NEW YORK/LONDON, March 31 (Reuters) – International mergers and acquisitions (M&A) exercise shrank to its lowest stage in additional than a decade within the first quarter of 2023, as rising rates of interest, excessive inflation and fears of a recession soured the urge for food of corporations for dealmaking.

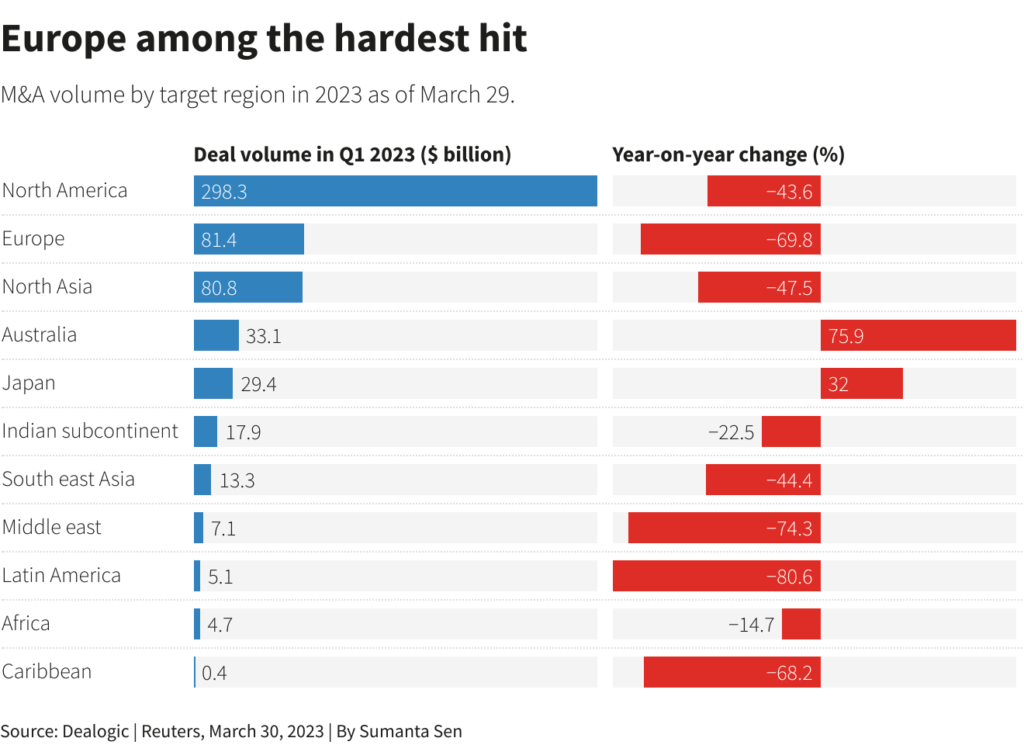

M&A volumes throughout the first quarter slumped 48% to $575.1 billion as of March 30, in comparison with $1.1 trillion throughout the identical interval final 12 months, in line with knowledge from Dealogic.

A banking disaster that began in america this month with Silicon Valley Financial institution and unfold to Europe with the Swiss government-orchestrated sale of Credit score Suisse Group AG (CSGN.S) to UBS Group AG (UBSG.S) roiled markets and stopped many offers of their tracks, funding bankers and legal professionals mentioned.

“The primary quarter had extraordinary ranges of volatility and uncertainty – greater than anticipated going into the 12 months. And that has the influence of suspending some bulletins,” mentioned Anu Aiyengar, international head of M&A at JPMorgan Chase & Co (JPM.N).

M&A volumes dropped 44% to $282.7 billion within the U.S. and 70% to $81.87 billion in Europe. Deal volumes in Asia Pacific fell 29% to $176.1 billion.

“Having a well-functioning financing market is a important ingredient for M&A. Market volatility has clearly been a problem and weighed on deal volumes within the quarter,” mentioned Brian Haufrect, co-head of M&A for Americas at Goldman Sachs Group (GS.N).

Within the absence of debt financing, non-public fairness corporations have been compelled to jot down bigger fairness checks for his or her offers.

“If this destructive debt financing surroundings continues for a number of years, folks could come to remorse having over-equitized offers at first. However if in case you have some confidence that within the subsequent 12-18 months the financing market will enhance and rates of interest will come down, it is nonetheless a good time to transact now,” mentioned Daniel Wolf, associate at Kirkland & Ellis.

The full variety of offers price over $10 billion fell by an enormous margin from final 12 months, because the urge for food for giant strategic tie-ups evaporated amid a harder antitrust surroundings and macroeconomic uncertainty.

“The primary quarter performed out the best way we thought it was going to, except for the banking disaster, which is the very last thing we wanted,” mentioned Damien Zoubek, co-head of U.S. M&A at Freshfields Bruckhaus Deringer.

Main transactions throughout the quarter included Pfizer Inc’s (PFE.N) $43 billion acquisitions of most cancers biotech Seagen (SGEN.O), a Silver Lake-led consortium’s $12.5 billion deal for software program maker Qualtrics Worldwide Inc (XM.O), and CVS Well being Corp’s (CVS.N) $10.6 billion takeover of major care supplier Oak Avenue Well being Inc.

“Nicely-capitalized patrons are in a position to borrow cash to do offers. I don’t see a glacial freeze forward of us,” mentioned Adam Emmerich, a company associate at Wachtell, Lipton, Rosen & Katz.

Kevin Brunner, co-head of worldwide M&A at Financial institution of America (BAC.N), echoed the optimistic sentiment. He pointed to some giant corporations making the most of depressed valuations to launch “bear hugs” and hostile takeover bids.

“There shall be some alternatives for this pent up demand in M&A to learn from decrease volatility and a clearer outlook as to the place we’re headed,” Brunner mentioned.

LACK OF CONFIDENCE

The depressed market valuations additionally offered a possibility for distinguished activist buyers to launch new proxy fights, with dealmakers anticipating a lift to M&A volumes from activist campaigns within the coming quarters.

“There are plenty of corporations which have parts that activists like when it comes to non-core property that may be bought or spun off, or the buildup of money that could possibly be deployed in a greater means, together with by means of inventory buybacks. So, all that’s resulting in extra activism,” mentioned Krishna Veeraraghavan, associate at Paul, Weiss, Rifkind, Wharton & Garrison LLP.

Funding-grade financing markets have been a comparatively brilliant spot throughout the quarter, as corporates have been in a position to line up financing for offers and outbid giant buyout corporations on some high-profile auctions.

“On the company facet, in case you are an investment-grade credit score, the markets have been very robust and supportive. Whereas you could have much less curiosity from sponsors, you’ve got extra curiosity from corporates who’ve been outbid during the last couple of years by the sponsor neighborhood,” mentioned Barry Weir, co-head of EMEA M&A at Citigroup (C.N).

It could possibly be some time earlier than the basics turn into favorable for dealmaking once more, mentioned Jim Langston, co-head of U.S. M&A at Cleary Gottlieb Steen & Hamilton LLP.

“Inflationary pressures aren’t subsiding as quick as folks anticipated; there’s nonetheless plenty of geopolitical tensions, and in plenty of methods, the disruption within the financing market is intensifying,” Langston mentioned.

Reporting by Anirban Sen in New York and Andres Gonzalez in London; Further reporting by David French; Enhancing by Stephen Coates

: .