Each investor desires a portfolio that may generate returns, however discovering the correct shares for that’s at all times a problem. The analysts at Goldman Sachs have developed a data-based rule to kind by way of the mass of shares and discover the shares which can be going to herald stable returns.

The important thing to Goldman’s ‘Rule of 10’ lies in every firm’s projected gross sales development – the agency appears for shares with potential to indicate a multi-year CAGR of 10% or increased. In accordance with David Kostin, the financial institution’s Chief Funding Officer and Head of Funding Technique, fast and constant gross sales development is a prevalent attribute amongst right this moment’s main shares as they ascend the ranks.

“We refresh our ‘Rule of 10’ display, which identifies shares with realized and anticipated annual gross sales development higher than 10% throughout the 5 years from 2021 by way of 2025,” Kostin famous.

Among the high analysts at Goldman Sachs have been recommending shares that align with the “Rule of 10” standards. We’ll check out two of them, utilizing the information drawn from the TipRanks platform. Each are S&P-listed companies, and each have proven excessive sustained gross sales development over time – with excessive potential to take care of that efficiency. It additionally doesn’t damage that every inventory is admired by the remainder of the analyst neighborhood, sufficient so to earn a “Robust Purchase” consensus score. Let’s take a more in-depth look.

SolarEdge Applied sciences (SEDG)

The primary Goldman decide on our record is SolarEdge Applied sciences, a designer and producer of microinverters, that are important expertise in solar energy installations. Microinverters convert DC present, the sort produced by photovoltaic panels, into AC present that can be utilized on the grid and in family techniques. SolarEdge is likely one of the main corporations within the US microinverter phase, with roughly 40% market share.

The corporate doesn’t relaxation solely on the microinverter enterprise; it produces a variety of photo voltaic expertise merchandise. The product line contains monitoring techniques for photovoltaic technology techniques, energy optimizers, and even solar-powered EV chargers for dwelling use. SolarEdge markets on to the residential market, in addition to to industrial shoppers, together with constructing house owners, small companies, development shoppers, and set up professionals.

When examined by way of the lens of Goldman’s ‘Rule of 10,’ SolarEdge reveals a projected gross sales CAGR of 24% from 2022 by way of the tip of 2025. Few corporations can match this outstanding degree of sustained development.

SolarEdge’s present efficiency offers good motive to imagine it would match the projections. The corporate confirmed a number of report metrics in its 1Q23 monetary outcomes, the final quarterly outcomes reported. These included report quarterly income of $943.89 million, a outcome that was up 44% year-over-year and got here in additional than $12.05 million forward of the estimates. The data additionally included the non-GAAP EPS outcomes of $2.90, a big enchancment in comparison with the $1.20 worth in 1Q22 and surpassing the forecast by 95 cents.

In his protection of SolarEdge for Goldman Sachs, 5-star analyst Brian Lee sees the corporate’s diversification as a key help for its success. Lee acknowledges that SolarEdge has established itself within the US residential photo voltaic market, however he additionally factors out that the corporate’s enterprise is increasing on the quickest tempo in Europe and within the industrial and industrial markets.

“For 2023, we anticipate Europe to be one of many quickest rising areas, with whole photo voltaic installations up >25% yoy (we anticipate the expansion of resi to be inline-to-above the general market) vs. US residential finish market up <10% yoy and up to date datapoints suggesting it may find yourself being worse than that. Notably, SEDG’s shipments to Europe accounted for ~60% of the entire in 1Q23… When it comes to finish market, 50%-60% of SEDG’s whole volumes had been shipped to the C&I finish market — which seems to have remained stable and resilient regardless of macro uncertainties vs. resi, based mostly on our channel checks. With the aforementioned dynamics, we’re tactically extra optimistic on SEDG,” Lee opined.

To this finish, Lee charges SEDG shares a Purchase, unsurprisingly in gentle of his feedback, and units a $445 value goal that means ~65% one-year upside for the inventory. (To look at Lee’s monitor report, click on right here)

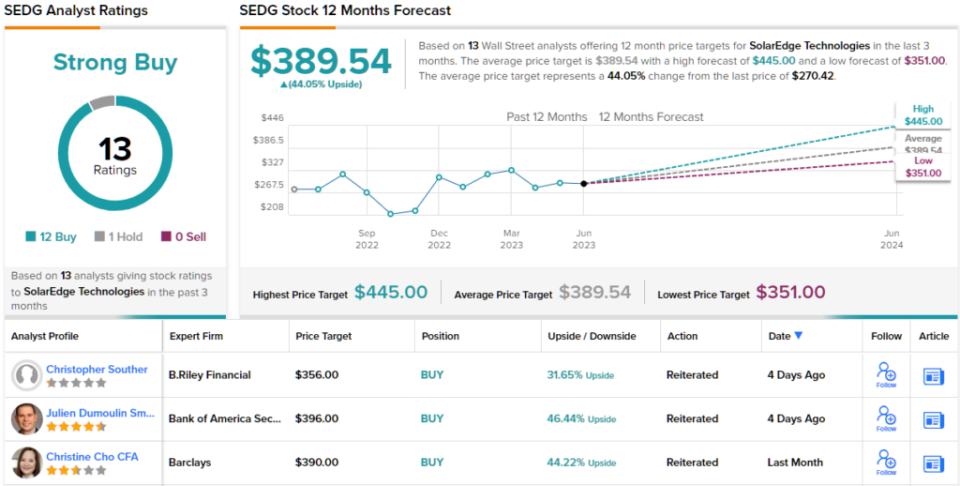

Total, SolarEdge has attracted 13 analyst evaluations not too long ago, with a breakdown of 12 to 1 in favor of Buys over Holds. The shares are buying and selling for $270.42, and the typical value goal of $389.54 suggests a acquire of 44% within the subsequent 12 months. (See SEDG inventory forecast)

Intuit, Inc. (INTU)

The second inventory we’re has not too long ago accomplished its strongest season of the 12 months. Intuit is a software program firm finest identified for its two flagship merchandise: TurboTax and QuickBooks. These software program merchandise present tax calculation and submitting providers, bookkeeping capabilities, and different accounting duties optimized for in-home or small enterprise use. The corporate’s different merchandise embrace the Credit score Karma private software program package deal and the favored advertising automation system, Mailchimp.

Intuit’s product line is geared toward facilitating monetary and advertising record-keeping and automation for non-professionals, and the corporate boasts over 100 million prospects worldwide. The corporate operates out of 20 places of work in 9 completely different nations, and final 12 months introduced in $12.7 billion in whole income.

Making use of the Goldman Rule of 10, we discover that Intuit’s 2022 to 2025E CAGR runs at 13%, a stable determine that places the corporate effectively above the ten% threshold Goldman makes use of to foretell future success. The corporate has loads of room for future development, as its largest phase is tax prep – and the US tax preparation market alone exceeds $11.2 billion. Globally, the tax prep market is estimated at greater than $28 billion this 12 months.

The corporate completed its fiscal Q3 on April 30, reporting high line income of $6.02 billion, up 7% from the prior 12 months interval. The revenues simply missed expectations, coming in $73.9 million, or 1.22%, under the forecast. On the backside line, Intuit’s non-GAAP earnings per share hit $8.92, for a 17% y/y improve, and beat the analyst forecasts by 42 cents.

Kash Rangan, one other of Goldman’s 5-star analysts, lays out a number of the explanation why Intuit is poised to money in on its development potential. Because the analyst writes, “We see a number of long-term structural development drivers: 1) Generative AI may solidify INTU’s market management as it’s uniquely positioned to leverage an enormous quantity of tax-related information with the usage of LLMs. 2) The broader ~$30bn tax-prep market creates important alternatives for TurboTax Stay (which holds 3-5% of the market) to seize share. 3) With Intuit solely capturing ~10% of the ~$2 trillion in quantity occurring on its platform, and contemplating 70% of B2B funds are nonetheless not digitized, we anticipate its funds providing to scale to $4-5bn in income. Intuit’s skill to drag value levers to drive effectivity regardless of decrease top-line visibility must also be rewarded.”

Quantifying his optimistic stance, Rangan offers Intuit shares a Purchase score, together with a $565 value goal that signifies his confidence in a one-year upside of 25%. (To look at Rangan’s monitor report, click on right here)

That is one other inventory with a Robust Purchase consensus score from the Avenue. The score is predicated on 16 current analyst evaluations, which embrace 15 Buys towards a single Maintain. Intuit shares are presently priced at $451.57, whereas the $508.67 common value goal implies ~13% upside going ahead into subsequent 12 months. (See INTU inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely essential to do your personal evaluation earlier than making any funding.