The abrupt and fast collapse of the FTX cryptocurrency trade has precipitated a shock within the crypto house.

The autumn, in a couple of days, of an organization valued at $32 billion in February, ended up casting suspicion on the whole younger business of monetary providers, primarily based on the Blockchain know-how.

Confidence within the business is at an all-time low. Retail buyers have fled, whereas institutional buyers, linked to FTX and its sister firm Alameda Analysis, are nonetheless figuring out their losses from their publicity to Sam Bankman-Fried’s empire.

Whereas there are classes to be realized from this catastrophe which threatens the whole sector, it’s an understatement to say that it’ll take a very long time to regain the misplaced confidence.

‘A Lot of Errors’

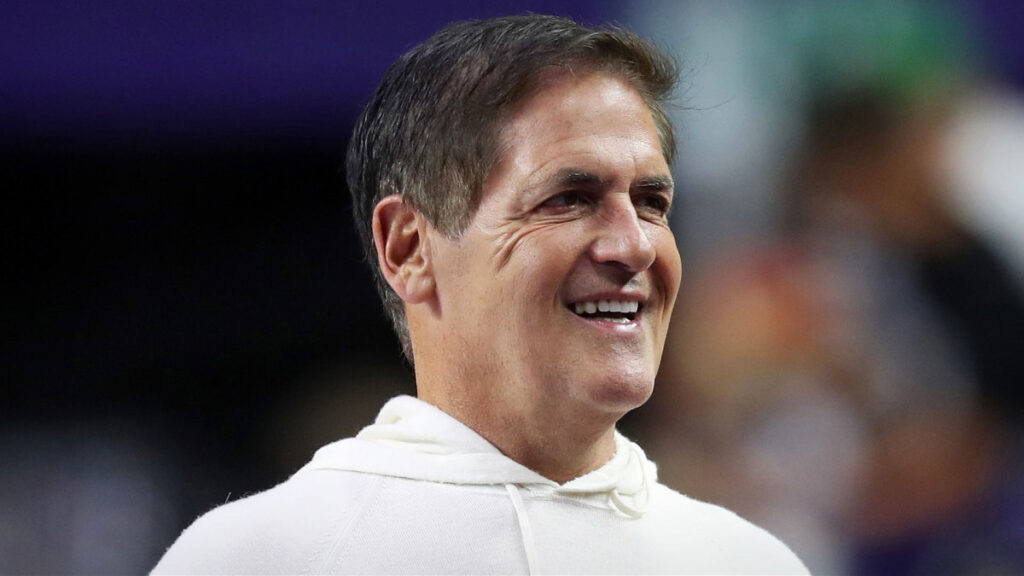

Billionaire Mark Cuban has not misplaced religion, although. He continues to consider within the business and assures that there’s nonetheless numerous worth within the sector, regardless of the autumn of FTX. He believes that crypto has its place and that you just simply have to have a look at the large image.

“Separate the sign from the noise,” Cuban informed TMZ. “There’s been lots of people making numerous errors, but it surely would not change the underlying worth.”

Cuban stated that, so long as shoppers have viable choices within the crypto world, he would not foresee the forex going within the tank.

The Dallas Mavericks proprietor is presently the topic of a category motion lawsuit associated to the chapter of crypto lender Voyager Digital, which he had promoted in a partnership signed in October 2021. This partnership between Voyager Digital and the Dallas Mavericks had one mission: to advertise cryptocurrencies by making cash extra accessible by means of academic and digital packages.

“Cuban and Ehrlich, as will likely be defined, went to nice lengths to make use of their expertise as buyers to dupe tens of millions of People into investing — in lots of instances, their life financial savings — into the misleading Voyager platform and buying Voyager earn program accounts (“EPAs”), that are unregistered securities,” the category motion lawsuits stated, additionally referring to Stephen Ehrlich, who was CEO of Voyager.

“Consequently, over 3.5 million People have now all however misplaced over $5 billion in cryptocurrency belongings.”

Voyager filed for chapter as collateral harm of a credit score crunch attributable to the sudden collapse of sister cryptocurrencies Luna and UST on Could 9.Tens of millions of consumers have misplaced their financial savings. Property of Voyager Digital had been bought by FTX, as a part of the mortgage lender’s liquidation course of.

“A primary query. Why have I invested in crypto?” Cuban wrote on Twitter on November 13. “As a result of I consider sensible contracts could have a big influence in creating beneficial purposes. I’ve stated from day 1, the worth of a token is derived from the purposes that run on its platform and the utility they create.”

Sensible Contract

A wise contract is a bit of pc code that determines the phrases of a transaction (loans, buying and selling, and so forth.) and would not depend on any third get together.

“What has not been created is an software that’s ubiquitous. One that’s clearly wanted by everybody and they’re prepared to undergo the training curve to make use of. Possibly it by no means comes. I hope and suppose it is going to,” Cuban continued.

The billionaire then in contrast the crypto business to the streaming business, implying that unhealthy concepts are more likely to perish whereas good ones will prevail.

“The most effective analogy I can use is the early days of streaming. The shit individuals needed to do to hearken to a 16k stream of music was insane. An web subscription on your dial up modem. Obtain the supplier consumer. Obtain a tcp/ip consumer. Obtain the streaming consumer,” he argued. “Click on on a batch file on a web site. Make certain all of it labored collectively. All whereas being laughed at for simply not turning in your radio or television.”

He concluded on a observe of optimism.

“However for in workplace or out of promote it was price it. It began as area of interest in 1995. Now understand that Sensible Contracts are about 5 years previous.”

Cuban is concerned in a number of crypto initiatives, together with the very choose Bored Ape Yacht Membership, which represents a set of over 10,000 on-line photographs of monkeys hanging humorous poses. Bored Apes are the costliest non-fungible tokens (NFTs).

He’s what many referred to as within the crypto house an Ethereum maximalist, which implies that he strongly believes within the potential of the second largest crypto ecosystem after Bitcoin. Ethereum is taken into account the web of the crypto business which goals to disrupt conventional monetary providers.