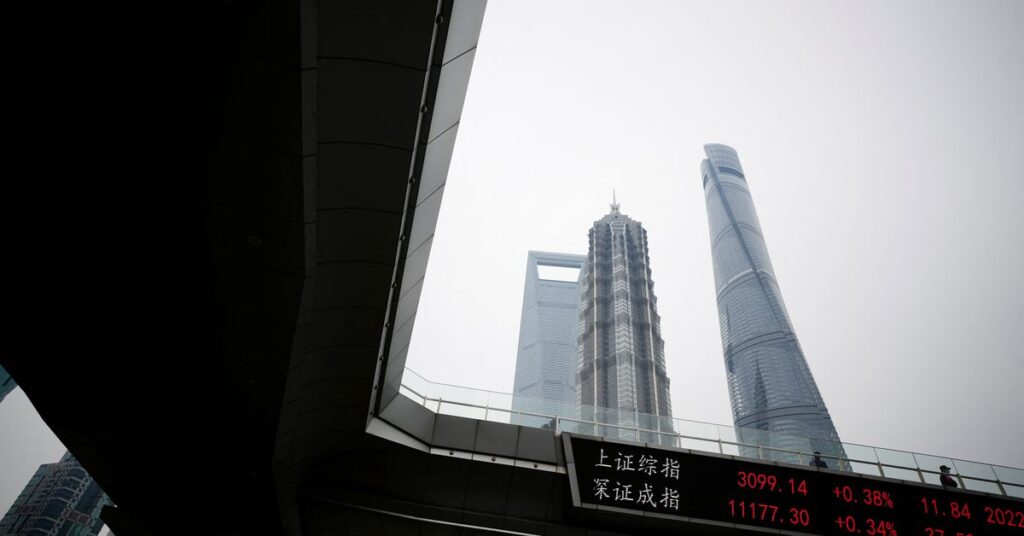

Nov 25 (Reuters) – International fairness funds noticed outflows within the week ended Nov. 23 on worries over a recession attributable to larger rates of interest and recent lockdowns as COVID circumstances rise in China.

In keeping with Refinitiv Lipper knowledge, buyers withdrew $8.6 billion and $840 million respectively from U.S. and European fairness funds however invested $470 million in Asian fairness funds.

Amongst fairness sector funds, financials, tech, and actual property funds had outflows of $751 million, $429 million, and $390 million, respectively, though shopper staples acquired $600 million price of inflows.

In the meantime, international bond funds posted outflows for a 3rd straight week, amounting to $2.52 billion.

International short- and mid-term bond funds noticed withdrawals of $4.84 billion, the largest weekly outflow in 5 weeks, however high-yield bond funds lured inflows for a second successive week, to the worth of $2.35 billion.

In the meantime, international authorities bond funds acquired inflows price $809 million in a 3rd straight week of web shopping for.

International cash market funds noticed a lot greater inflows, with buyers bracing for the discharge of the Federal Reserve’s assembly minutes.

The info confirmed buyers accrued international cash market funds price $26.4 billion, in contrast with an outflow of $9.4 billion within the earlier week.

Vitality funds remained in demand for the fifth consecutive week as they acquired web funding of $149 million. Buyers additionally bought about $18 million of treasured metallic funds after 5 weeks of web promoting in a row.

In keeping with knowledge out there for twenty-four,768 rising market (EM) funds, EM fairness funds acquired $1.11 billion however EM bond funds had outflows of $201 million after $233 million price of web purchases the earlier week.

Reporting by Gaurav Dogra and Patturaja Murugaboopathy in Bengaluru;Modifying by Elaine Hardcastle

: .