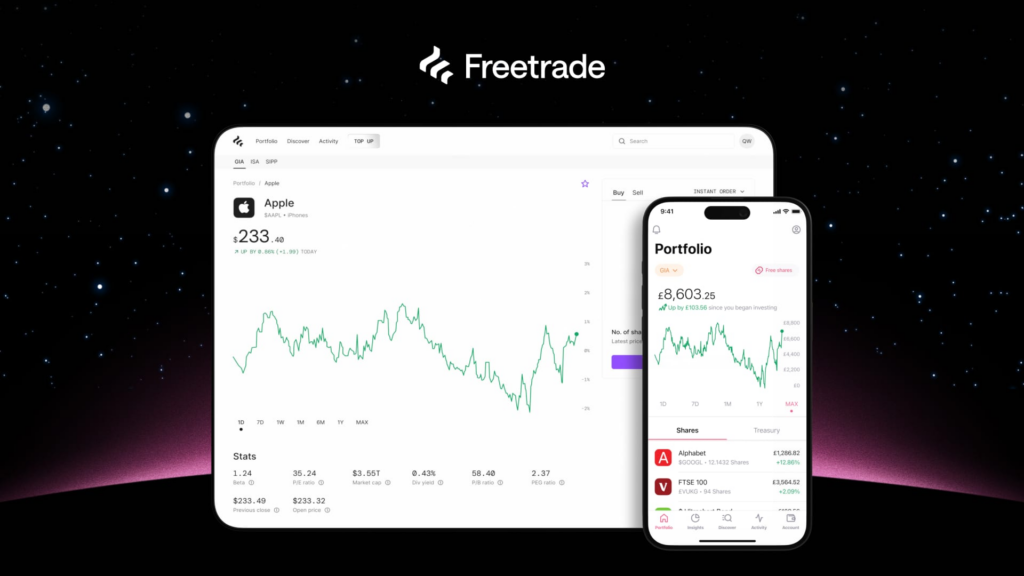

The Freetrade software on a smartphone and desktop PC.

Freetrade

LONDON — Freetrade, a British rival to common inventory buying and selling app Robinhood, mentioned Thursday that it has been acquired by on-line investing platform IG Group.

The deal values Freetrade at £160 million ($195 million) — a 29% low cost to its final valuation. The startup mentioned that it will proceed to function as a commercially standalone entity beneath its personal model.

Based in 2016, Freetrade garnered recognition amongst primarily youthful, extra inexperienced merchants within the U.Okay. with its zero-commission buying and selling platform.

The app initially started by providing equities however later expanded to roll out buying and selling in exchange-traded funds, financial savings merchandise and authorities bonds.

In pandemic occasions, Freetrade was using excessive on a retail dealer frenzy. The app benefited closely from GameStop “brief squeeze” in early 2021, when merchants on a Reddit discussion board for retail traders piled into the inventory and brought on it to rally in worth.

Brief-selling refers back to the apply of an investor borrowing an asset after which promoting it on the open market with the expectation of repurchasing it for much less cash in future for a revenue.

Nonetheless, worsening macroeconomic situations in 2022 and 2023 hit Covid high-fliers like Freetrade arduous — and in 2023, Freetrade accomplished a crowdfunding spherical at a valuation of £225 million down 65% from the £650 million it was price beforehand.

The deal is a possible sign for additional consolidation coming to the wealth know-how business. It comes after Hargreaves Lansdown was acquired for £5.4 billion by a consortium of traders together with personal fairness big CVC Group.

Viktor Nebehaj, CEO and co-founder of Freetrade, described the takeover as a “transformative deal that acknowledges the numerous worth that Freetrade has created.”

“Along with IG Group’s vital sources and backing, that is an thrilling alternative to speed up our development and supply of recent merchandise and options,” he added.

Freetrade mentioned the transaction is topic to customary closing situations together with regulatory approvals, including that it expects it’ll shut the deal later this 12 months.