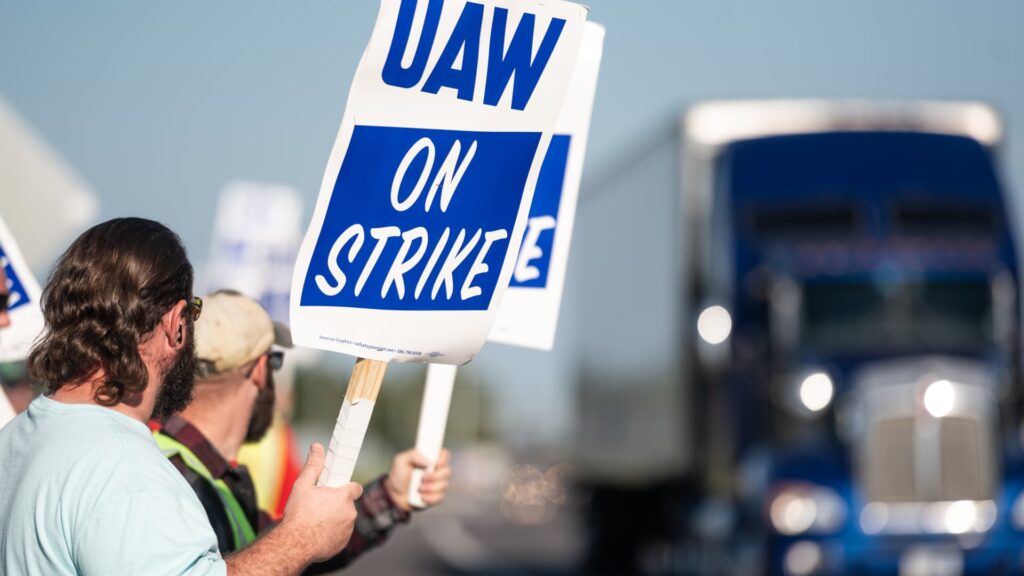

GM staff with the UAW Native 2250 union strike outdoors the Common Motors Wentzville Meeting Plant in Wentzville, Missouri, Sept. 15, 2023.

Michael B. Thomas | Getty Pictures

Take a look at the businesses making headlines in noon buying and selling.

Common Motors, Ford, Stellantis — Shares of Ford rose barely, whereas Common Motors gained 1% and Stellantis was up 2% as a focused strike by the United Auto Staff started. Staff walked off the job at a number of meeting crops belonging to the three automakers Thursday night time after a key deadline to settle a brand new labor contract handed.

Planet Health — Shares slid 13% after the gymnasium chain’s board pushed out CEO Chris Rondeau. The transfer was surprising to staff near Rondeau, an individual aware of the matter informed CNBC. Board member Craig Benson, identified for his position as the previous governor of New Hampshire, is the interim CEO.

Nucor — The steelmaker fell 5% after providing worse-than-expected steerage for third-quarter earnings, with the corporate pointing to pricing and quantity challenges. Nucor stated to anticipate earnings between $4.10 and $4.20 per share, whereas analysts polled by LSEG, previously often called Refinitiv, forecast $4.57.

PTC Therapeutics — The therapeutics inventory plummeted 28.3% after the European Medicines Company’s Committee for Medicinal Merchandise for Human Use issued a adverse opinion on a conversion of conditional to full advertising authorization for a PTC drug to deal with nonsense mutation Duchenne muscular dystrophy. Raymond James downgraded the inventory to underperform from outperform following the information.

Core & Most important — The infrastructure inventory retreated greater than 3% a day after it introduced a secondary inventory providing. The providing of 18 million Class A shares by promoting shareholders will likely be held concurrently with the repurchase of three.1 million Class A shares. Partnership pursuits in an organization unit additionally will likely be purchased again.

Arm Holdings — Shares slipped as a lot as 2% in noon buying and selling throughout its second session as a public firm, however had been lately up almost 1%. Funding banking agency Needham initiated protection of the inventory at maintain and not using a worth goal following Arm’s debut that valued the corporate at about $60 billion. Needham analyst Charles Shi cautioned, nonetheless, that the inventory’s worth already “seems to be full.”

Insulet, Dexcom — Shares of the diabetes-focused health-care corporations fell Friday after Bloomberg Information reported Thursday afternoon that Apple has chosen a brand new chief for its staff working to develop a noninvasive blood sugar monitoring gadget. Shares of Insulet shed 3%, whereas Dexcom sank 3.8%.

Chipmakers — Chip tools shares ASML Holding, KLA, Lam Analysis and Utilized Supplies dropped almost 4% every following a report that Taiwan Semiconductor is telling distributors to delay deliveries attributable to demand considerations. U.S.-listed shares of Taiwan Semiconductor misplaced 2%.

Adobe — Shares of the Photoshop maker dropped 4% following Adobe’s fiscal third-quarter earnings Thursday. The corporate reported an earnings and income beat and ahead steerage that matched Road projections. Whereas Goldman Sachs and Financial institution of America reiterated purchase rankings, JPMorgan remained impartial, citing macroeconomic headwinds and a excessive premium for Adobe’s pending acquisition of Figma for $20 billion.

Apellis Prescription drugs — The biopharmaceutical firm superior 7.5% following a Wells Fargo improve to chubby from equal weight. The financial institution stated Apellis has a good threat/reward forward of third-quarter earnings.

DoorDash — Shares of the meals supply firm fell 3% after MoffettNathanson downgraded the inventory to market carry out from outperform. The Wall Road agency stated the resumption of mortgage repayments introduce bookings threat to meals supply. The inventory remains to be up greater than 60% this 12 months.

Axis Capital — The insurance coverage inventory rose 2.7% following an improve to purchase from underperform by Financial institution of America. The Wall Road agency stated its pessimistic outlook was altering regardless of current underperformance within the reinsurance area.

Estée Lauder — The cosmetics inventory superior almost 2% after Redburn Atlantic Equities turned much less bearish. The agency upgrades shares to impartial from promote, saying the corporate was feeling technical advantages as buyer ordering patterns normalize.

Casella Waste Methods — The waste inventory traded about 1.6% increased after getting initiated by Goldman Sachs at purchase. Goldman known as the corporate a “compounder with pricing.”

— CNBC’s Yun Li, Jesse Pound, Samantha Subin, Pia Singh, Brian Evans and Lisa Kailai Han contributed reporting.