WASHINGTON (AP) — Six Republican-led states are suing the Biden administration in an effort to halt its plan to forgive scholar mortgage debt for tens of thousands and thousands of People, accusing it of overstepping its government powers.

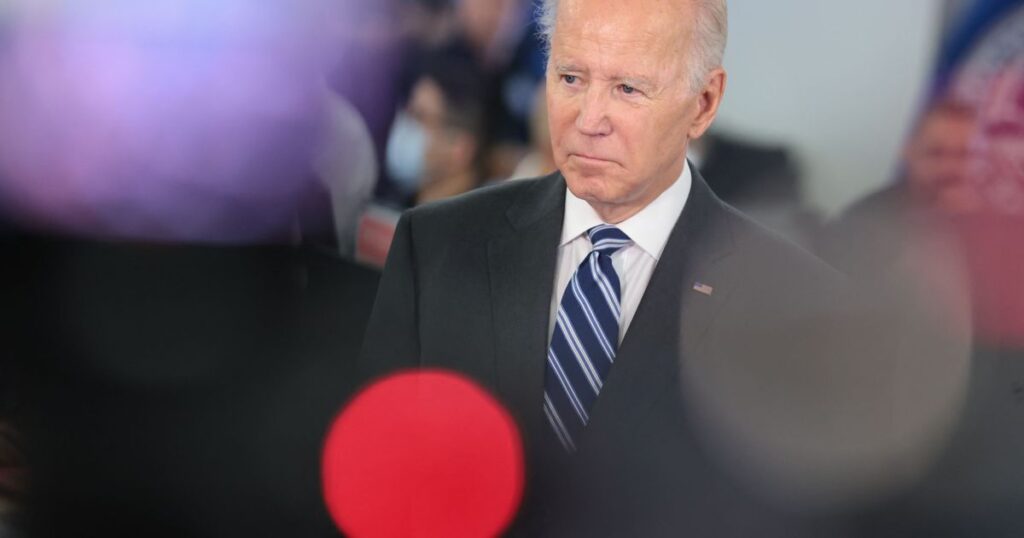

It’s not less than the second authorized problem this week to the sweeping proposal laid out by President Joe Biden in late August, when he stated his administration would cancel as much as $20,000 in schooling debt for large numbers of debtors. The announcement, after months of inside deliberations and stress from liberal activists, turned rapid political fodder forward of the November midterms whereas fueling arguments from conservatives about legality.

Within the lawsuit, being filed Thursday in a federal court docket in Missouri, the Republican states argue that Biden’s cancellation plan is “not remotely tailor-made to deal with the results of the pandemic on federal scholar mortgage debtors,” as required by the 2003 federal legislation that the administration is utilizing as authorized justification. They level out that Biden, in an interview with CBS’ “60 Minutes” this month, declared the Covid-19 pandemic over, but remains to be utilizing the continued well being emergency to justify the wide-scale debt aid.

“It’s patently unfair to saddle hard-working People with the mortgage debt of those that selected to go to school,” Arkansas Lawyer Basic Leslie Rutledge, who’s main the group, stated in an interview.

She added: “The Division of Schooling is required, beneath the legislation, to gather the steadiness due on loans. And President Biden doesn’t have the authority to override that.”

The states of Iowa, Kansas, Missouri, Nebraska and South Carolina joined Arkansas in submitting the lawsuit. Iowa has a Democratic lawyer normal, however the state’s Republican governor, Kim Reynolds, signed on the state’s behalf. The states argue that Missouri’s mortgage servicer is dealing with a “variety of ongoing monetary harms” due to Biden’s choice to cancel loans. Different states that joined the lawsuit argue that Biden’s forgiveness plan will in the end disrupt income to state coffers.

The administration has lengthy stated it was assured the forgiveness program would survive court docket challenges.

“Republican officers from these six states are standing with particular pursuits, and preventing to cease aid for debtors buried beneath mountains of debt,” White Home spokesman Abdullah Hasan stated Thursday. “The president and his administration are lawfully giving working and center class households respiration room as they recuperate from the pandemic and put together to renew mortgage funds in January. ”

Biden’s forgiveness program will cancel $10,000 in scholar mortgage debt for these making lower than $125,000 or households with lower than $250,000 in revenue. Pell Grant recipients, who sometimes exhibit extra monetary want, will get a further $10,000 in debt forgiven.

The administration additionally stated it could lengthen the present pause on federal scholar mortgage repayments — placed on maintain close to the beginning of the pandemic greater than two years in the past — as soon as extra via the top of the 12 months.

The administration confronted threats of authorized challenges to its plans virtually instantly, with conservative attorneys, Republican lawmakers and business-oriented teams asserting that Biden was overstepping his authority in taking such sweeping motion with out the assent of Congress.

Democratic lawmakers battling in powerful reelection contests additionally distanced themselves from the coed mortgage plan, as Republican officers referred to as it an unfair authorities giveaway for comparatively prosperous folks on the expense of those that didn’t pursue greater schooling.

Of their lawsuit, the Republican attorneys normal additionally contend that the forgiveness program violates the Administrative Process Act, which lays out how federal companies ought to make laws in an effort to guarantee government department insurance policies are well-reasoned and defined.

“The president doesn’t have the authority to place himself within the place of Congress,” Rutledge stated within the interview. “These actions have to be taken by Congress and he can’t override that.”

To justify the plan’s legality, the Biden administration is counting on a post-Sept. 11, 2001, legislation meant to assist members of the army that the Justice Division says permits Biden to scale back or erase scholar mortgage debt throughout a nationwide emergency. However Republicans argue the administration is misinterpreting the legislation as a result of, partially, the pandemic not qualifies as a nationwide emergency.

One other lawsuit towards Biden’s scholar mortgage program was filed this week in an Indiana federal court docket by the Pacific Authorized Basis, a libertarian authorized advocacy group that employs a lawyer who says he could be harmed by the forgiveness plan. The lawyer, Frank Garrison, says erasing his present debt load will set off a tax legal responsibility from the state of Indiana, which is amongst not less than a half dozen states the place the forgiven mortgage quantities can be topic to state taxes.

The White Home dismissed the lawsuit as baseless as a result of any borrower who doesn’t need the debt aid can decide out. The Schooling Division remains to be on monitor to unveil the applying for the forgiveness plan in early October, and it despatched an e mail to debtors Thursday explaining the right way to put together to use. The e-mail famous that candidates don’t have to submit any supporting paperwork.

Republicans have additionally seized on the Biden plan’s price ticket and its influence on the nation’s finances deficit. The Congressional Finances Workplace stated this week that this system will value about $400 billion over the subsequent three a long time. The White Home countered that the CBO’s estimate of how a lot the plan will value simply in its first 12 months, $21 billion, is decrease than what the administration initially believed.

Related Press author Collin Binkley contributed to this report.