An worker places gold bullions right into a protected deposit field at Degussa store in Singapore

Edgar Su | Reuters

Gold costs hit one other document excessive this week after a roaring 2023, and a mix of geopolitical tensions and continued central financial institution shopping for ought to see demand stay resilient subsequent yr, in line with the World Gold Council.

The yellow steel broke by way of $2,100 per ounce on Monday earlier than moderating barely, and spot costs have been hovering at round $2,030 per ounce early Friday.

In its Gold Outlook 2024 report revealed Thursday, the World Gold Council famous that many economists now anticipate a “comfortable touchdown” within the U.S. — the Federal Reserve bringing inflation again to focus on with out triggering a recession — which might be constructive for the worldwide financial system.

The trade physique (which represents gold mining firms) famous that traditionally, comfortable touchdown environments have “not been significantly engaging for gold, leading to flat to barely unfavourable common returns.”

“That stated, each cycle is totally different. This time round, heightened geopolitical tensions in a key election yr for a lot of main economies, mixed with continued central financial institution shopping for may present further help for gold,” the WGC added.

Its strategists additionally famous that the probability of a comfortable touchdown is “under no circumstances sure,” whereas a world recession continues to be not off the desk.

“This could encourage many traders to carry efficient hedges, resembling gold, of their portfolios,” the WGC added.

The 2 most vital occasions for gold demand in 2023 have been the collapse of Silicon Valley Financial institution and the Hamas assault on Israel, the WGC stated, estimating that geopolitical occasions added between 3% and 6% to gold’s value over the yr.

“And in a yr with main elections happening globally, together with within the U.S., the EU, India, and Taiwan, traders’ want for portfolio hedges will doubtless be increased than regular,” the report stated, waiting for 2024.

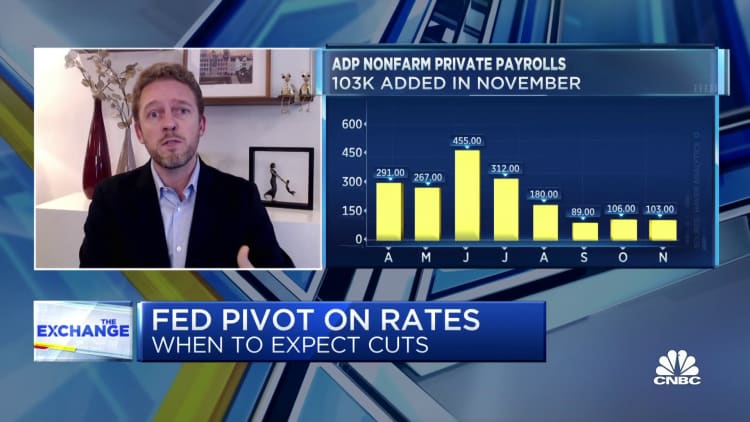

All eyes on the Fed

WGC Chief Market Strategist John Reade advised CNBC on Thursday that gold costs would doubtless stay range-bound however uneven subsequent yr. He expects them to react to particular person financial information factors that inform the doubtless trajectory of Fed coverage till the primary rate of interest minimize is within the bag.

Markets are presently pricing the primary 25-basis-point minimize to the Fed funds fee as early as March subsequent yr, in line with CME Group’s FedWatch software.

Nonetheless, though fee cuts are often seen as excellent news for gold (as money returns fall and savers look elsewhere for high-yielding investments), Reade highlighted that two components may imply that “anticipated coverage fee easing could also be much less sanguine for gold than it seems on the floor.”

Firstly, if inflation cools extra shortly than charges — as it’s largely anticipated to do — then actual rates of interest stay elevated. And secondly, lower-than-expected development may hit gold shopper demand.

“I am not saying rates of interest have to return to 0 to reignite the demand, however that mixture I consider the primary minimize within the States and cuts elsewhere in different essential economies, will I feel change a little bit of the sentiment in direction of gold,” Reade stated.

Central financial institution shopping for to proceed

One different supporting issue for the yellow steel wanting forward is additional central-bank shopping for, in line with the World Gold Council.

Central banks have been a serious supply of demand within the world gold market over the past couple of years and 2023 is more likely to be a document yr. The WGC expects this to proceed in 2024.

Reade stated the group was stunned by the numerous improve in central financial institution purchases in 2022 and that the tempo of shopping for continued this yr.

In its report, the WGC estimated that central financial institution demand added 10% or extra to gold’s efficiency in 2023, and famous that even when 2024 doesn’t attain the identical heights, above-trend shopping for ought to nonetheless supply an additional increase to gold costs.

“Our expectations are that central financial institution purchases will proceed subsequent yr on a web foundation, and that is just about the case for the reason that world monetary disaster,” Reade stated.

“My very own expectation is that central banks are very a lot going to be once more, the form of distinguished story within the gold market in 2024, however I feel that it might be optimistic of us to say that it should be one other document yr or a record-matching yr.”