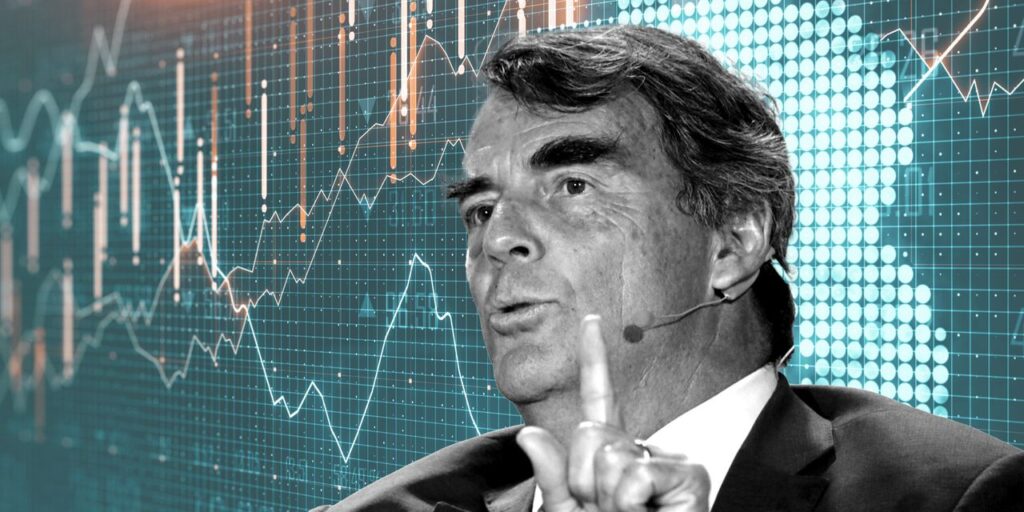

Tim Draper, founder and managing associate of Draper Associates and Draper College, balked at evaluating the beautiful implosion of crypto buying and selling platform FTX to the infamous biotech startup Theranos, in a dialog with MarketWatch.

“It’s not like Theranos,” he stated. In a Friday telephone interview, Draper stated he hadn’t been conscious of anybody genuinely evaluating the downfall of the embattled FTX, which filed for chapter safety on Friday, with Theranos.

FTX founder Sam Bankman-Fried, the now-former CEO of the platform and its related corporations, was going through an $8 billion shortfall, The Wall Road Journal reported.

Nevertheless, some have been drawing such comparisons, together with Galaxy Digital

BRPHF,

CEO Mike Novogratz in an interview with CNBC: “You recognize, we mainly have a state of affairs that appears like Theranos,” he stated on the enterprise community on Thursday.

“I’m livid,” Novogratz stated, referring to how FTX’s capsizing hurts confidence within the nascent crypto market, with bitcoin

BTCUSD,

the progenitor of the present crypto, forming within the wake of the 2008-2009 monetary disaster.

Theranos founder Elizabeth Holmes rose to prominence on the again of the assumption that she had invented groundbreaking developments in blood-testing know-how. The corporate’s valuation grew to $9 billion as she attracted a wave of high-profile buyers, together with Draper, earlier than it was uncovered that no such know-how existed. She was convicted of fraud in January 2022.

For his half, Bankman-Fried, 30, introduced his resignation from his place as the top of FTX on Friday. The SEC and DOJ are investigating FTX’s latest implosion, although at this level Bankman-Fried isn’t in any authorized hassle.

The collapse comes as some had come to treat Bankman-Fried as a form of savior to different beleaguered crypto corporations earlier this yr. SBF, as he’s typically recognized, was a member of MarketWatch’s listing of the 50 most influential individuals.

Like Holmes, he was heralded as a phenom, showing on the August/September cowl of Fortune journal because the “subsequent Warren Buffett,” the legendary worth investor.

The rate of his downturn has additionally been beautiful. His internet value had been estimated to be $15.6 billion earlier than this week, in line with the Bloomberg Billionaires Index. However now the overwhelming majority of his fortune has been worn out, Bloomberg said.

Based on WSJ, some $2 billion was poured into the three-year-old FTX with little oversight or ample scrutiny into its enterprise.

The change lent billions of {dollars} to fund dangerous bets at its affiliated buying and selling agency, Alameda Analysis, utilizing cash that clients had deposited at FTX, in line with reviews.

A spokesman for FTX declined to remark.

“That is about individuals who bought forward of their skis.” Draper stated. He added, “I really feel for many who bought caught up on this mess.”

The enterprise capitalist and crypto fanatic stated he, for one, has by no means seen SBF because the golden boy of crypto and has been broadly skeptical of platforms that don’t provide clear transparency relating to their holdings.

“I’ve been very cautious with DeFi [decentralized finance] and have averted most of these,” stated Draper, who’s an investor in buying and selling platforms Coinbase International Inc.

COIN,

and Ledger.

“You’re higher with good stable administration, good stable efficiency,” Draper stated.

“I have a tendency to not observe the hype,” he added.

For probably the most half, cryptocurrencies, together with Ether

ETHUSD,

and bitcoin, have been swooning because the FTX drama has unfolded. The inventory market briefly jolted decrease on Tuesday, with the Dow Jones Industrial Common

DJIA,

shedding greater than 600 factors on Tuesday, earlier than the broader market — together with the S&P 500

SPX,

— bounded again on Thursday, boasting an incredible 1,200-point rally.

Additional FTX studying: