Worn out from 2022’s unremitting bear market? Properly, excellent news. In response to Financial institution of America, the scene is about for a 2023 bull run. However extra intriguingly, given the present circumstances, the market leaders will not be invited to this occasion with these additional down the meals chain set to the paved the way.

Or as BofA’s Chief Funding Strategist Michael Hartnett places it, “Secular traits of stagflation, reshoring, localization, fiscal stimulus = small cap bull in 2023.”

Hartnett has historical past on his aspect. Just like how the market behaved within the Seventies’ high-inflationary period, after nearly 20 years of ruling the roost, Nasdaq 100 domination is beginning to considerably wane, and Hartnett is anticipating a repeat of previous occasions. “Stagflation continued by way of late-Seventies however as soon as inflation shock of 1973/1974 over, US small cap entered one of many nice bull markets of all-time,” Hartnett added.

With this in thoughts, we delved into the TipRanks database and pulled up two small-cap shares which can be rated as Sturdy Buys by the analyst consensus. It additionally doesn’t harm that each supply buyers double-digit upside potential, and a small dividend as a bonus. This makes them splendid candidates to push forward, ought to BofA’s thesis play out.

H&E Gear Providers (HEES)

There are numerous jobs that solely require gear on a short lived foundation, significantly for large-scale industrial work; that is the place H&E Gear Providers enters the body.

H&E is among the largest gear rental corporations within the U.S. and makes the majority of its income from renting out miscellaneous building and industrial gear comparable to earth-moving instruments, aerial work platforms, industrial carts, air compressors and materials dealing with gear, amongst others. The corporate additionally affords a variety of various providers comparable to new and used gear gross sales and repairs and upkeep.

Seeing out 2021, the corporate had 102 department places unfold out throughout 24 states. Simply to get an thought of the dimensions, H&E’s portfolio boasts 42,725 items of kit, which on common are lower than 3.5 years previous.

After a considerably uneven interval, revenues have been steadily rising all through 2022 and that was evident in Q3 too. The highest-line confirmed $324.3 million, amounting to ~18% year-over-year improve whereas additionally beating the Road’s estimate by $20.34 million. Gross margin rose to ~47% vs. the 41.4% seen in 3Q21, whereas internet revenue noticed a ~55% uptick to $38.4 million. This resulted in EPS of $1.05, far larger than the $0.82 predicted by the analysts.

Because of the stable earnings progress, the corporate has been capable of simply preserve its $0.275 per quarter frequent share dividend. The cost has been held at this stage since Could of 2015. At its present price, the cost annualizes to $1.10 per frequent share and yields 2.7%.

Stifel analyst Stanley Elliott believes that H&E is a go-to story for buyers, and descriptions why: “HEES continues to execute on its heat begin technique and nonetheless expects at the least 10 openings in 2022. We view the accelerated progress potential from heat begins as a comparatively distinctive attribute relative to friends which have much less runway. We stay optimistic on the shares given this heat begin technique in addition to a positive footprint. We additionally see enhancing non-resi building exercise, rebuilding in FL, and infrastructure invoice advantages as tailwinds into 2023. Regardless of these enticing progress drivers for the corporate, shares commerce at a significant low cost to friends whereas carrying a ~3% dividend yield.”

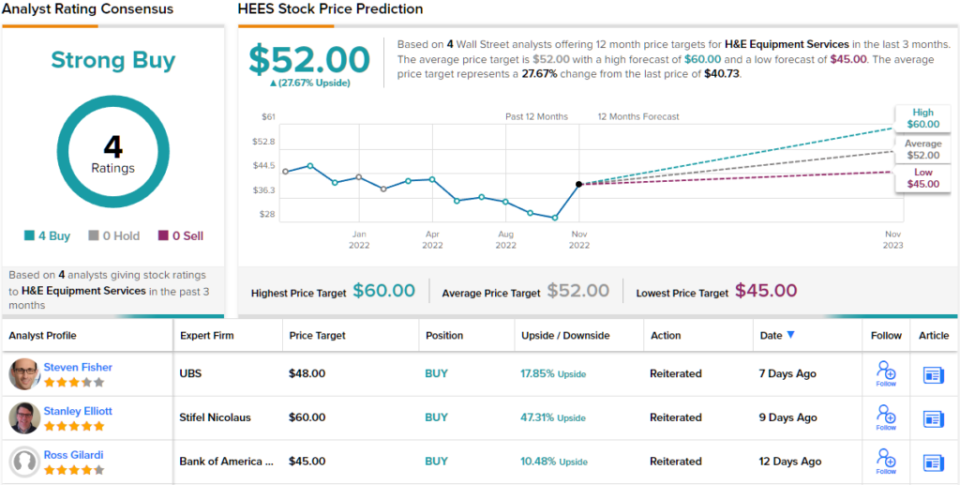

These bullish feedback underpin Elliot’s Purchase ranking on HEES, whereas his $60 worth goal suggests shares will climb 47% larger over the approaching months. (To observe Elliot’s observe file, click on right here)

Trying on the consensus breakdown, different analysts are on the identical web page. With 4 Buys and no Holds or Sells, the phrase on the Road is that HEES is a Sturdy Purchase. H&E shares are priced at $40.73 and their $52 common goal implies a achieve of ~28% achieve within the subsequent 12 months. As for small-cap credentials, H&E’s market cap stands just below $1.5 billion. (See H&E inventory forecast on TipRanks)

Patrick Industries (PATK)

The following small-cap inventory we’ll take a look at is Patrick Industries, a pacesetter within the area of part merchandise and constructing supplies. These are made and offered by the corporate and geared towards a number of industries comparable to leisure autos (RV), manufactured housing (MH), marine and quite a few different Industrial segments. The choices embody every thing from counter tops, flooring and toilet/kitchen fixtures and laminated merchandise to furnishings, electronics & audio programs, home equipment and extra.

By way of its nationwide manufacturing and distribution community, final yr, the corporate delivered gross sales of +$4 billion, derived from its 70-plus subsidiaries, of which over 75% got here from the RV/marine industries.

The corporate is on track to beat that determine this yr despite the powerful macro backdrop. Within the newest quarterly report, for Q3, the corporate generated income of $1.11 billion, representing a 4.7% year-over-year improve. Whereas that amounted to a sequential drop from the $1.48 billion generated in Q2, the determine got here above Road expectations by $20 million. The corporate has additionally made a behavior of beating the EPS forecasts and that was no completely different in Q3. The analysts have been calling for EPS of $2.03 however Patrick delivered $2.43.

The corporate additionally declared a Q3 dividend, in August, of $0.33 per frequent share. This cost offers an annualized frequent share dividend of $1.32, which in flip makes the yield 2.75%.

Among the many bulls is Truist’s 5-star analyst Michael Swartz, who’s satisfied the market has “but to completely respect the structural enhancements PATK has made to its margin profile over the previous 3-4 years.”

“Working example,” the 5-star analyst went on to elucidate, “regardless of a worsening manufacturing outlook throughout all of PATK’s key finish markets because it final reported (July), the corporate truly raised its full yr margin expectations. Whereas we do anticipate some YoY stress on gross margin to proceed into 1H23, we more and more imagine that the corporate can preserve 20% gross and 10%+ EBITDA margins even in a worsening macro atmosphere.”

What does this all imply for buyers, then? The analyst charges PATK shares a Purchase backed by a $60 worth goal. Ought to the determine be met, buyers might be pocketing positive aspects of 25% a yr from now. (To observe Swartz’s observe file, click on right here)

Equally, different Wall Road analysts have been impressed by PATK. It earns a ‘Sturdy Purchase’ consensus ranking because of the three Buys and 1 Maintain assigned within the final three months. As well as, the typical worth goal of $62.50 implies ~30% upside potential. (See PATK inventory forecast on TipRanks)

To seek out shares which have acquired essentially the most bullish current rankings from the Road, go to TipRanks’ Analysts’ Prime Shares software. The software additionally reveals which shares have dropped essentially the most over the past three months – enabling you to pinpoint the very best shares buying and selling at compelling ranges.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is rather vital to do your individual evaluation earlier than making any funding.