12 months-to-date, the S&P 500 has delivered a formidable return of 14%. Nonetheless, these good points are a bit deceiving as the majority of the upside has been pushed by just a few chosen shares, particularly the tech Mega Caps (AAPL, MSFT, NVDA, META, AMZN). If we exclude these 5 shares, the index has solely superior by 5%.

Whereas one might argue that the market is due for a cooling down interval after such a rally, Goldman Sachs Chief U.S. Fairness Strategist David Kostin suggests in any other case, citing previous proof. “Prior episodes of sharply narrowing breadth have been adopted by a ‘catch-up’ from a broader valuation re-rating,” Kostin defined.

As such, Kostin not solely elevated Goldman’s year-end value goal for the S&P 500 from 4000 to 4500 (a 12.5% carry), however there’s additionally the prospect of shares but to reap the advantages of the rally closing the hole because the 12 months progresses.

In opposition to this backdrop, Goldman Sachs analysts have been in search of out these equities and have turned their focus to 2 which have loads of upside, in accordance with their calculations – within the order of 90%, or extra. Working the tickers by way of the TipRanks database, it’s clear Goldman is just not alone in pondering these shares have a lot to supply traders; each are additionally rated as Robust Buys by the analyst consensus.

Hire the Runway (RENT)

Our first Goldman-backed inventory is a disruptor within the vogue business. Hire the Runway lives as much as its moniker by precisely describing its actions, which contain providing purchasers the chance to hire high-end vogue objects. This idea of short-term possession permits prospects to browse a various vary of kinds, sizes, and types on the Hire the Runway web site or cellular app. They’ll then select objects to hire for particular events or timeframes. The platform offers choices for each one-time leases and subscription plans. According to the developments of 2023, the corporate makes use of AI algorithms and machine studying methods to reinforce varied points of its enterprise, together with stock administration and personalization.

It’s a system that helped the corporate ship a powerful set of leads to its most up-to-date readout – for the fiscal first quarter of 2023 (April quarter). Income rose by 10.6% year-over-year to $74.2 million, beating the Avenue’s expectations by $0.99 million. Likewise, EPS of -$0.46 got here in higher than the -$0.49 the prognosticators had been on the lookout for. That stated, issues in regards to the outlook blotted the efficiency. The corporate sees FQ2 income hitting the vary between $77 million to $79 million. Consensus was on the lookout for 81 million.

Shares pulled again consequently and have typically lagged the market this 12 months – declining by 24% up to now. For Goldman Sachs analyst Eric Sheridan, nevertheless, the current valuation represents a possibility for traders.

“In our view, RENT shares (at present ranges) aren’t pricing-in the multi-year situation of 25% topline development and scaling margins that mgmt. outlined final quarter,” stated the 5-star analyst. “Long term, we nonetheless see RENT because the chief within the subscription-based effort to drive the adoption of the sharing economic system theme within the attire sector. Particularly, we’d flag RENT mgmt’s feedback on AI as a possible constructive for his or her platform and a broader disruptive pressure for the business which warrants additional consideration in coming quarters.”

These feedback underpin Sheridan’s Purchase score on RENT, whereas his $6 value goal suggests the inventory will run up by a bountiful 150% over the approaching 12 months. (To observe Sheridan’s observe report, click on right here)

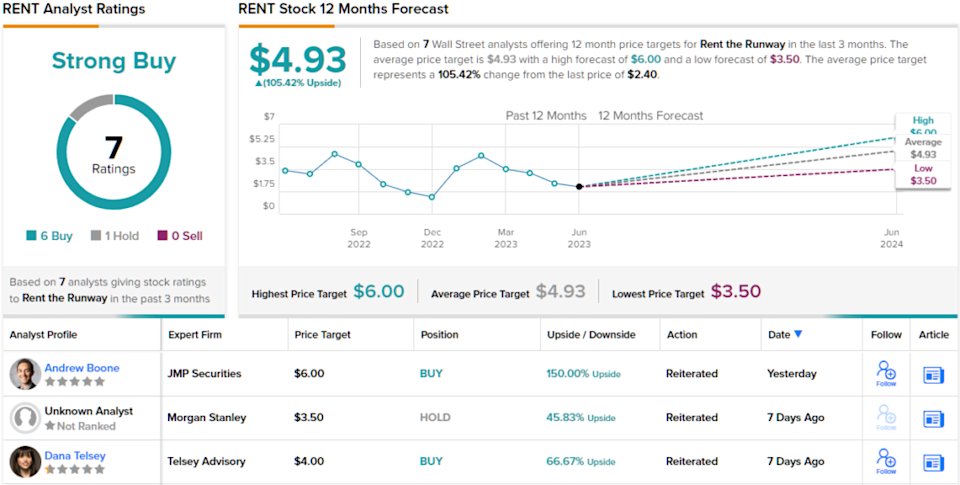

Sheridan’s upbeat thesis will get help on the Avenue. The inventory’s Robust Purchase consensus score is predicated on 6 Buys vs. 1 Maintain. Moreover, the $4.93 common goal leaves room for one-year good points of 105%. (See RENT inventory forecast)

Arrowhead Prescription drugs (ARWR)

For our subsequent Goldman-backed identify we’ll swap gears and head to the biotech house. Arrowhead Prescription drugs is on the forefront of RNA interference (RNAi) therapeutics, growing revolutionary medicines that focus on and silence particular disease-causing genes. The corporate’s cutting-edge know-how, referred to as the Focused RNAi Molecule (TRiM) platform, allows the exact supply of RNAi medication to particular tissues and organs, opening up new prospects for the remedy of assorted illnesses.

The corporate has a prolonged and various medical pipeline and a few eye-catching business collaborations together with Takeda, Amgen, and Horizon Therapeutics. Trying ahead, Arrowhead expects to have 18 drug candidates in medical research by the tip of 2023, addressing a broad vary of cell sorts, akin to liver, strong tumor, pulmonary, CNS, and skeletal muscle. It additionally already has candidates in Section 3 research.

Additional again in improvement, however making some promising progress, the corporate can be growing ARO-RAGE, presently in a Section 1/2 research for the remedy of sufferers with bronchial asthma. This drug has been displaying some constructive outcomes. At Arrowhead’s latest R&D Day, the agency offered knowledge that confirmed {that a} single inhaled dose of 184 mg knocked down the RAGE protein – which is correlated with lung illnesses akin to bronchial asthma – by a mean of 90% and as much as a most of 95%.

This drug’s potential has caught the attention of Goldman Sachs analyst Madhu Kumar, who lays down the bullish thesis for the remedy.

“There may be important market potential for ARO-RAGE within the broader bronchial asthma therapeutic panorama,” stated the 5-star analyst. “Particularly, we estimate the biologics marketplace for eosinophilic bronchial asthma to achieve over $4B in 2023 and develop to about $7B over the subsequent 5 years. This estimate takes into consideration gross sales estimates for Tezspire from AMGN and JNJ, Nucala from GSK, Fasenra from AZN, and Dupixent from REGN and SNY.”

“Whereas many of those biologics share the identical dosing routine as ARO-RAGE of as soon as each 4 weeks (though ARO-RAGE might doubtlessly be dosed much less continuously), we see potential for differentiation with respect to efficacy, together with price of exacerbation, compelled expiratory quantity in 1 second (FEV1), and fractional exhaled nitric oxide (FeNO),” Kumar went on so as to add.

How does this all translate to traders? Kumar charges the shares as Purchase, backed by a $68 value goal. Ought to the determine be met, traders might be pocketing returns of 92% a 12 months from now. (To observe Kumar’s observe report, click on right here)

Elsewhere on the Avenue, ARWR receives a further 8 Buys and three Holds, all coalescing to a Robust Purchase consensus score. Going by the $61.45 common goal, the shares will climb ~74% larger over the 12-month timeframe. (See ARWR inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather necessary to do your personal evaluation earlier than making any funding.