April 10 (Reuters) – International cash market funds continued to draw sturdy inflows in cautious commerce within the week ended April 5 as a raft of financial information through the week signalled weakening within the U.S. manufacturing exercise and a cooling within the labor market.

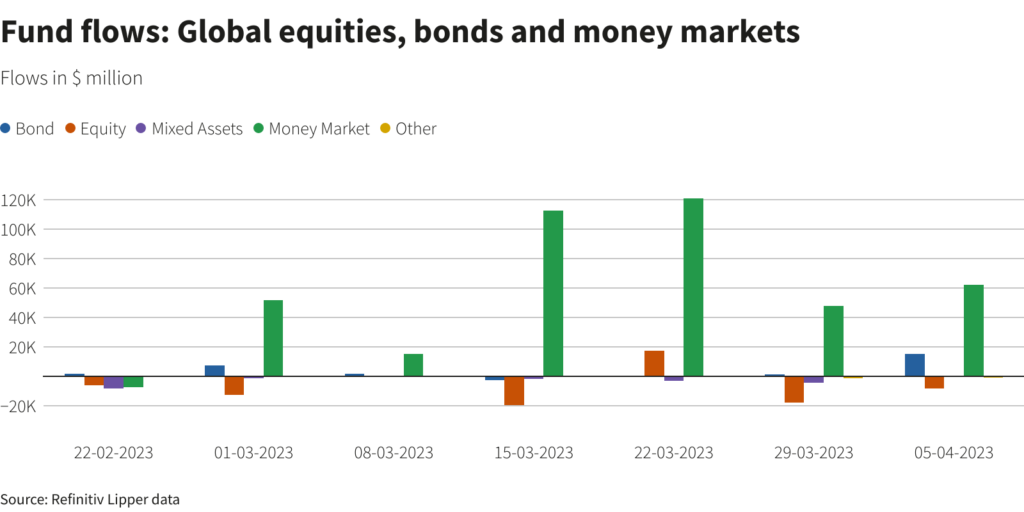

Funds within the international cash market noticed purchases value a web $61.91 billion, that marked a sixth consecutive week of web inflows, information from Refinitiv Lipper confirmed. Buyers additionally bought a web $3.38 billion value of presidency bond funds.

The U.S., European and Asian cash market funds obtained inflows value $42.51 billion, $25.62 billion and $280 million, respectively.

Riskier fairness funds, in the meantime, witnessed $8.37 billion value of outflows after $17.99 billion web promoting within the earlier week.

Financials and healthcare sector funds logged outflows of $1.54 billion and $979 million, respectively, though tech obtained $616 million value of inflows.

In the meantime, international bond funds drew $15.16 billion value of inflows, the most important quantity since July 2021.

Buyers bought $5.26 billion value of excessive yield and $1.71 billion value of goal maturity bond funds, however bought $1.15 billion value of short-term bond funds.

Amongst commodities, treasured metallic funds obtained $685 million in a fourth successive week of web shopping for, whereas vitality funds noticed a marginal $68 million value of web promoting after two weeks of inflows in a row.

Knowledge for 23,935 rising market funds confirmed fairness and bond funds, each obtained a second weekly influx, amounting $397 million and $412 million, respectively.

Reporting by Gaurav Dogra and Patturaja Murugaboopathy in Bengaluru; Modifying by Sherry Jacob-Phillips

: .