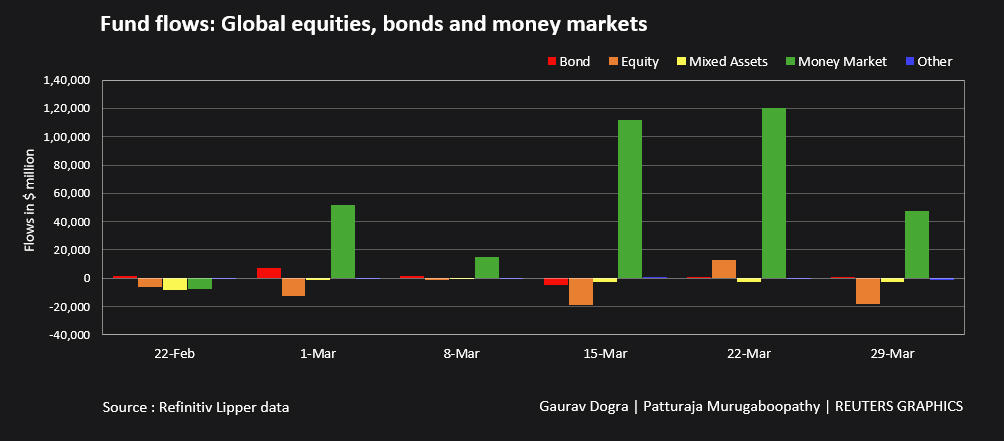

March 31 (Reuters) – International cash market funds continued to draw huge inflows within the week ended March 29, as buyers chased safer belongings amid lingering worries over the turmoil within the banking sector and considerations over tightening financial situations.

International cash market funds obtained a web influx of $47.6 billion, which was their fifth consecutive weekly influx, underscoring buyers’ warning after the collapse of two regional U.S. lenders earlier this month.

In the meantime, buyers bought about $18 billion value of world fairness funds after shopping for about $13.1 billion per week in the past.

They exited U.S. and European fairness funds of $20.68 billion and $630 million respectively, however acquired $2.3 billion value of Asian funds.

Nonetheless, some sector-focused fairness funds had been in demand, with tech and shopper discretionary receiving a web of $1.41 billion and $630 million in web shopping for.

In the meantime, world bond funds obtained $481 million in a second consecutive week of web shopping for, due to safe-haven demand for presidency bond funds. International authorities bond funds had $5.08 billion value of inflows.

Nonetheless, high-yield and short- and medium-term bond funds noticed $2.94 billion and $1.43 billion value of web promoting, respectively.

Amongst commodities, treasured metallic funds obtained $371 million in a 3rd straight week of web shopping for. Vitality funds additionally gathered $111 million value of inflows.

Knowledge for 23,903 rising market funds confirmed that equities obtained $1.1 billion and bonds secured $24 million value of inflows after witnessing two weekly outflows in a row.

Reporting by Gaurav Dogra and Patturaja Murugaboopathy in Bengaluru; Enhancing by Varun H Okay

: .