The S&P 500 is up by 14% year-to-date however it has not gone unnoticed that the strong efficiency has been pushed by sturdy shows from the tech mega-caps.

Based on Goldman Sachs strategist Lily Calcagnini, there are higher funding alternatives proper now additional down the meals chain.

“Small shares commerce at a valuation low cost relative to massive caps, suggesting now could be a pretty entry level for traders with multi-year investing time horizons,” Calcagnini defined. “Even inside the massive cap universe, smaller firms look cheap relative to bigger ones within the context of each the final 10 and 35 years.”

In reality, whereas Calcagnini makes the case that the S&P 500 will acquire one other 9% over the following yr and hit 4,700, she anticipates a 14% rise within the small-cap targeted Russell 2000 index, which can characterize a 5 pp of outperformance vs. the S&P 500 outlook.

In the meantime, the analysts at Goldman Sachs have been moving into the main points and searching for out these small-caps with stable upside potential. We ran a few their picks by the TipRanks database to additionally gauge widespread Avenue sentiment. Seems the Goldman consultants will not be the one ones eager on these Russell 2000-included names; each are rated as ‘Sturdy Buys’ by the analyst consensus. Let’s discover out what makes them interesting funding selections proper now.

Springworks Therapeutics (SWTX)

First up on our small-cap checklist, we’ll check out Springworks Therapeutics, a clinical-stage biopharma firm with a $1.57 billion market cap. Springworks makes use of a precision medication technique to accumulate, develop, and produce transformative medicines to market, with the purpose of bettering the lives of people by debilitating cancers.

With biotechs it’s all concerning the pipeline, and Springworks at present has two medication making headway in medical trials throughout a number of packages.

Essentially the most superior of those is oral, small-molecule, selective gamma secretase inhibitor nirogacestat, being assessed as a remedy for various cancers. Based mostly on optimistic knowledge from the Section 3 DeFi trial, the FDA has accepted Springworks’ NDA (new drug utility) for nirogacestat in desmoid tumors and a PDUFA date has been set for November 27 (prolonged from the prior August 27 date).

There’s one other catalyst within the pipeline from the anticipated readout of topline knowledge from the Section 2b ReNeu research of allosteric MEK1/2 inhibitor mirdametinib in NF-1-associated plexiform neurofibroma. This could happen throughout the second half of the yr. NF1 is a genetic dysfunction related to a heightened susceptibility to tumors, making it one of the prevalent syndromes of its variety. It at present impacts roughly 100,000 people within the US.

Assessing the pipeline and upcoming catalysts, Goldman Sachs analyst Corinne Jenkins highlights the potential of each these medication: “Based mostly on the accessible medical knowledge, we anticipate a excessive probability of approval for niro in DT… Moreover, we count on a powerful launch given the excessive diploma of doctor consciousness and help for niro in DT noticed throughout our channel checks and SWTX’s market analysis. Past niro, we view the upcoming knowledge from the Ph2b ReNeu research of mirdametinib in pediatrics and adults with NF-1-associated plexiform neurofibroma in 2H23 as driving the following leg of the story.”

These feedback underpin Jenkins’ Purchase score on SWTX, whereas her $43 value goal implies one-year share appreciation of ~71%. (To look at Jenkins’ observe file, click on right here)

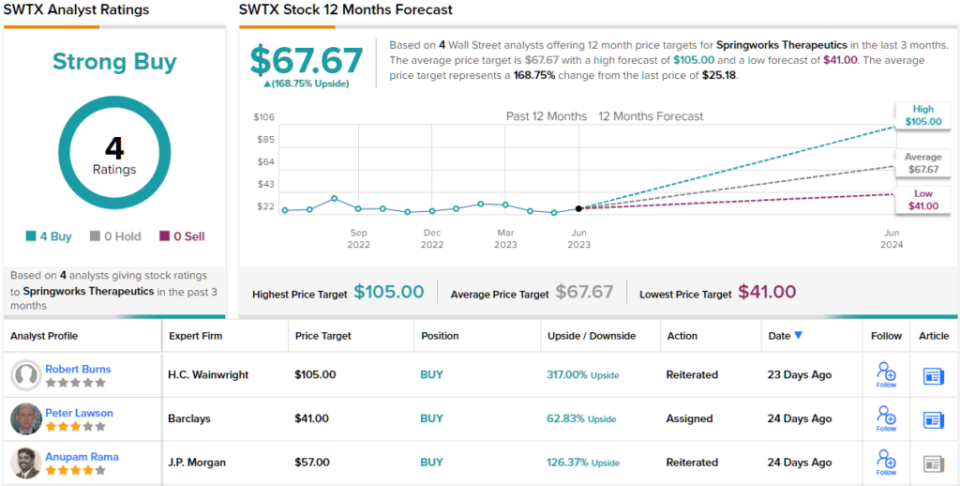

Different analysts are much more optimistic. Of the 4 funding banks which have rated SWTX over the previous three months, all 4 agree the inventory is a “purchase” — and on common, they assume it’s price $67.67 a share — ~169% forward of present pricing. (See SWTX inventory forecast)

Arvinas, Inc. (ARVN)

We’ll keep within the biotech house for the following Goldman-backed small-cap. Boasting a market cap of $1.44 billion, Arvinas is an organization targeted on growing progressive protein degradation therapies to deal with a variety of ailments. The corporate makes use of its proprietary PROTAC (PROteolysis TArgeting Chimera) platform, which harnesses the physique’s pure protein disposal system to selectively eradicate disease-causing proteins. By focusing on particular proteins for degradation, Arvinas goals to offer simpler and sturdy therapies in comparison with conventional small molecule inhibitors or antibodies.

Most of Arvinas’ pipeline continues to be within the pre-clinical stage however a number of medication are in numerous levels of medical testing. The newest replace involved the progress of ARV-766, an investigational orally bioavailable PROTAC protein degrader being assessed in males with metastatic castration-resistant prostate most cancers (mCRPC). Knowledge from the Section 1/2 dose escalation and growth trial confirmed that ARV-766 was well-tolerated and displayed promising exercise in a closely pre-treated, post-NHA (novel hormonal brokers), all-comers affected person group.

Arvinas can also be making headway within the improvement of bavdegalutamide (ARV-110), an extra orally administered PROTAC protein degrader. This potential remedy gives a beacon of hope for males battling metastatic castration-resistant prostate most cancers (mCRPC) who haven’t responded to beforehand authorised systemic therapies. The corporate is slated to kick off a Section 3 trial within the latter half of 2023, and intends to reveal the information on radiographic progression-free survival from the Section 1/2 trial inside the similar timeframe.

Regardless of the wealthy pipeline of therapeutic candidates, Arvinas shares are down 21% this yr. Based on Goldman Sachs analyst Madhu Kumar, this presents a possibility for the inventory to endure substantial progress.

“Given the early sign, ARVN will advance ARV-766 together with abiraterone to pre-novel hormonal agent (NHA) sufferers in 2H23. Past ARV-766, up to date knowledge from the Section 1/2 trial of AR PROTAC bavdegalutamide (bav), together with radiographic progression-free survival (rPFS), will probably be offered at a medical congress in 2H23. Given the weak point in ARVN shares YTD, we consider even modest optimistic alerts for the AR PROTAC franchise may generate upside,” Kumar famous.

How does this all translate to traders? Kumar charges ARVN a Purchase together with a $91 value goal. Ought to the determine be met, traders stand to pocket returns of a powerful 237% a yr from now. (To look at Kumar’s observe file, click on right here)

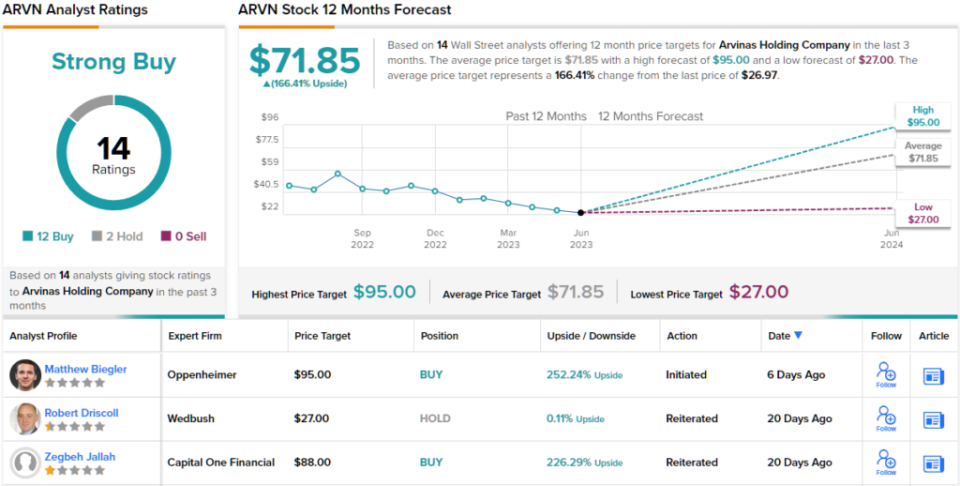

The view from the remainder of the Avenue is hardly much less upbeat. Whereas 2 analysts desire sitting this one out, all 12 different current analyst critiques are optimistic, offering the inventory with a Sturdy Purchase consensus score. The common goal at present stands at $71.85, suggesting shares will publish progress of 72% within the months forward. (See ARVN inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather necessary to do your individual evaluation earlier than making any funding.