The abrupt collapse of FTX continues to reverberate via the cryptocurrency business.

Whereas it’s nonetheless very early to find out the complete repercussions of Sam Bankman-Fried’s crypto empire submitting for chapter, it’s anticipated that there are going to be many victims within the crypto sphere, in response to business sources.

The reasoning is that FTX, the cryptocurrency trade, which was nonetheless valued at $32 billion in February, was a central participant within the crypto chessboard. So was its sister firm Alameda Analysis, a hedge fund and buying and selling platform, additionally based by Bankman-Fried.

In the summertime of 2022, the 2 corporations had emerged as business saviors, after the collapse of sister cryptocurrencies Luna and UST prompted a credit score crunch which rocked many corporations uncovered to their Terra ecosystem. Hedge fund Three Arrows Capital (3AC) was pressured into liquidation, whereas crypto lenders Celsius Community and Voyager Digital filed for chapter. Bankman-Fried bailed out many firms, together with lender BlockFi, brokerage RobinHood and others.

‘One other $1 Billion’

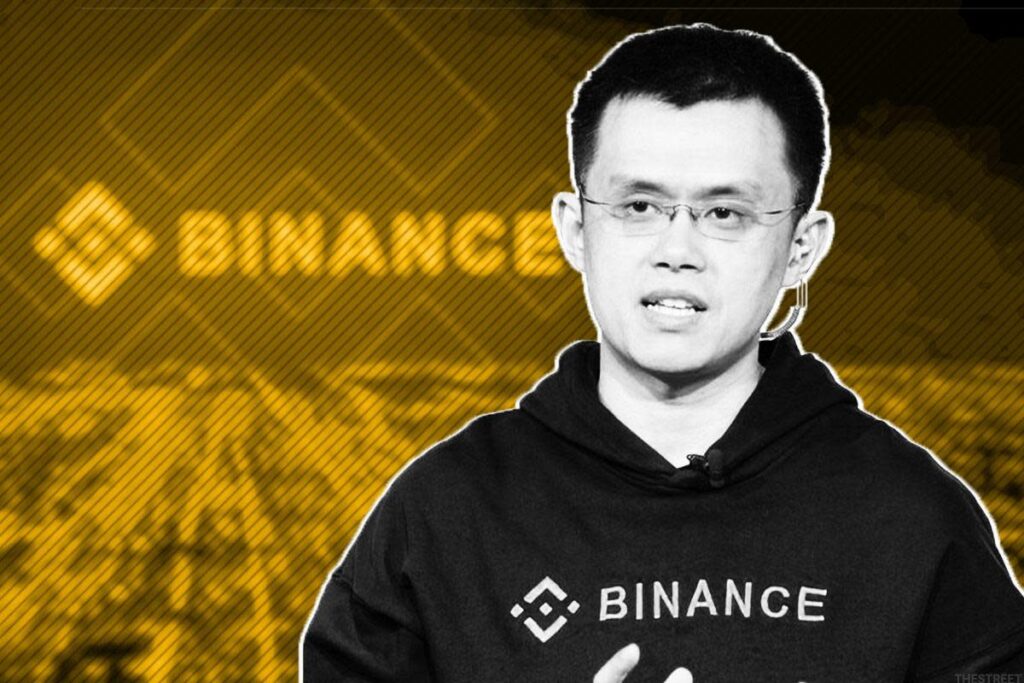

Now that FTX is down, there isn’t a doubt that many corporations can be impacted. Lender BlockFi and brokerage Genesis have already suspended money withdrawals by their prospects. To keep away from a systemic disaster, Changpeng Zhao, the founder and CEO of Binance, the world’s largest cryptocurrency trade, has introduced a fund to assist firms dealing with monetary difficulties.

Particulars on how this fund will work haven’t but been supplied. However Zhao, who now seems to be the massive winner from the autumn of Bankman-Fried, has simply revealed that Binance is allocating $2 billion to this fund.

“Yesterday, #Binance allotted ANOTHER $1 billion to the business get better initiative. All in BUSD,” Zhao posted on Twitter on November 25.

This announcement comes a day after a primary piece of stories, given by Zhao throughout an interview with Bloomberg Information. In that interview, he introduced that Binance had already allotted $1 billion to the rescue fund.

“If that’s not sufficient we are able to allocate extra,” Zhao informed the information outlet.

“To scale back additional cascading destructive results of FTX, Binance is forming an business restoration fund, to assist initiatives who’re in any other case robust, however in a liquidity disaster,” Zhao first mentioned on November 14. “Extra particulars to come back quickly. Within the meantime, please contact Binance Labs if you happen to assume you qualify.”

Binance Labs is the monetary arm of Binance.

Zhao has additionally determined to open this fund to different gamers and buyers who wish to assist the crypto business. Aptos Labs and Leap Crypto will contribute to the fund.

The Fall of FTX

Historical past will do not forget that it was the choice of Zhao and Binance to promote $530 million value of FTT, the cryptocurrency issued by FTX, which was the start of the top for the Bankman-Fried empire. Certainly, after the announcement of this determination on Twitter on November 6, there adopted a run on the platform of panicked FTX prospects. 5 days later, the agency was bankrupt, after Binance had given up on buying it two days earlier.

As a crypto trade, FTX executed orders for his or her purchasers, taking their money and shopping for cryptocurrencies on their behalf. FTX acted as a custodian, holding the purchasers’ crypto currencies.

FTX then used its purchasers’ crypto property, via its sister firm’s Alameda Analysis buying and selling arm, to generate money via borrowing or market making. The money FTX borrowed was used to bail out different crypto establishments in the summertime of 2022.

On the identical time, FTX was utilizing the cryptocurrency it was issuing, FTT, as collateral on its stability sheet. This represented a major publicity, as a result of focus threat and the volatility of FTT.

As soon as this publicity got here to gentle, purchasers, fearing an FTX collapse, rushed to liquidate their crypto positions and get their a reimbursement. On November 6, Prospects withdrew a report $5 billion in a run on the trade. This led to the insolvency of FTX, because it didn’t have the crypto property, now on mortgage or bought, to honor its purchasers’ promote orders.